In-Depth Examination Of 7 Analyst Recommendations For ASML Holding

ASML Holding NV ADR ASML | 715.86 | -0.53% |

Ratings for ASML Holding (NASDAQ:ASML) were provided by 7 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 7 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 6 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

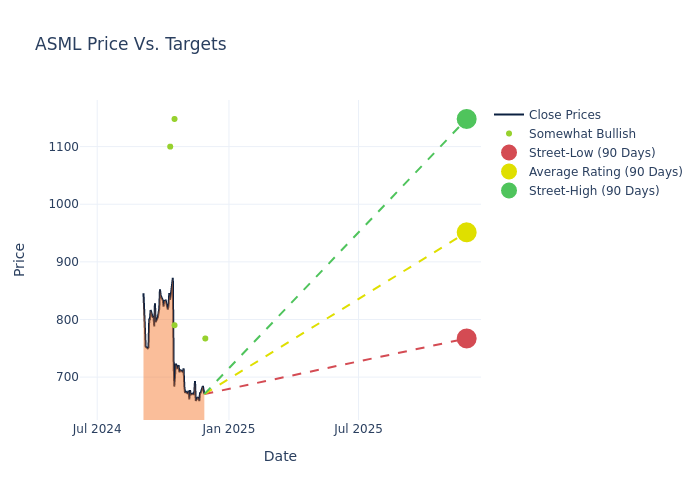

Analysts have set 12-month price targets for ASML Holding, revealing an average target of $975.29, a high estimate of $1207.00, and a low estimate of $767.00. A decline of 12.03% from the prior average price target is evident in the current average.

Analyzing Analyst Ratings: A Detailed Breakdown

The standing of ASML Holding among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Sara Russo | Bernstein | Lowers | Outperform | $767.00 | $815.00 |

| Sara Russo | Bernstein | Lowers | Outperform | $815.00 | $1052.00 |

| Joseph Quatrochi | Wells Fargo | Lowers | Overweight | $790.00 | $1000.00 |

| Sandeep Deshpande | JP Morgan | Lowers | Overweight | $1148.00 | $1207.00 |

| Mehdi Hosseini | Susquehanna | Lowers | Positive | $1100.00 | $1300.00 |

| Sandeep Deshpande | JP Morgan | Raises | Overweight | $1207.00 | $1202.00 |

| Joseph Quatrochi | Wells Fargo | Lowers | Overweight | $1000.00 | $1185.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to ASML Holding. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of ASML Holding compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of ASML Holding's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into ASML Holding's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on ASML Holding analyst ratings.

Unveiling the Story Behind ASML Holding

ASML is the leader in photolithography systems used in the manufacturing of semiconductors. Photolithography is the process in which a light source is used to expose circuit patterns from a photo mask onto a semiconductor wafer. The latest technological advances in this segment allow chipmakers to continually increase the number of transistors on the same area of silicon, with lithography historically representing a high portion of the cost of making cutting-edge chips. ASML outsources the manufacturing of most of its parts, acting like an assembler. ASML's main clients are TSMC, Samsung, and Intel.

ASML Holding: Delving into Financials

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Over the 3 months period, ASML Holding showcased positive performance, achieving a revenue growth rate of 11.9% as of 30 September, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: ASML Holding's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 27.81% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): ASML Holding's ROE excels beyond industry benchmarks, reaching 13.46%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): ASML Holding's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 5.03% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: With a below-average debt-to-equity ratio of 0.29, ASML Holding adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Basics of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.