In One Chart | Mag7 Earnings Breakdown, NVDA Included - Winners, Losers, A Brief Look Into the Printing Season

Alphabet Inc. Class A GOOGL | 165.97 | -5.69% |

Amazon.com, Inc. AMZN | 197.45 | -2.68% |

NVIDIA Corporation NVDA | 144.55 | -0.92% |

Alphabet Inc. Class C GOOG | 167.51 | -5.54% |

Microsoft Corporation MSFT | 414.88 | +0.05% |

AI CapEX in Spotlight

In a week when most of the Mag7 companies reported quarterly earnings, the focus was on AI expenditures rather than the monetization of these investments.

Although the results were generally positive, forward-looking guidance indicating that ongoing spending could impact margins led traders to reduce their exposure to some large tech companies.

The clear winners were Alphabet Inc. Class A(GOOGL.US) and Amazon.com, Inc.(AMZN.US), both benefiting from increased demand for their cloud services.

Let's take a closer look...

01

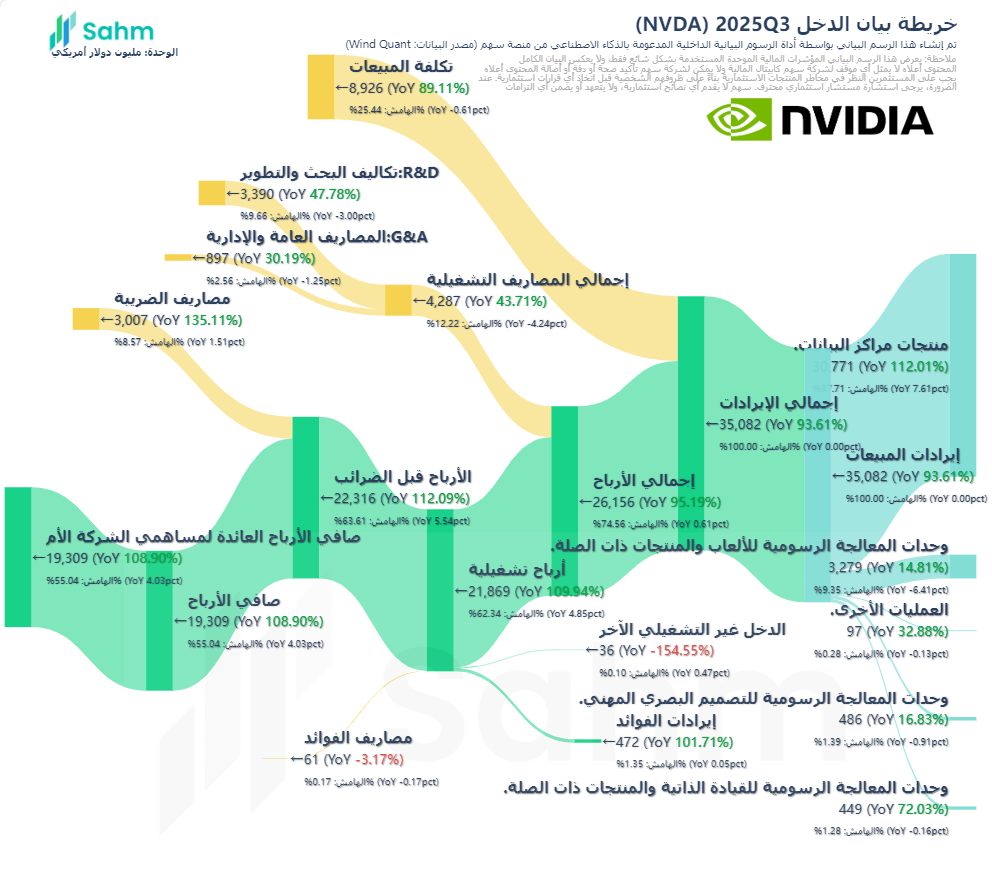

Nvidia

- Revenues of US$35.1 billion, up from US$18.12 billion in the same period last year, and exceeding market expectations of US$33 billion.

- Net income stood at US$19.31 billion, significantly up from US$9.243 billion the previous year and above the anticipated US$16.93 billion.

02

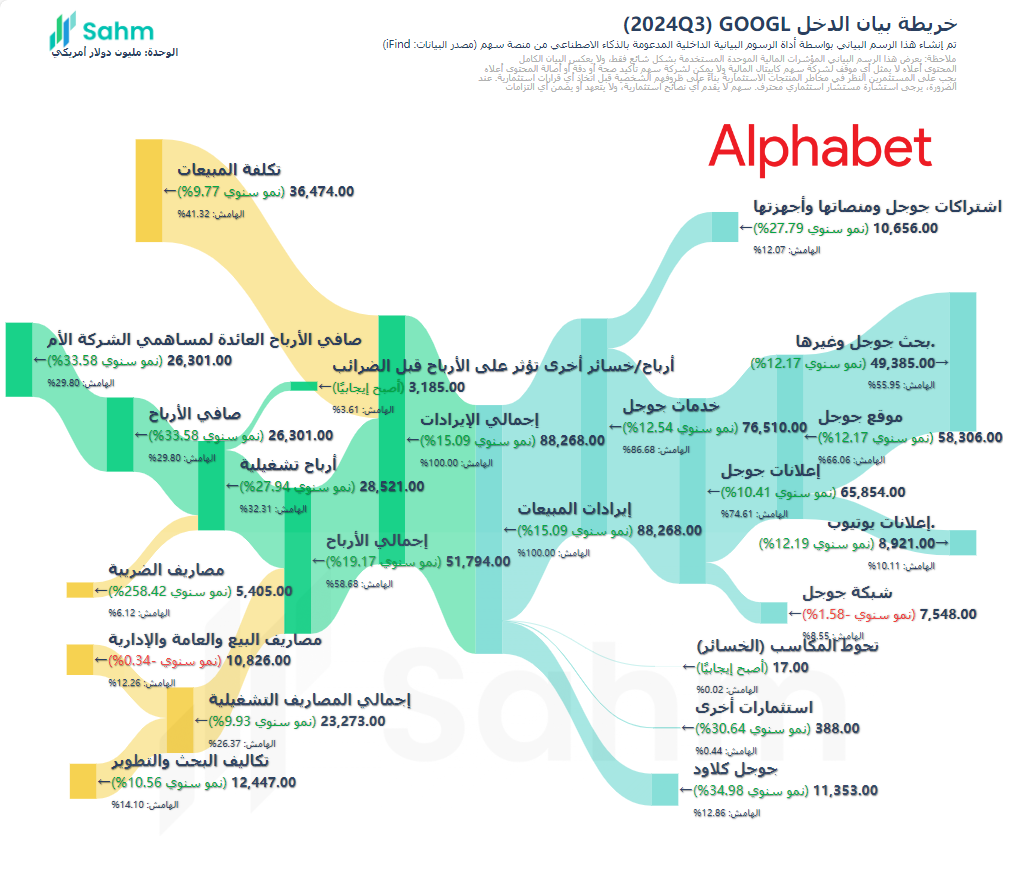

ALPHABET (Google's parent)

Alphabet Inc. Class C(GOOG.US)/Alphabet Inc. Class A(GOOGL.US)

- Revenue of US$88.27 billion, a 15% year-over-year increase, surpassing analyst predictions of US$86.44 billion.

- Non-GAAP net income was US$26.3 billion, up 34%

- Diluted EPS of US$2.12, exceeding market forecasts of US$1.83.

03

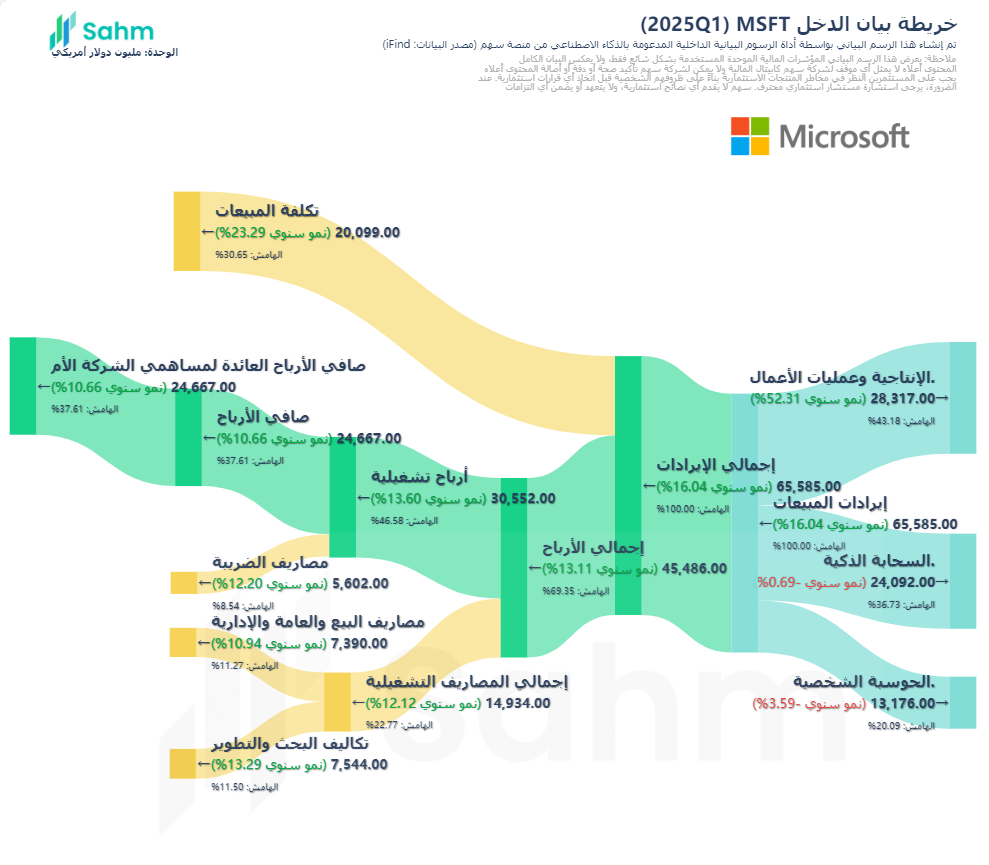

MICROSOFT

Microsoft Corporation(MSFT.US)

- Net income of US$24.667 billion reflected an 11% year-over-year increase, unaffected by a positive currency impact of US$78 million which equated a 10% net increase.

- Diluted earnings per share (EPS) were US$3.30, up 10% from US$2.99 in the previous year, surpassing analysts' expectations. Yahoo Finance reported that 31 analysts had an average EPS forecast of US$2.96.

- Revenue for the quarter amounted to US$65.585 billion, a 16% increase from US$56.517 billion last year, aligning with analysts’ expectations who anticipated US$64.51 billion.

04

AMAZON

- - Net sales: US$158.88 billion, up from US$143.083 billion, an 11% increase.

- - Net income: US$15.328 billion, up 55% from US$9.879 billion a year ago.

- - Operating income: US$17.411 billion, up from US$11.188 billion.

- - AMZN exceeded the anticipated revenue of US$157.2 billion and EPS of US$1.14 from analyst forecasts.

05

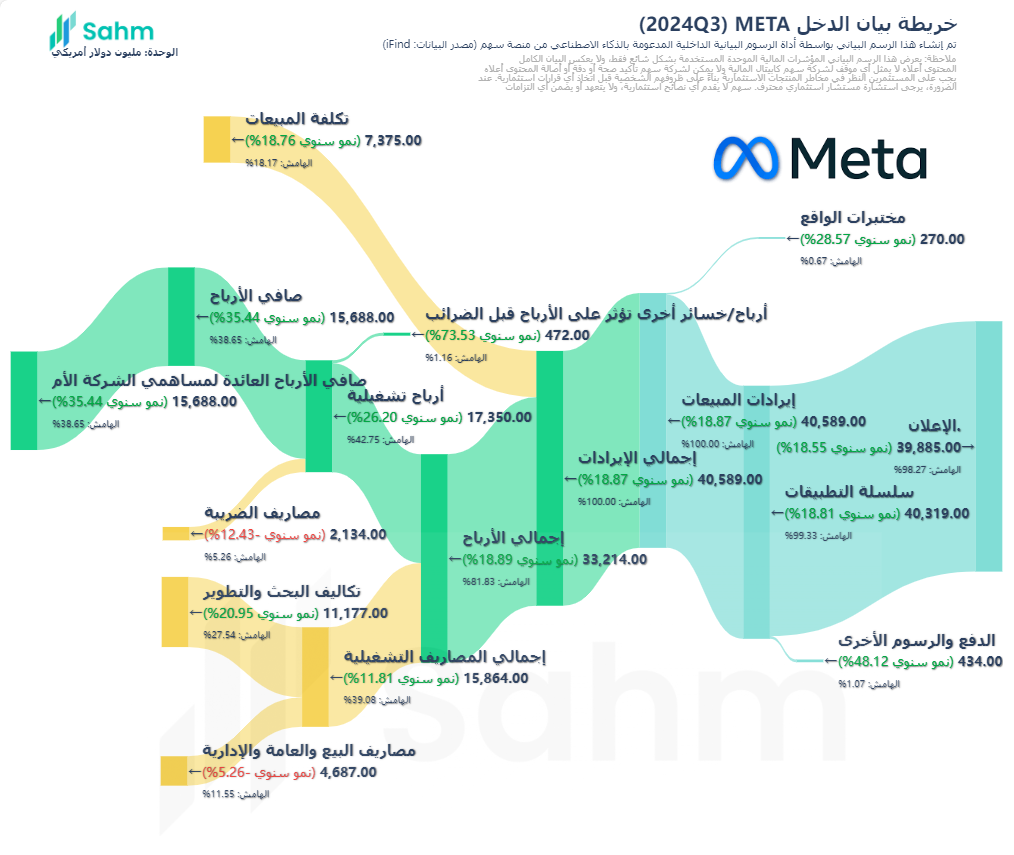

META PLATFORM

- Revenue of US$40.589 billion, a 19% increase year-over-year, exceeding analysts' expectations of US$40.3 billion.

- Net income rose by 35% to US$15.688 billion, the smallest annual increase since Q2 2023, while diluted earnings per share jumped 37% to US$6.03, surpassing the forecasted US$5.25.

06

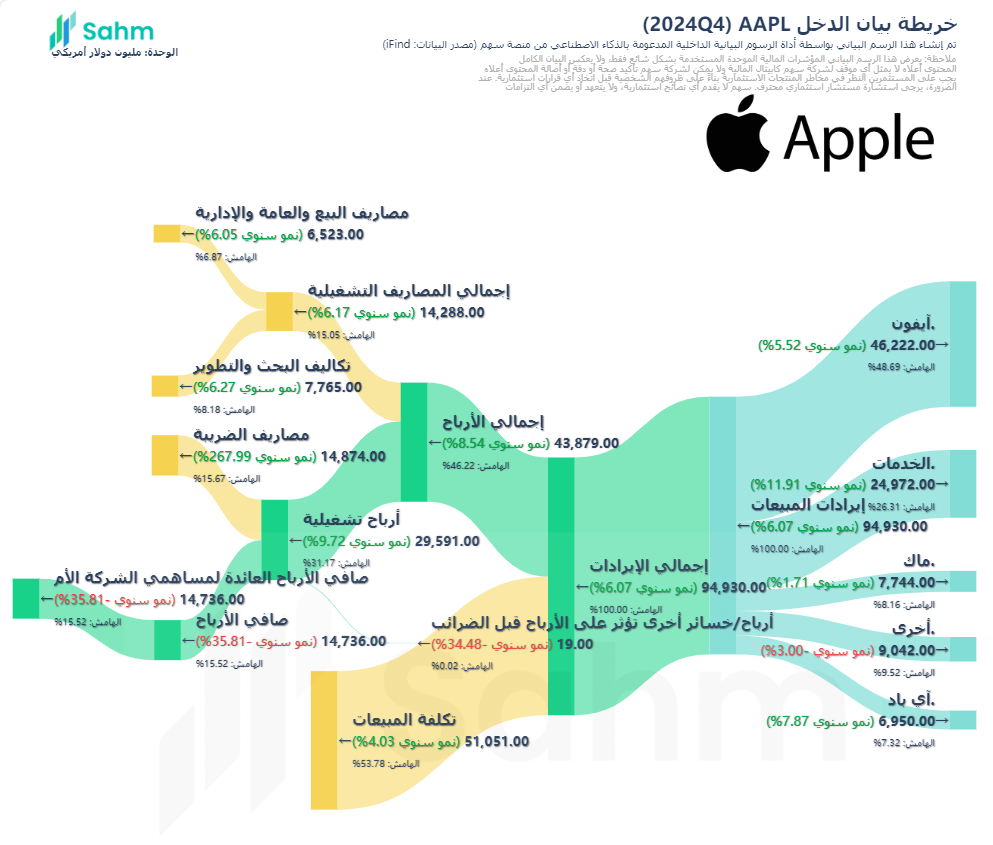

APPLE

- Revenue reaching US$94.93 billion, surpassing Wall Street's expectation of US$94.4 billion.

- Earnings per share (EPS) were US$1.64, also exceeding the forecast of US$1.55.

07

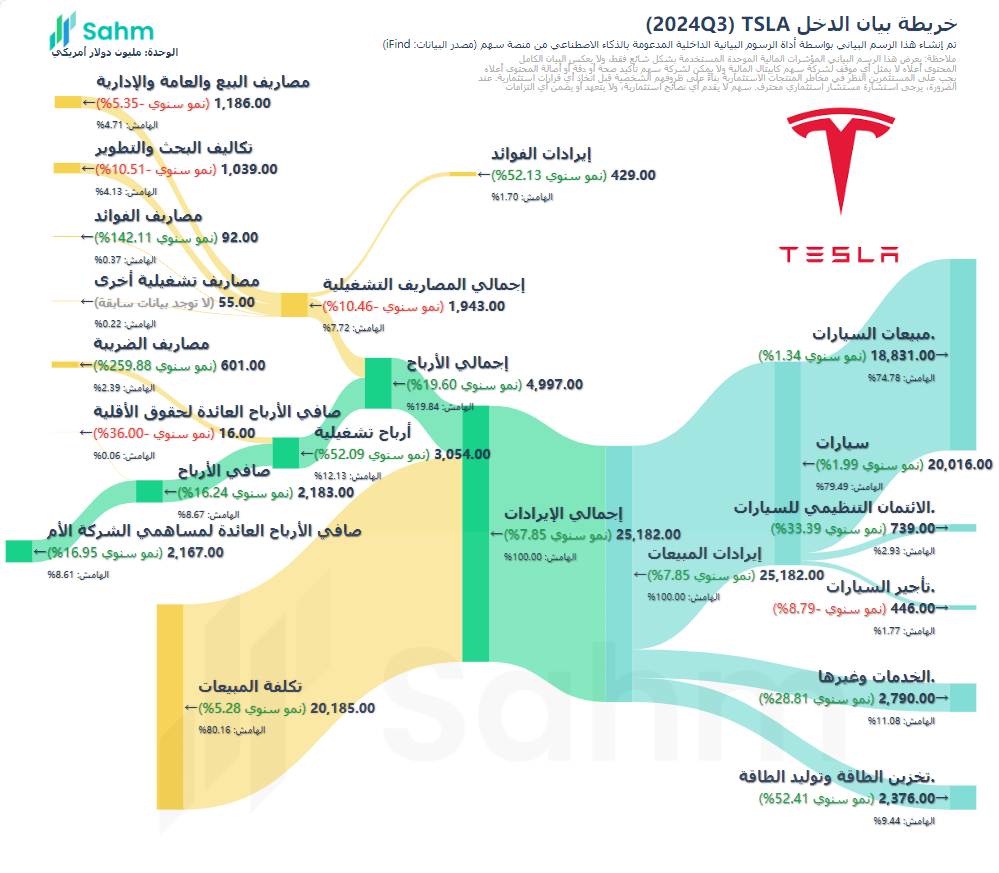

Tesla

- Revenue: Q3 total revenue reached US$25.182 billion, up 7.8% year-over-year.

- EPS: Non-GAAP diluted EPS for Q3 was US$0.72, up nearly 9.1% year-over-year, beating the forecast of US$0.60.

- Net Profit: Non-GAAP net profit for Q3 was US$2.505 billion, up 8.1% year-over-year.

- Free Cash Flow: Q3 FCF was US$2.742 billion, up 223%, surpassing the expected US$1.61 billion.