Please use a PC Browser to access Register-Tadawul

Hilton Worldwide Holdings' (NYSE:HLT) investors will be pleased with their splendid 143% return over the last five years

Hilton Worldwide Holdings, Inc. HLT | 0.00 |

When you buy a stock there is always a possibility that it could drop 100%. But on a lighter note, a good company can see its share price rise well over 100%. For example, the Hilton Worldwide Holdings Inc. (NYSE:HLT) share price has soared 140% in the last half decade. Most would be very happy with that. On top of that, the share price is up 16% in about a quarter. But this move may well have been assisted by the reasonably buoyant market (up 9.1% in 90 days).

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

Check out our latest analysis for Hilton Worldwide Holdings

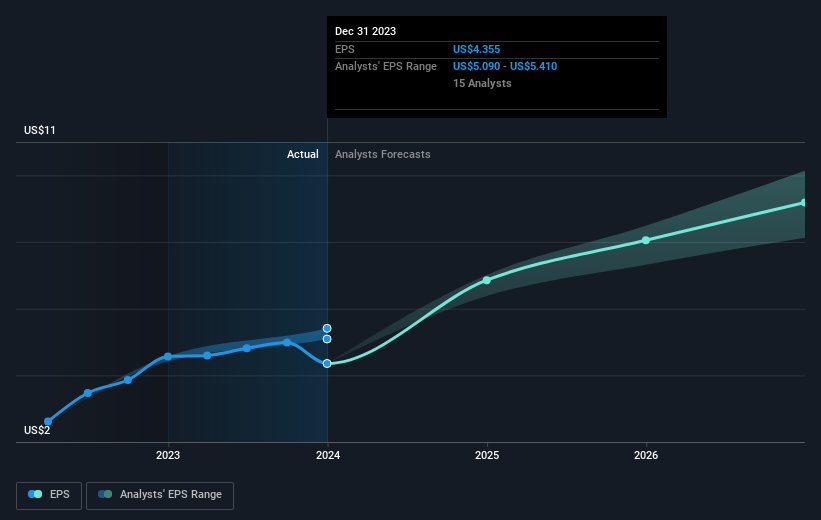

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last half decade, Hilton Worldwide Holdings became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Hilton Worldwide Holdings has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Hilton Worldwide Holdings' financial health with this free report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Hilton Worldwide Holdings' TSR for the last 5 years was 143%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that Hilton Worldwide Holdings has rewarded shareholders with a total shareholder return of 51% in the last twelve months. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 19% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Hilton Worldwide Holdings better, we need to consider many other factors. Even so, be aware that Hilton Worldwide Holdings is showing 3 warning signs in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.