Exploring Bilibili And Two More Growth Stocks With Significant Insider Holdings

LI Auto LI | 26.09 27.55 | +3.29% +5.60% Pre |

As global markets exhibit mixed signals with the Dow Jones facing a downturn and the Nasdaq hitting new highs, investors are navigating through a complex landscape marked by varying performance across major indices. In such an environment, growth companies with high insider ownership can offer unique advantages, as these insiders often have a deep commitment to the company's long-term success.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.1% |

| Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

| Cettire (ASX:CTT) | 28.7% | 29.9% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 24.5% |

| Plenti Group (ASX:PLT) | 12.6% | 106.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

| HANA Micron (KOSDAQ:A067310) | 19.8% | 76.8% |

Let's review some notable picks from our screened stocks.

Bilibili (NasdaqGS:BILI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bilibili Inc. operates as an online entertainment platform primarily targeting the younger demographics in China, with a market capitalization of approximately $5.63 billion.

Operations: The company's revenue is primarily generated from internet information services, totaling CN¥23.12 billion.

Insider Ownership: 20.8%

Earnings Growth Forecast: 79.2% p.a.

Bilibili, a company with high insider ownership, recently reported a net loss increase in Q1 2024 despite growing revenues to CNY 5.66 billion from CNY 5.07 billion year-over-year. The firm's share price remains volatile, yet it trades at a 9.7% discount to its estimated fair value. Analysts expect Bilibili's earnings to grow significantly at an annual rate of 79.16%, with revenue growth projected to outpace the US market average, highlighting potential for future profitability and growth amidst current challenges.

Li Auto (NasdaqGS:LI)

Simply Wall St Growth Rating: ★★★★★☆

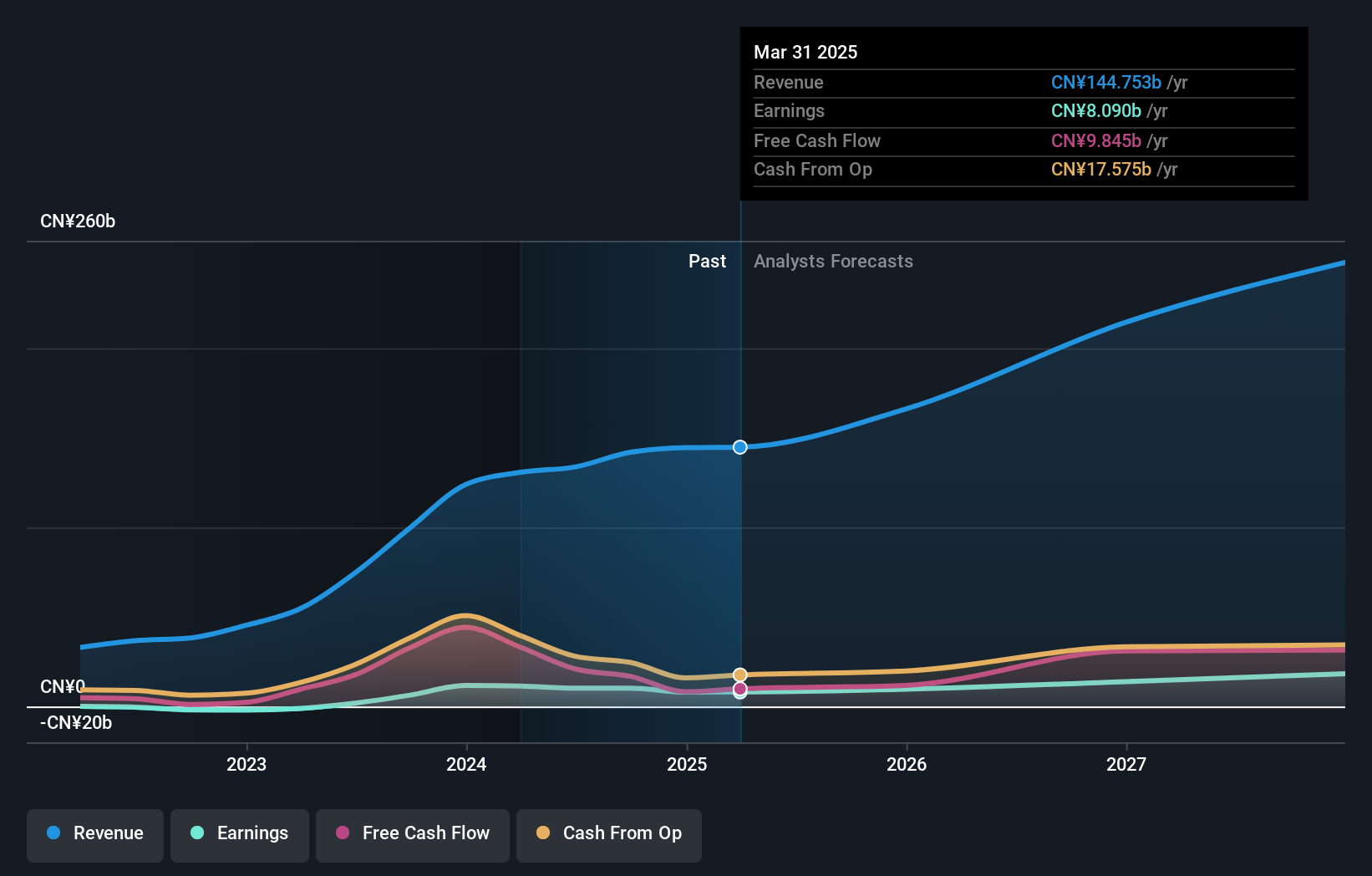

Overview: Li Auto Inc., with a market cap of $21.39 billion, operates in the electric vehicle market in the People’s Republic of China.

Operations: The primary revenue source, totaling CN¥130.70 billion, is derived from its auto manufacturing segment.

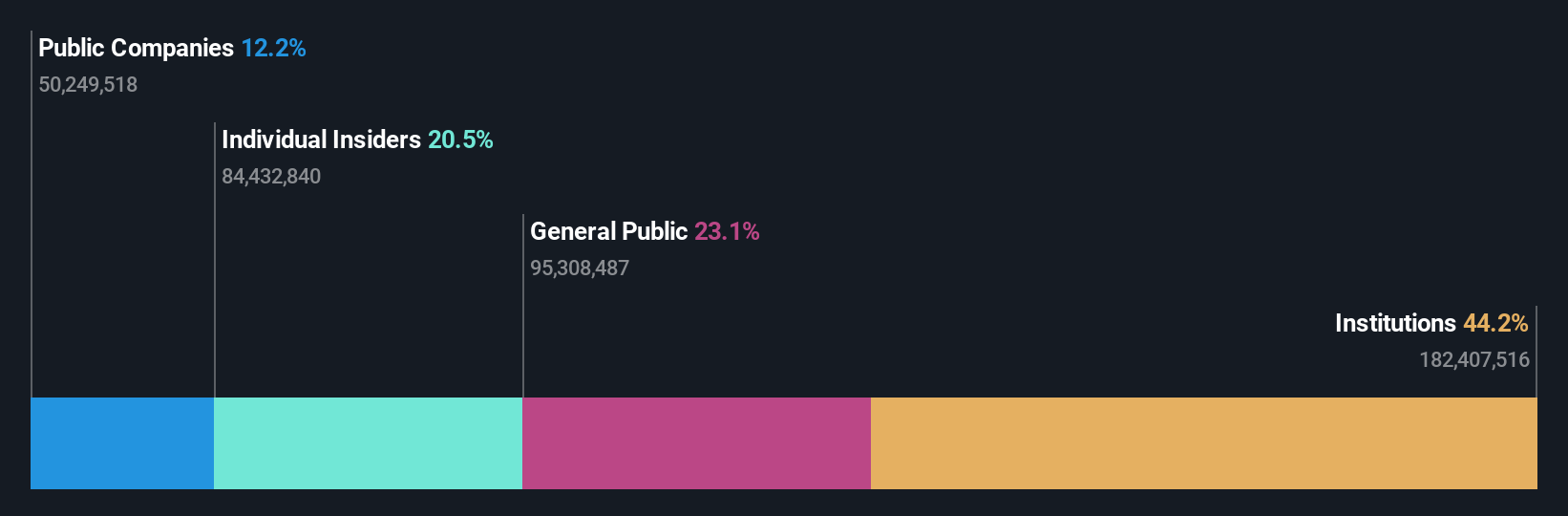

Insider Ownership: 29.3%

Earnings Growth Forecast: 21.5% p.a.

Li Auto, a growth company with significant insider ownership, reported a substantial revenue increase to CNY 25.63 billion in Q1 2024 from CNY 18.79 billion year-over-year, though net income declined to CNY 592.56 million from CNY 929.67 million. Despite this mixed financial performance and recent legal challenges regarding overstated vehicle demand, the company forecasts robust vehicle delivery growth (21.3% to 27.1%) and expects revenues between US$4.1 billion and US$4.3 billion for Q2 2024, indicating potential resilience and expansion in its market presence.

Konfoong Materials International (SZSE:300666)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Konfoong Materials International Co., Ltd. operates in the materials industry and has a market capitalization of approximately CN¥12.10 billion.

Operations: The company generates revenue primarily from the manufacturing of computer, communications, and other electronic equipment, totaling CN¥2.81 billion.

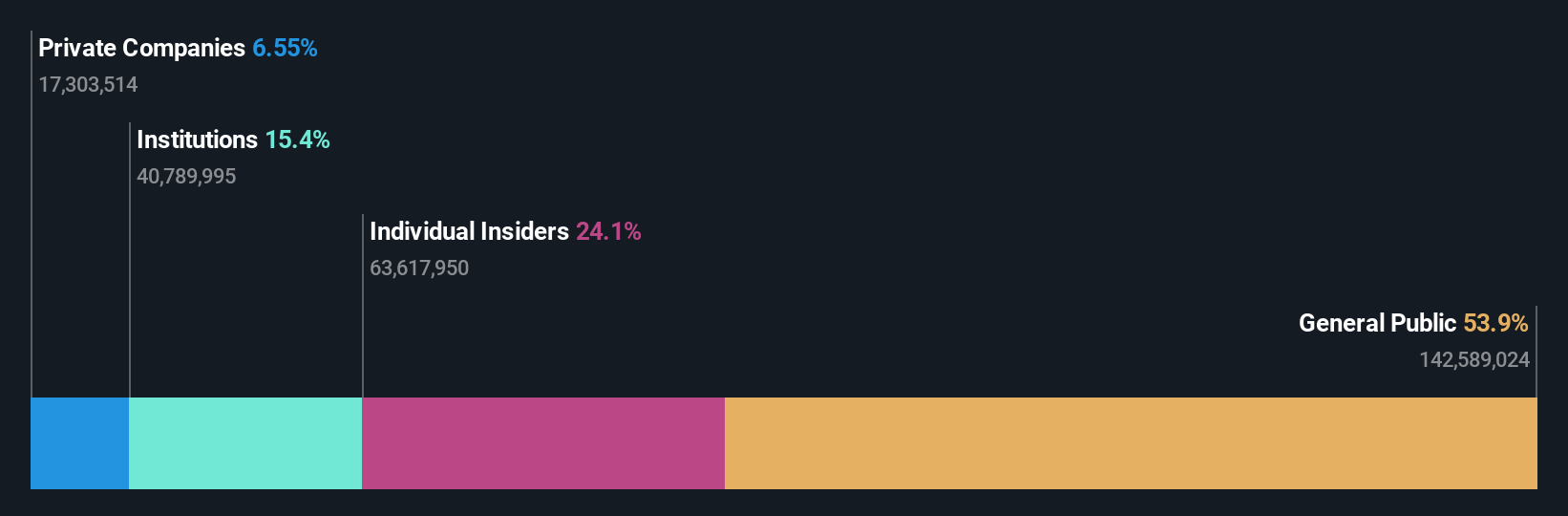

Insider Ownership: 24%

Earnings Growth Forecast: 24.8% p.a.

Konfoong Materials International Co., Ltd, a contender in the growth sector with high insider ownership, is poised for notable expansion. With a price-to-earnings ratio slightly below the industry average at 47.8x and anticipated revenue and earnings growth surpassing market expectations at 21.5% and 24.8% respectively per year, the company demonstrates strong future potential despite a forecasted modest return on equity of 9%. Recent activities include a dividend decrease to CNY 2 per 10 shares and ongoing share buybacks totaling CNY 64.99 million, underscoring active financial management amidst solid quarterly performance with Q1 sales up to CNY 772.39 million from CNY 565.23 million year-over-year.

Turning Ideas Into Actions

- Explore the 1485 names from our Fast Growing Companies With High Insider Ownership screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.