Please use a PC Browser to access Register-Tadawul

Market Buzz: What Caused Nvidia’s 13% Drop in Three Days and Where Is It Headed?

NVIDIA Corporation NVDA | 0.00 | |

GraniteShares 2x Long NVDA Daily ETF NVDL | 0.00 | |

Super Micro Computer, Inc. SMCI | 0.00 | |

Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR TSM | 0.00 |

NVIDIA Corporation(NVDA.US) shares took a sharp dive overnight on Monday, closing down 6.68% and marking the biggest single-day decline in two months. The plunge also hit the leveraged Nvidia bullish ETF GraniteShares 2x Long NVDA Daily ETF(NVDL.US) , which fell 14%.

This marks Nvidia's third consecutive day of losses, with a cumulative decline of 12.88% over the past three days. Since peaking last Thursday, the stock has pulled back by 16%, erasing over $430 billion in market value and falling below the $3 trillion threshold. According to media reports, this represents the largest three-day drop in market value for any publicly traded company.

Just last Tuesday, on June 18th, Nvidia had closed as the most valuable company by market cap.

Why Did Nvidia’s Stock Plunge?

Analysts have identified several factors contributing to the recent plunge in Nvidia's stock price. They cite the impact of "triple witching," frequent insider selling by Nvidia’s executives, and profit-taking by some investors.

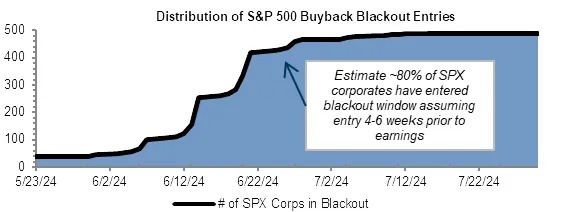

The timing of Nvidia’s pullback also coincides with a broader cooling off in U.S. tech stocks. According to Goldman Sachs, 80% of S&P 500 companies have entered a "buyback blackout period." Buybacks have historically been a key driver of stock gains, especially for tech stocks.

Reports indicate that Nvidia CEO Jensen Huang sold 720,000 Nvidia shares between June 13 and June 21, netting $94.6 million at an average price of $131.44 per share. To date, Huang has sold 720,000 shares, and under his pre-submitted selling plan—adjusted for stock splits—he is expected to sell a total of 6 million shares by March 2025, leaving 5.28 million shares still to be sold.

Additionally, Nvidia's CFO Colette Kress and other executives, including Executive Vice President Deborah Shoquist, have collectively sold tens of millions of dollars worth of stock. Since Nvidia reported its first-quarter earnings on May 22, over one-third of its insiders have opted to sell shares, marking the highest rate of insider selling in years.

It's noteworthy that Huang’s selling plan was announced as far back as March. Market analysts emphasize that these sales are part of executive compensation plans, including Restricted Stock Units (RSUs) and Performance Stock Units (PSUs), which are common practices for CEOs under regulatory compliance.

The U.S. Securities and Exchange Commission (SEC) allows executives and insiders to set up so-called "10b5-1 plans" to mitigate the risk of trading on non-public information. These plans must be established before insiders become aware of any material non-public information and automatically execute trades under specified conditions, such as predetermined price levels and trading volumes.

In September of last year, Huang sold 237,500 Nvidia shares under a similar pre-established trading plan, generating $110 million at an average price of $463.95 per share before the stock split.

What's Next for Nvidia? Analysts Weigh In

Buff Dormeier, Chief Technical Analyst at Kingsview Partners, sees signs of capitulation in Nvidia's sudden reversal. "Seeing this happen after all the positive news of stock splits and hitting peak market value is concerning," he commented.

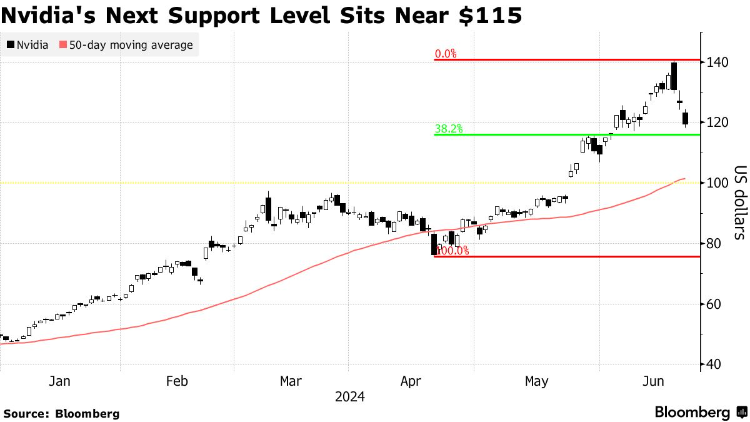

Dormeier suggests that Nvidia has a short-term support level of around $115, with the next major support at $100.

Oppenheimer's Head of Technical Analysis, Ari Wald, emphasizes that a stock's long-term trend is more critical than specific support levels, and Nvidia still shows strong performance. The stock price remains well above its 50-day moving average of $101 and 100-day moving average of $92.

Wald notes that tops usually form after several rounds of buying and selling, followed by a strengthening downward trend as key levels are breached. However, he states that Nvidia has not yet shown such patterns.

Both Wald and Dormeier are closely watching the $100 level. Bruce Zaro, Chief Technical Strategist at Granite Wealth Management, also identifies $100 as a key level to monitor.

Zaro points out that for a trending stock like Nvidia, breaking higher is not usually difficult. However, if the stock price falls below $100, it could signal some issues. He adds that this wouldn't necessarily alter Nvidia’s long-term trend but suggests the market may require more patience. This is particularly relevant given the upcoming U.S. election and the Federal Reserve's shifting monetary policy, which could introduce further volatility and downward pressure in the markets.

What to Watch Next?

- Nvidia Shareholder Meeting

Nvidia (NVDA) is set to hold its annual shareholder meeting on June 26. Investors will be closely monitoring the event for management's insights and forward-looking statements about the burgeoning Artificial Intelligence (AI) sector.

In this crucial address, Nvidia CEO Jensen Huang might declare that the AI market is poised to exceed analysts’ forecasts. According to Bloomberg, the generative AI ecosystem is projected to become a $1.3 trillion market by 2032, a significant increase from earlier estimates.

Despite the optimistic outlook expected at the shareholder meeting, investors will be keen to hear how the company addresses rising competitive pressures. Analysts have pointed out that Nvidia relies heavily on a select number of key enterprises for its revenue, which could pose a risk.

A hot topic leading up to the meeting is the growing concern over peak sales, especially in data centers powering AI protocols. Should demand cool off, the chipmaker will need to pivot. Investors will be watching closely to see if management discusses innovations that diversify Nvidia's offerings beyond just hardware, potentially easing fears of a sales plateau.

- Earnings on the Horizon

Investors are quickly shifting their attention to demand as we approach the earnings season for the second quarter of 2024. This period will offer insights into end-demand and profit margins for tech firms developing AI products, particularly those utilizing a significant number of Nvidia chips.

Should demand prove robust, we could see stock prices rise. However, investors are currently hedging their bets, wary of potential disappointing signals. With valuations being at their peak, even minor disruptions in the AI growth narrative could trigger a substantial market correction.

Companies like Super Micro Computer Super Micro Computer, Inc.(SMCI.US) and Taiwan Semiconductor Manufacturing Company ( Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR(TSM.US) )—both key suppliers to Nvidia and beneficiaries of the overall surge in AI demand—are also in the spotlight. Should the Nvidia chip market continue its upward trajectory, these firms could experience sustained demand.

The primary focus over the next month will be gauging the demand for AI products rolled out by companies and assessing whether this will drive increased capital expenditure. If demand falters, we might witness a reduction in future orders, casting doubts on both revenue and margin forecasts.