Please use a PC Browser to access Register-Tadawul

Innoviz Technologies Ltd.'s (NASDAQ:INVZ) Stock Retreats 27% But Revenues Haven't Escaped The Attention Of Investors

Inetvisionz Com Inc Com INVZ | 0.00 |

To the annoyance of some shareholders, Innoviz Technologies Ltd. (NASDAQ:INVZ) shares are down a considerable 27% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 63% loss during that time.

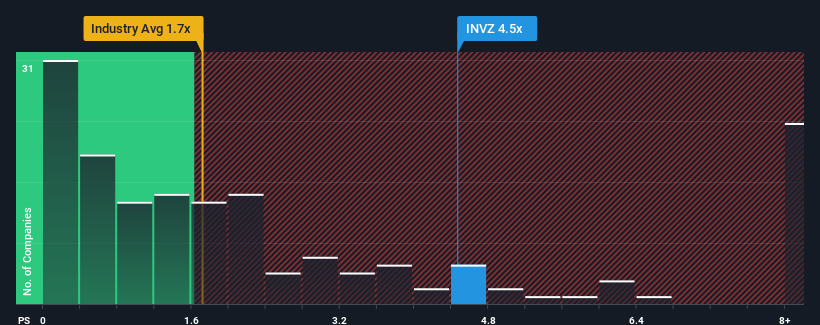

In spite of the heavy fall in price, you could still be forgiven for thinking Innoviz Technologies is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.5x, considering almost half the companies in the United States' Electronic industry have P/S ratios below 1.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Innoviz Technologies' P/S Mean For Shareholders?

Recent times have been advantageous for Innoviz Technologies as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Innoviz Technologies will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Innoviz Technologies?

Innoviz Technologies' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 16% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 141% each year as estimated by the four analysts watching the company. With the industry only predicted to deliver 9.4% per year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Innoviz Technologies' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Innoviz Technologies' P/S?

Even after such a strong price drop, Innoviz Technologies' P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Innoviz Technologies' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.