Please use a PC Browser to access Register-Tadawul

Marvell Technology (NasdaqGS:MRVL) Unveils 400G Technology at OFC 2025 Despite 14% Price Dip Last Week

Marvell Technology Group Ltd. MRVL | 0.00 |

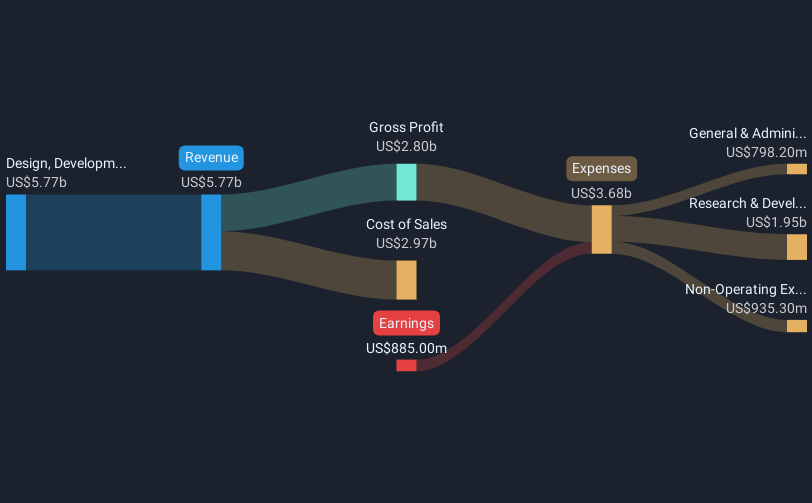

Marvell Technology (NasdaqGS:MRVL) unveiled groundbreaking advancements at OFC 2025, including the industry's first 400G/lane technology and a 1.6T silicon photonics light engine, aimed at boosting AI network efficiency. Despite these announcements, the company's shares fell 14% last week, a move likely influenced by the broader market downturn. The Nasdaq Composite entered bear market territory amid heightened fears of a global trade war following new U.S. tariffs and retaliatory measures from China. This broader sell-off affected tech stocks, including chipmakers, with concerns over economic growth and inflation overshadowing Marvell's technological strides.

Over the last five years, Marvell Technology achieved a total return of 134.02%, which indicates a strong long-term performance when considering the market challenges it faced. Relative to the broader market over the past year, Marvell underperformed, with the US Market achieving higher returns, partly due to the company's significant reliance on the data center sector, which poses a risk if spending shifts. Despite innovation like the successful introduction of 400G/lane and 1.6T technologies, the company's tech achievements couldn't fully counterbalance industry uncertainties and market volatility that affected share performance.

Marvell's emphasis on cutting-edge technology and infrastructure was evident with its upgraded partnership with AWS, which supports its cloud and AI initiatives. Nevertheless, issues such as increased inventory levels, dependency on key customers, and high debt levels raise concerns. The company's repurchase of shares totaling US$161.53 million from November 2024 to March 2025 suggests an effort to bolster shareholder value amidst these challenges. Looking ahead, Marvell's ongoing focus on AI and connectivity enhancements is pivotal for its continued growth trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.