Please use a PC Browser to access Register-Tadawul

In One Chart | Why FedEx Soared by 8.74% in The After-Hours Session?

FedEx Corporation FDX | 0.00 |

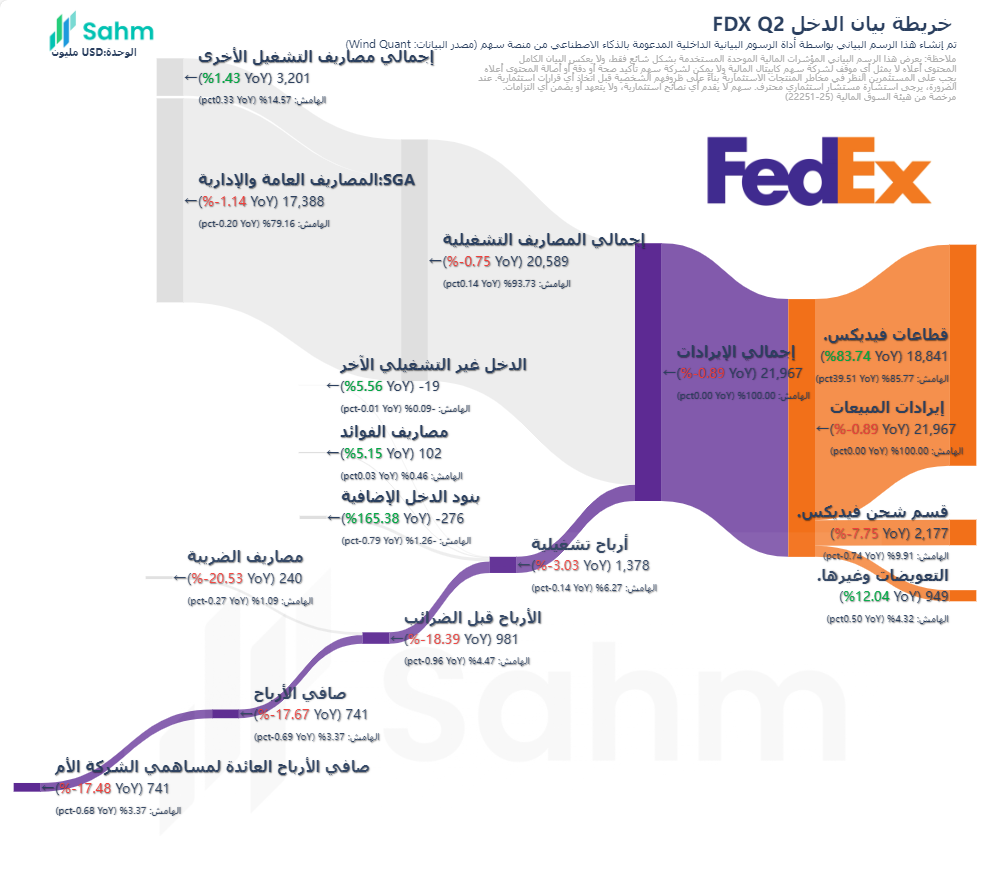

FedEx Corporation(FDX.US) announced its fiscal Q2 results for 2025 after markets closed on Thursday, indicating revenues of US$22 billion, a 0.9% year-over-year increase but falling short of the US$22.1 billion expected by the market. The company also announced plans to spin off its freight division into a separate publicly traded company as part of a strategy to streamline operations.

Under non-GAAP measures, net earnings were US$990 million compared to US$1.01 billion the previous year. Adjusted earnings per share came in at US$4.05, exceeding market expectations of US$3.94. Following this news, FedEx shares surged by 13% in after-hours trading. Year-to-date, the stock has risen by approximately 9%, lagging behind the S&P 500's 23% gain.

1/3

The Freight Unit Spin-Off

FedEx plans to complete the spin-off of its freight division within the next 18 months. This move aims to increase "operational focus, accountability, and flexibility." The freight division generated US$9.4 billion in revenue last year, while the company's other divisions achieved US$78.3 billion in revenue for fiscal 2024.

Investors are optimistic about the freight unit competing with companies like Old Dominion Freight Line and XPO Logistics. The surge in e-commerce has boosted demand for freight and logistics services, driving up the stocks of these companies. Daiwa analyst Jairam Nathan speculated that the spin-off might add US$79 per share to FedEx's value.

FedEx will maintain commercial agreements and continue to collaborate with the new freight company. The company had begun reviewing its freight business in June, prompting expectations of a possible spin-off or sale. Goldman Sachs serves as FedEx's financial advisor, with Skadden, Arps, Slate, Meagher & Flom LLP providing legal counsel. Bloomberg Industry Research estimates that the freight division's enterprise value exceeds US$30 billion.

2/3

Delivery Sector Challenges

Alongside the spin-off announcement, FedEx revised its full-year profit forecast downward, citing persistent weak demand in the US express delivery sector. The company now anticipates adjusted earnings for FY2025 to range between US$19 and US$20 per share, down from the previous estimate of US$20 to US$21 per share. The midpoint of this new range aligns closely with analysts' average estimate of US$19.48 per share compiled by Bloomberg.

FedEx attributed its better-than-expected Q2 profit to ongoing efficiency savings, which offset lower-than-expected freight revenues. However, the weaker outlook indicates FedEx's ongoing struggle with declining parcel demand. Consumers prioritizing spending on services over goods and opting for slower, cheaper shipping methods have impacted the industry.

The trucking sector continues to recover from a prolonged freight recession fueled by capacity oversupply during the pandemic when heightened consumer demand for shipments drove up freight rates.

FedEx aims to combat sluggish demand by integrating its express delivery division (which delivers parcels by air) with its ground shipping network. The company is also recovering from business losses due to an expired contract with the US Postal Service, which it estimates could hit Q2 revenue by US$500 million. FedEx stated it has reduced its daytime flight hours by 60%.

3/3

Results Table

| FedEx Corporation(FDX.US) - GSD. Income Statement (Single Quarter) (Unit: million, USD) | 2024-11-30 | 2023-11-30 |

| Reporting Period | Q2 | Q2 |

| Report Type | Consolidated | Consolidated |

| Total Operating Income | 21,967.000 | 22,165.000 |

| Main Business Income | 21,967.000 | 22,165.000 |

| Other Operating Income | 0.000 | 0.000 |

| Total Operating Expenses | 20,589.000 | 20,744.000 |

| Operating Costs | 0.000 | 0.000 |

| Operating Expenses | 20,589.000 | 20,744.000 |

| Operating Profit | 1,378.000 | 1,421.000 |

| Add: Interest Income | 0.000 | 0.000 |

| Minus: Interest Expenses | 102.000 | 97.000 |

| Add: Profit and Loss on Equity Investments | 0.000 | 0.000 |

| Other Non-Operating Profit and Loss | -19.000 | -18.000 |

| Profit Before Non-recurring Items | 1,257.000 | 1,306.000 |

| Add: Profit and Loss on Non-recurring Items | -276.000 | -104.000 |

| Profit Before Tax | 981.000 | 1,202.000 |

| Minus: Income Tax | 240.000 | 302.000 |

| Minority Shareholder Profit and Loss | 0.000 | 0.000 |

| Net Profit from Continuing Operations | 741.000 | 900.000 |

| Add: Net Profit from Non-Continuing Operations | 0.000 | 0.000 |

| Other Special Items | 0.000 | 0.000 |

| Net Profit | 741.000 | 900.000 |

| Minus: Preferred Dividends and Other Adjustments | 0.000 | 2.000 |

| Net Profit attributable to Ordinary Shareholders | 741.000 | 898.000 |

| Comprehensive Income | 558.000 | 962.000 |

| FedEx Corporation(FDX.US) - Main Business Composition (by Indicator. Single Quarter) (Unit: million, USD) | 2024-11-30 | 2023-11-30 |

| Reporting Period | Q2 | Q2 |

| Report Type | Consolidated | Consolidated |

| Income | 21,967.000 | 22,165.000 |

| Products | 21,967.000 | 22,165.000 |

| FedEx Division | 18,841.000 | 10,254.000 |

| TNT Express Division | 0.000 | 0.000 |

| FedEx Ground Division | 0.000 | 8,639.000 |

| FedEx Freight Division | 2,177.000 | 2,360.000 |

| FedEx Services Division | 0.000 | 65.000 |

| Offset and other (products) | 949.000 | 847.000 |