Please use a PC Browser to access Register-Tadawul

IPO Monitor | Entaj IPO Hits Top Price SAR 50: Retail Subscription Now Open After 208X Institutional Oversubscription

Tadawul All Shares Index TASI.SA | 0.00 |

Entaj IPO Overview

Riyadh, Saudi Arabia – Arabian Company for Agricultural and Industrial Investment (“Entaj”), a leading poultry brand in the Kingdom of Saudi Arabia, today marks the commencement of its retail investor subscription phase for its highly anticipated initial public offering (IPO). This follows the successful completion of the institutional book-building process, which saw overwhelming demand from participating parties. Eligible Individual investors can now participate in the offering on Sahm Platform

Institutional Offering Results:

- Final Offer Price: SAR 50 per share, at the top of the previously announced range.

- Market Capitalization at Listing: Approximately 1.5 billion (USD 400 million).

- Oversubscription: The institutional offering was oversubscribed by approximately 208.4 times, with a total of SAR 93 billion in orders.

- Subscription Period for Individual Investors: Starting today, Wednesday, 26 February 2025 (27/08/1446H), until 2:00 PM KSA time on Thursday, 27 February 2025 (28/08/1446H).

Related read: TASI IPOs: 91% Win Rate on First Day and the Secrets Behind It

IPO Summary

| Category | Details |

|---|---|

| Company Name | Arabian Company for Agricultural and Industrial Investment (Entaj) |

| Market | Main Market (TASI) |

| Core Activities | Poultry products, egg trays, red meat products |

| Capital | SAR 300 million |

| Total Shares | 30 million |

| Par Value | SAR 10 per share |

| Issue Percentage | 30% |

| Number of Offered Shares | 9 million |

| Qualified Subscribers | Participating institutions & Retail investors |

| Total Number of Shares Offered to Retail Investors | 900,000 shares (10% of offered shares) |

| Minimum Number of Offer Shares to be Applied for by Individual Investors | 10 shares |

| Maximum Number of Offer Shares to be Applied for by Individual Investors | 250,000 shares |

Key Investment Highlights:

Entaj is a leading poultry producer in Saudi Arabia, offering a wide range of high-quality products, including fresh, frozen, and cut-up chicken, to both retail and food service fulfillment sectors. Established in 2004 under the Arabian Agricultural Services Company (ARASCO), the Entaj brand grew significantly and, after a strategic restructuring in 2021, now operates under the Arabian Company for Agricultural and Industrial Investment.

1. Supportive Macro Environment & Sector Growth Potential

Entaj operates in Saudi Arabia’s thriving poultry sector, supported by a growing population (projected to rise from 33.1M in 2023 to 37.7M by 2028) and increasing consumer spending on food. Fresh poultry value sales are forecast to surge from SAR 18.3B (2023) to SAR 26.7B by 2028, with volume sales reaching 1.22M tonnes.

2. Leading Brand with Expanding Market Share

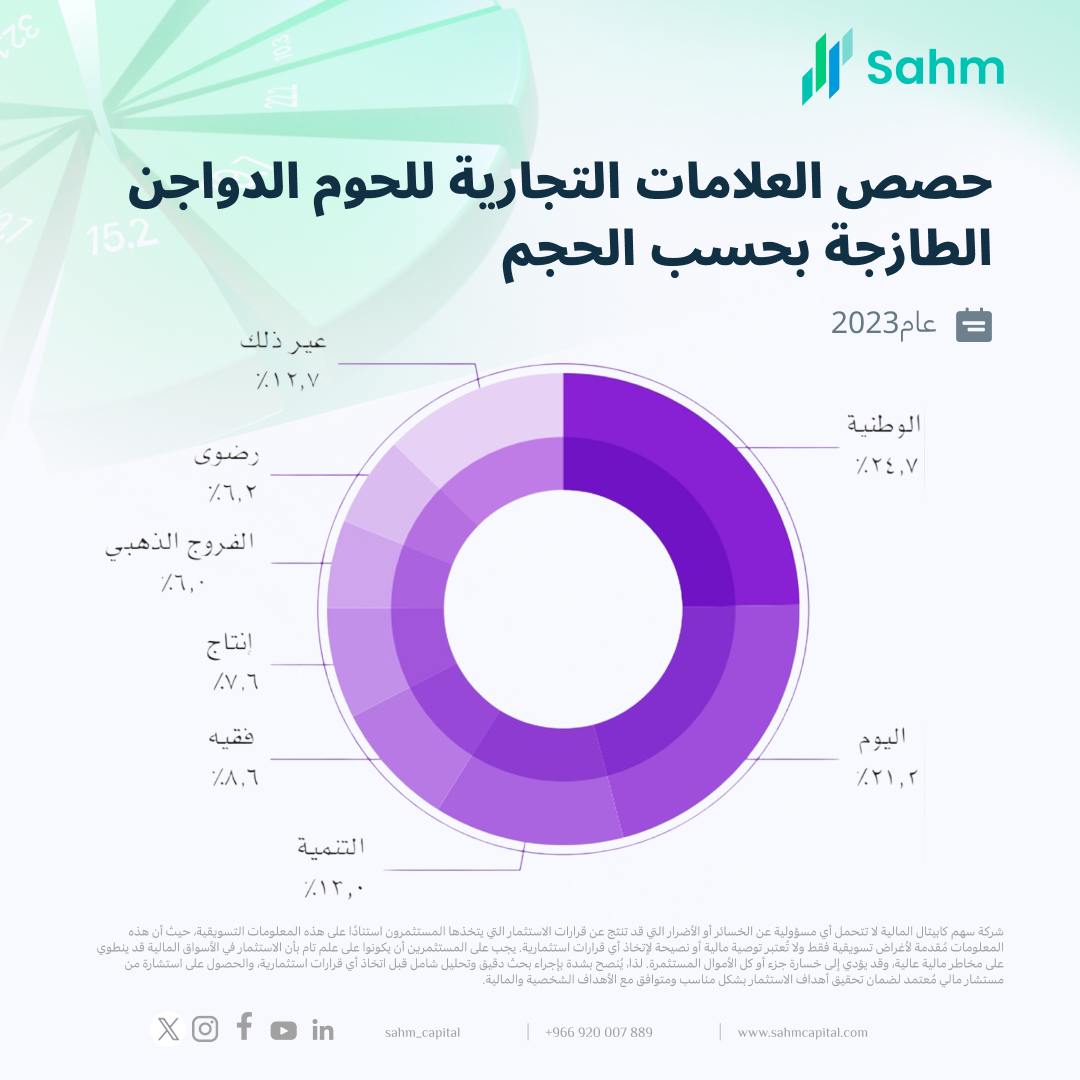

A top contender in Saudi Arabia’s fresh poultry market, Entaj holds a 7.6% share, competing with larger players like Al-Watania and Alyoum. Its brand reputation—built on quality, innovation, and consumer trust—is rapidly strengthening, supported by recent initiatives to enhance visibility and loyalty.

3. Vertically Integrated Operations & Advanced Capabilities

Entaj’s end-to-end operations feature state-of-the-art biosecure farms, hatcheries, and production facilities, ensuring efficiency and compliance with global standards (Saudi GAP, FSSC 22000, ISO, Halal). Its diverse product range (poultry, red meat, eggs) is distributed via a robust regional network and e-commerce platform.

4. Direct Consumer Access via Multi-Channel Distribution

The company delivers daily to over 4,000 retail outlets—from local baqalas to hypermarkets—with temperature-controlled logistics. As a preferred supplier to hospitality clients, Entaj also offers tailored solutions and is expanding its distribution fleet and regional hubs to penetrate underserved areas.

5. Resilient Financial Performance & Growth Focus

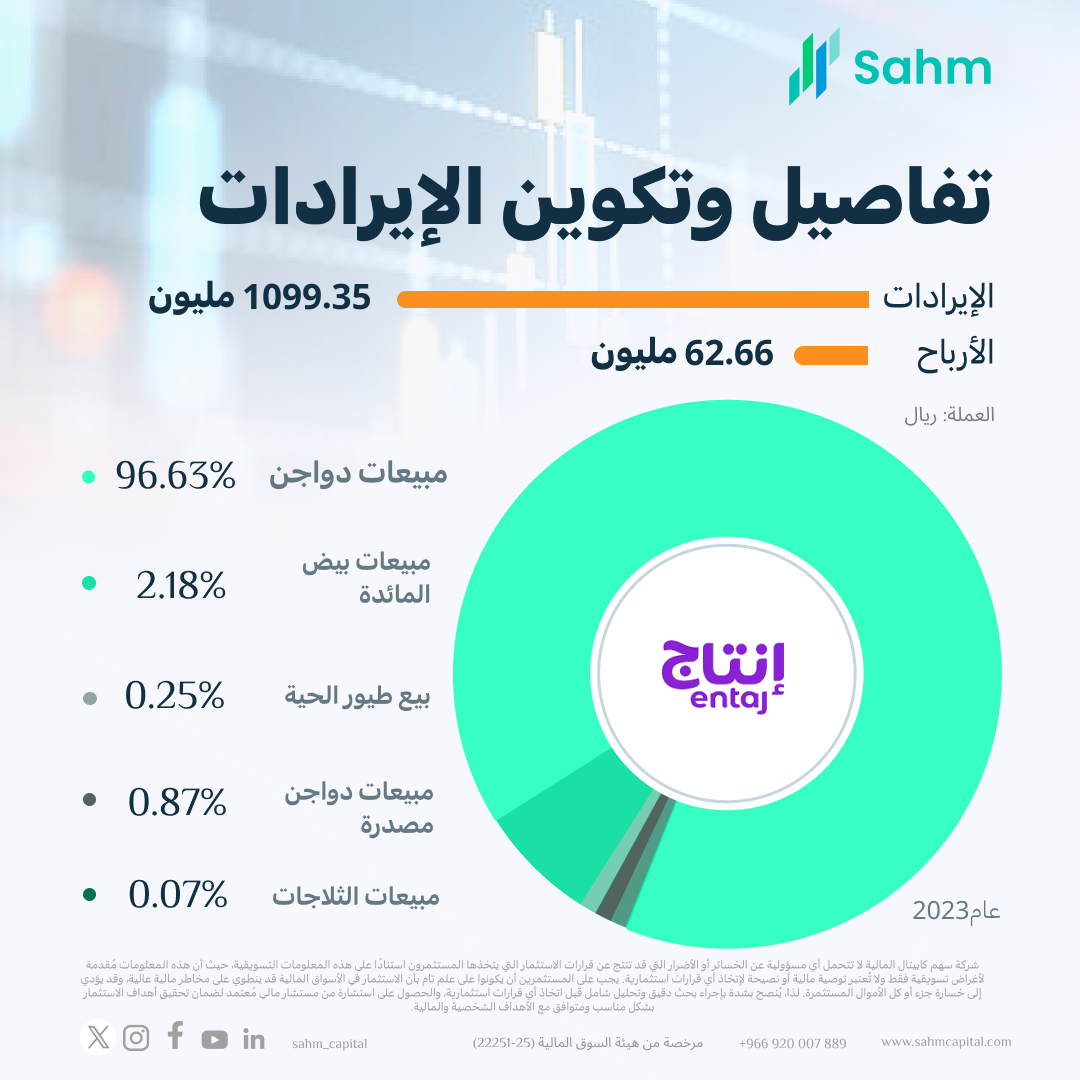

Entaj achieved a 23% revenue CAGR over the past three years, driven by demand for locally sourced poultry (96.6% of revenue). While 2023 growth was constrained by capacity, ongoing expansion investments aim to unlock future scalability and profitability.

6. Experienced Leadership & Strategic Backing

The management team brings decades of cross-industry expertise, supported by parent company ARASCO—a Saudi industry leader—which provides resources and strategic alignment for regional and international growth.

Investor Groups

Tranche (A): Participating Parties

This tranche is reserved for entities eligible to participate in the book-building process, including investment funds, Qualified Foreign Investors, GCC Corporate Investors, and certain foreign investors under swap agreements (collectively referred to as "Participating Parties").

- Provisionally Allocated Shares: 9,000,000 Offer Shares, representing 100% of the total Offer Shares.

- Final Allocation: The final distribution will occur after the Individual Subscriber subscription period ends, with allocations made at the Financial Advisor’s discretion in coordination with the Company. Some Participating Parties may not receive any shares.

- Adjustment for Individual Subscriber Demand: If Individual Subscribers show sufficient demand, the Financial Advisor may reduce the allocation for Participating Parties to 8,100,000 shares, representing 90% of the total.

Tranche (B): Individual Subscribers

This tranche is available to:

- Saudi natural persons, including female divorcees or widows with minor children from a non-Saudi spouse, who may subscribe for their children’s benefit.

- Non-Saudi natural persons residing in the Kingdom, or GCC nationals with an investment account at one of the Receiving Agents.

- Allocation: Up to 900,000 Offer Shares, representing 10% of the total.

- Subscription Restrictions: Subscriptions made in the name of a divorced wife or duplicate subscriptions will be deemed invalid.

- Adjustment for Unsubscribed Shares: If Individual Subscribers do not fully subscribe, the Financial Advisor, in coordination with the Company, may reduce the allocated shares proportionally based on the number of shares subscribed.

Substantial Shareholders of the Company Pre- and Post Offering

| Pre-Offering | Post-Offering | |||||

|---|---|---|---|---|---|---|

| Shareholder | Number of Shares | Ownership (%) | Nominal Value (SAR) | Number of Shares | Ownership (%) | Nominal Value (SAR) |

| ARASCO | 28,530,000 | 95.10% | 285,300,000 | 19,530,000 | 65.10% | 195,300,000 |

| Total | 28,530,000 | 95.10% | 285,300,000 | 19,530,000 | 65.10% | 195,300,000 |

Note:

- Direct and Indirect Ownership: ARASCO owns the entire capital of Ocean Line Marine Services Company, which holds 4.90% of the Company’s shares before the Offering. As such, ARASCO indirectly controls the entire capital of the Company before the Offering.

Expected Offering Timetable

| Event | Date |

|---|---|

| Bidding and Book-Building Period for Participating Entities | From Sunday, 10 Sha’ban 1446H (corresponding to 9 February 2025G) until 3:00 p.m. Thursday, 14 Sha’ban 1446H (corresponding to 13 February 2025G) |

| Deadline for Submission of Subscription Application Forms | On Tuesday, 26 Sha’ban 1446H (corresponding to 25 February 2025G) |

| Subscription Period for Individual Subscribers | For a period of two days, starting on Wednesday, 27 Sha’ban 1446H (corresponding to 26 February 2025G) until 2:00 p.m. Thursday, 28 Sha’ban 1446H (corresponding to 27 February 2025G) |

| Deadline for Payment of the Subscription Amount by Participating Entities | On Wednesday, 27 Sha’ban 1446H (corresponding to 26 February 2025G) |

| Deadline for Submission of Subscription Application Forms and Payment of the Subscription Amount by Individual Subscribers | On Thursday, 28 Sha’ban 1446H (corresponding to 27 February 2025G) |

| Announcement of the Final Allocation of the Offer Shares | No later than Tuesday, 4 Ramadan 1446H (corresponding to 4 March 2025G) |

| Refund of Excess Subscription Monies (if any) | No later than Tuesday, 10 Ramadan 1446H (corresponding to 10 March 2025G) |

| Expected Commencement Date for Trading the Shares on the Exchange | Trading of the Company’s Shares is expected to commence after the fulfilment of all requirements and the completion of all relevant legal procedures. The commencement of trading will be announced in local newspapers and on Tadawul’s website (www.saudiexchange.sa). |

Note: The above timetable and dates are approximate. Actual dates will be announced on the websites of Tadawul (www.saudiexchange.sa), the Financial Advisor (www.alahlicapital.com), and the Company (www.entaj.com).

Read the full Prospectus

Introducing the new IPO feature on Sahm platform: A step-by-step guide to subscribing to the IPO

Further updates regarding this IPO will be provided as more information becomes available.

- Reporting by Zaid, Sahm News team