Please use a PC Browser to access Register-Tadawul

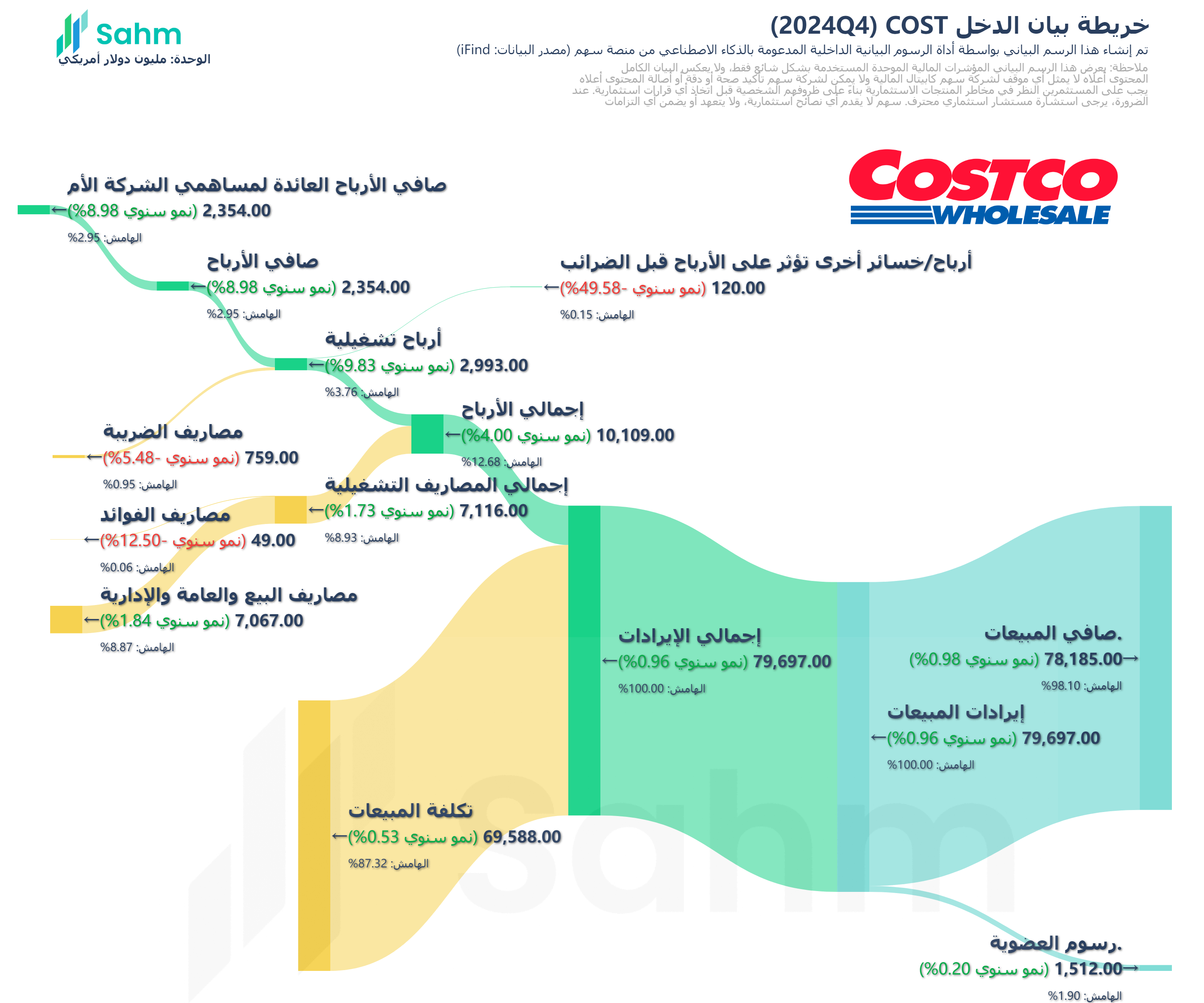

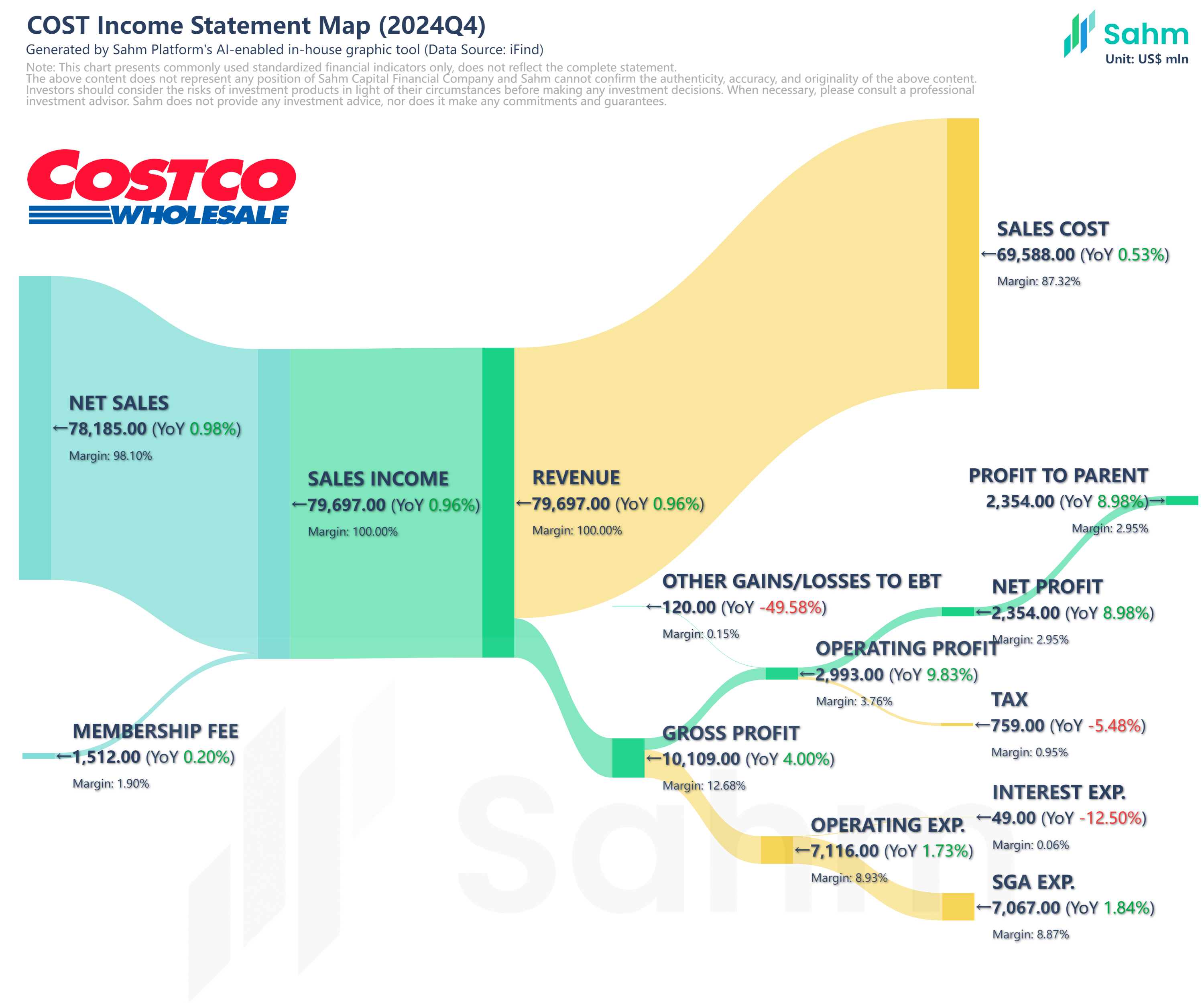

In One Chart | Costco Wholesale Earnings Breakdown (2024Q4)

Costco Wholesale Corporation COST | 991.54 | -0.75% |

Wal-Mart Stores, Inc. WMT | 96.83 | +0.99% |

Target Corporation TGT | 95.26 | -2.77% |

Home Depot, Inc. HD | 372.81 | -0.21% |

Costco Wholesale Corporation(COST.US) reported stronger-than-expected profits in the fourth quarter, indicating that consumer spending remained robust despite ongoing cost pressures.

The company's financial report showed that in the fourth quarter of fiscal year 2024, which ended on September 1st:

- Total Revenue was $79.697 billion, up 1% year-over-year, slightly below the analysts' average estimate of $79.96 billion.

- Revenue from Net Sales were $78.185 billion, up 1% year-over-year, while membership fees were $1.512 billion, relatively flat compared to the same period last year.

- Net Profit for the quarter was $2.354 billion, up 9% year-over-year.

- Diluted Earnings Per Share were $5.29, better than the analysts' average estimate of $5.07.

- Comparable Store Sales grew 5.4% in Q4, higher than the analysts' average estimate of 4.27% growth.

- Comparable Store Sales in the US increased 5.3%, while e-commerce sales grew nearly 19%.

Costco stated that customer traffic in the US increased year-over-year in Q4, although the average ticket size decreased slightly. The company said it gained more paid members, with around 90% of members renewing their memberships in Q4. Due to its customers paying membership fees and generally being more affluent, Costco has historically been less affected by macroeconomic challenges.

However, Costco raised its membership fees in the US and Canada in September, and it may take several months to see the impact of this change on renewal rates.

Non-food categories have been one of Costco's recent growth areas. Furthermore, the company is investing in further developing its online sales under the new management team. The company highlighted appliances, precious metals, home furnishings, and gift cards as its main online sales categories.

Meanwhile, as the holiday shopping season approaches, retailers are increasingly concerned about the possibility of a strike at East Coast ports, as workers and their employers try to finalize a contract by the end of the month. Costco said it has contingency plans in place to address potential shipping delays, including shifting cargo to different ports.

It is worth noting that the latest quarterly results from US retailers have been mixed, indicating that consumers are becoming more selective and weighing their options before the holiday shopping season. Early forecasts for the holiday shopping season suggest that in-store sales will see a slight increase, while online sales will see substantial growth.

Wal-Mart Stores, Inc.(WMT.US) and Target Corporation(TGT.US) stated that consumers are focused on purchasing essential goods, but they also noted that there are no signs of a new consumer downturn yet. However, Home Depot, Inc.(HD.US) said that consumers are delaying major purchases due to economic uncertainty, and some discount retailers have pointed to pressure on low-income consumers.