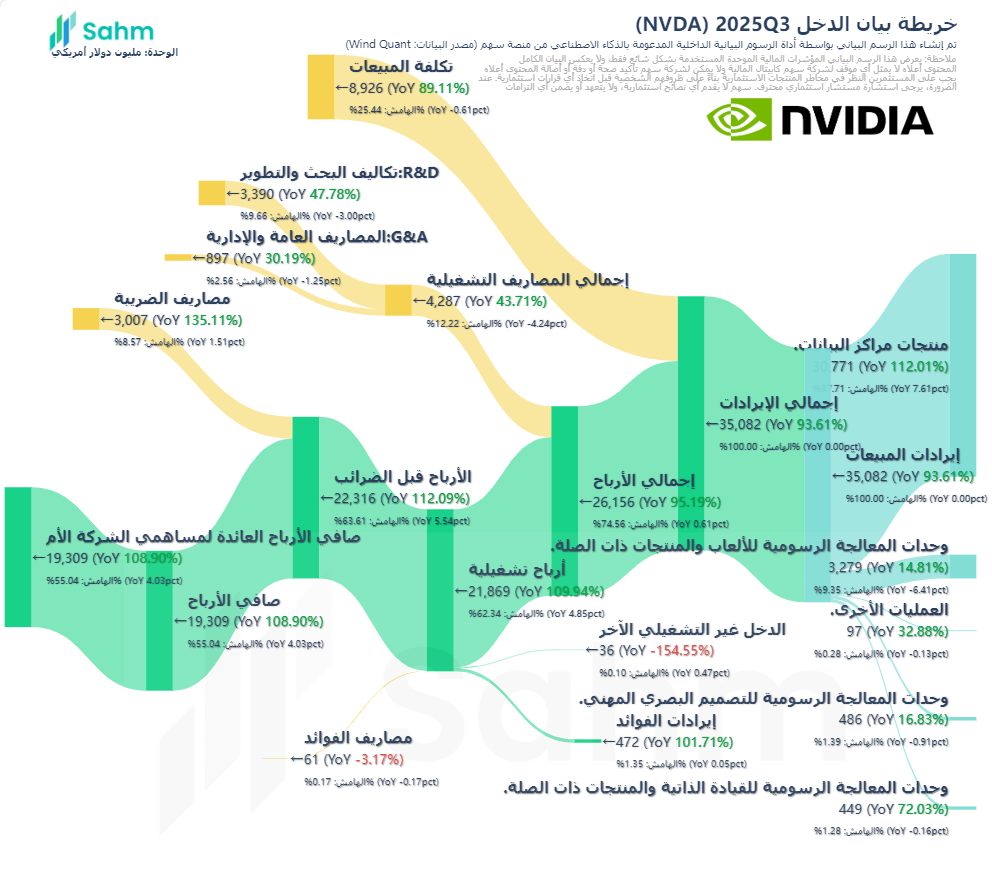

In One Chart | NVDA 2025Q3 Earnings Breakdown, Table, Analyses

NVIDIA Corporation NVDA | 145.89 | -0.76% |

01

Consolidated Income Statement

| NVIDIA Corporation(NVDA.US) - GSD. Income Statement (Single Quarter) (Unit: USD) | 2025-10-27 | 2024-10-29 |

| Reporting Period | Q3 | Q3 |

| Report Type | Consolidated | Consolidated |

| Revenue | 35,082,000,000.000 | 18,120,000,000.000 |

| Main Business Revenue | 35,082,000,000.000 | 18,120,000,000.000 |

| Other Operating Income | ||

| Total Operating Expenses | 13,213,000,000.000 | 7,703,000,000.000 |

| Operating Costs | 8,926,000,000.000 | 4,720,000,000.000 |

| Operating Expenses | 4,287,000,000.000 | 2,983,000,000.000 |

| Operating Profit | 21,869,000,000.000 | 10,417,000,000.000 |

| Add: Interest Income | 472,000,000.000 | 234,000,000.000 |

| Minus: Interest Expenses | 61,000,000.000 | 63,000,000.000 |

| Add: Equity Investment Profit and Loss | ||

| Other Non-Operating Profit and Loss | 36,000,000.000 | -66,000,000.000 |

| Profit Before Non-recurring Items | 22,316,000,000.000 | 10,522,000,000.000 |

| Add: Non-recurring Item Profit and Loss | ||

| Profit Before Tax | 22,316,000,000.000 | 10,522,000,000.000 |

| Minus: Income Tax | 3,007,000,000.000 | 1,279,000,000.000 |

| Minority Shareholder Profit and Loss | ||

| Net Profit from Continuing Operations | 19,309,000,000.000 | 9,243,000,000.000 |

| Add: Net Profit from Non-Continuing Operations | ||

| Other Special Items | ||

| Net Profit | 19,309,000,000.000 | 9,243,000,000.000 |

| Minus: Preferred Dividends and Other Adjustments | ||

| Net Profit attributable to Ordinary Shareholders | 19,309,000,000.000 | 9,243,000,000.000 |

| Comprehensive Income | 19,356,000,000.000 | 9,206,000,000.000 |

| Display Currency | USD | USD |

02

Revenue by Products/Regions

| NVIDIA Corporation(NVDA.US) - GSD. Income Statement (Single Quarter) (Unit: USD) | 2025-10-27 | 2024-10-29 |

| Reporting period | Q3 | Q3 |

| Report type | Consolidated | Consolidated |

| Main Business Revenue | 35,082,000,000 | 18,120,000,000 |

| By Products | 35,082,000,000 | 18,120,000,000 |

| Data center products | 30,771,000,000 | 14,514,000,000 |

| Game GPU and related products | 3,279,000,000 | 2,856,000,000 |

| Professional visual design GPU | 486,000,000 | 416,000,000 |

| Smart driving GPU and related products | 449,000,000 | 261,000,000 |

| Other businesses | 97,000,000 | 73,000,000 |

| By Region | 35,082,000,000 | 18,120,000,000 |

| United States | 14,800,000,000 | 6,302,000,000 |

| Singapore | 7,697,000,000 | 2,702,000,000 |

| Taiwan, China | 5,153,000,000 | 4,333,000,000 |

| Mainland China | 5,416,000,000 | 4,030,000,000 |

| Other countries/regions | 2,016,000,000 | 753,000,000 |

03

Analyses, Guidance

NVIDIA Corporation(NVDA.US) announced its third-quarter earnings report after market close on Thursday:

- Revenues of US$35.1 billion, up from US$18.12 billion in the same period last year, and exceeding market expectations of US$33 billion.

- Net income stood at US$19.31 billion, significantly up from US$9.243 billion the previous year and above the anticipated US$16.93 billion.

The company's data centre business saw notable growth, with Q3 data centre revenues hitting US$30.8 billion, up from US$26.3 billion in the prior quarter, marking a 112% year-over-year increase.

Nvidia CEO Jensen Huang mentioned that the AI era is underway, propelling a global shift towards Nvidia computing. He noted the incredible demand for Nvidia's new generation GPU architecture, Hopper, and the anticipation for Blackwell in full production, driven by foundation model creators expanding their pre-training, post-training, and inference scales.

He believes that the AI era has fully arrived, driving global demand for Nvidia's computing platform. With the rapid penetration of AI technology across various industries, particularly in data centres, automated industries, and robotics, Nvidia will continue to lead the global transformation of computing technology.

Additionally, Nvidia's CFO highlighted that the company dispatched 13,000 Blackwell samples to customers in the third quarter, and the race among clients to be the first to deploy Blackwell reflected "astonishing" demand. Fourth-quarter revenues are expected to exceed previous estimates of several billion dollars for Blackwell.

For Q4 Guidance, Nvidia anticipates:

- Revenue of approximately US$37.5 billion, with a potential range of US$36.75 billion to US$38.25 billion, exceeding analysts' median expectations of US$37.1 billion.

- Non-GAAP gross margins to stand between 73% and 73.5%, with a fluctuation of 50 basis points, ranging from a minimum of 72.5% to a maximum of 74%.

Despite the results surpassing all market expectations, Nvidia's after-hours share price initially dropped by over 5% at one point before narrowing the loss.

The analysts had previously anticipated that :

- While cloud service providers' capital expenditure growth rate might slow, major vendors were still forecasting continued growth, indicating no expected issues in demand for Blackwell products.

- Limitations in capacity expansion and high baselines from earlier periods might cause revenue growth to decelerate.

- Additionally, the market had not fully considered potential delays or underperformance of the next-gen Rubin product, emphasizing the need to focus on management's future product descriptions.