Please use a PC Browser to access Register-Tadawul

Intellia Therapeutics (NASDAQ:NTLA) investors are sitting on a loss of 66% if they invested three years ago

Intellia Therapeutics, Inc. NTLA | 0.00 |

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But the long term shareholders of Intellia Therapeutics, Inc. (NASDAQ:NTLA) have had an unfortunate run in the last three years. Regrettably, they have had to cope with a 66% drop in the share price over that period. And over the last year the share price fell 26%, so we doubt many shareholders are delighted. Even worse, it's down 16% in about a month, which isn't fun at all.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for Intellia Therapeutics

Intellia Therapeutics wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, Intellia Therapeutics grew revenue at 2.3% per year. That's not a very high growth rate considering it doesn't make profits. It's likely this weak growth has contributed to an annualised return of 18% for the last three years. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term). Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

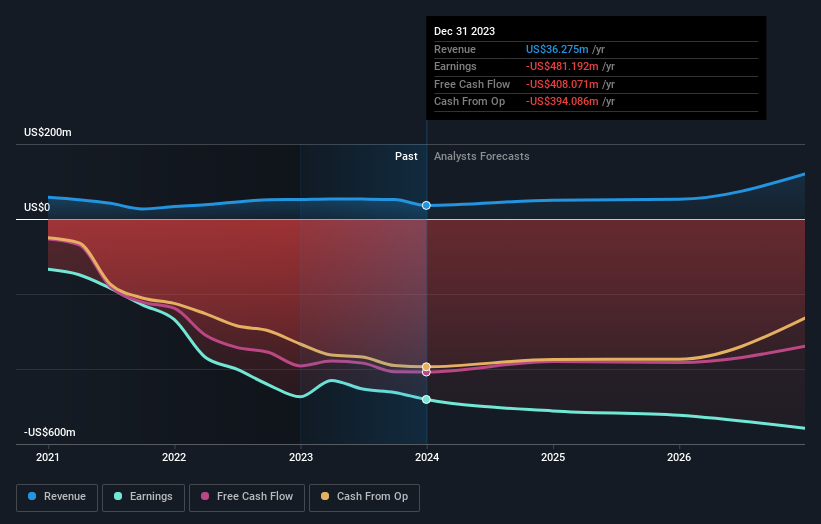

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Intellia Therapeutics is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

While the broader market gained around 28% in the last year, Intellia Therapeutics shareholders lost 26%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 9% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Intellia Therapeutics you should be aware of.

Of course Intellia Therapeutics may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.