Event Reminder | Get Ready for Next 10 Days (Oct. 30th - Nov. 9th)

Alphabet Inc. Class A GOOGL | 189.43 189.58 | +0.07% +0.08% Post |

Advanced Micro Devices, Inc. AMD | 120.63 120.80 | -0.13% +0.14% Post |

Microsoft Corporation MSFT | 418.58 419.56 | -0.69% +0.23% Post |

Meta Platforms META | 599.24 600.00 | +2.34% +0.13% Post |

Apple Inc. AAPL | 243.85 243.33 | -2.62% -0.21% Post |

The next ten days are set for a series of major events, all shaping investor sentiment, and it could be a period of intense volatility for markets.

Economic Digits

A series of economic reports due later this week will test investors' bets on the market direction.

In the meantime, hurricane "Helene" continues to impact the US, causing temporary job losses.

On Wednesday, the Bureau of Economic Analysis will release its preliminary estimate for Q3 Gross Domestic Product (GDP).

The US economy is expected to continue on a stable path, with a projected annual growth rate of 3%, consistent with Q2 growth.

| Riyadh Time | Indicator | Previous | Consensus | Forecast |

|---|---|---|---|---|

| 03:15 PM | ADP Employment Change OCT | 143K | 115K | 129.0K |

| 03:30 PM | GDP Growth Rate QoQ Adv Q3 | 3% | 3% | 3.3% |

| 03:30 PM | GDP Price Index QoQ Adv Q3 | 2.5% | 2.7% | 2.5% |

| 03:30 PM | Core PCE Prices QoQ Adv Q3 | 2.8% | 2.1% | 2.3% |

| 03:30 PM | GDP Sales QoQ Adv Q3 | 1.9% | 2.2% | |

| 03:30 PM | PCE Prices QoQ Adv Q3 | 2.5% | 2% | |

| 03:30 PM | Real Consumer Spending QoQ Adv Q3 | 2.8% | 3% | |

| 03:30 PM | Treasury Refunding Announcement |

On Thursday, the market will see the release of the Federal Reserve's preferred inflation measure.

Economists forecast that the annual Personal Consumption Expenditures (PCE), which excludes volatile food and energy prices, will reach 2.6% for September, down from 2.7% in August.

On a month-over-month basis, core PCE is expected to rise by 0.3%, compared to a 0.1% increase in the previous month.

| Riyadh Time | Indicator | Previous | Consensus | Forecast |

|---|---|---|---|---|

| 02:30 PM | Challenger Job Cuts OCT | 72.821K | 95K | |

| 03:30 PM | Core PCE Price Index MoM SEP | 0.1% | 0.3% | 0.1% |

| 03:30 PM | Personal Income MoM SEP | 0.2% | 0.3% | 0.2% |

| 03:30 PM | Personal Spending MoM SEP | 0.2% | 0.4% | 0.4% |

| 03:30 PM | Initial Jobless Claims OCT/26 | 227K | 230K | 228.0K |

| 03:30 PM | PCE Price Index MoM SEP | 0.1% | 0.2% | 0.1% |

| 03:30 PM | PCE Price Index YoY SEP | 2.2% | 2.1% | 2.1% |

| 03:30 PM | Continuing Jobless Claims OCT/19 | 1897K | 1890K | 1880.0K |

| 03:30 PM | Core PCE Price Index YoY SEP | 2.7% | 2.6% | 2.7% |

| 03:30 PM | Jobless Claims 4-week Average OCT/26 | 238.5K | 238.0K |

On Friday, the Bureau of Labor Statistics will publish the latest Non-Farm Payrolls data.

According to Bloomberg, the October jobs report is expected to show an addition of 125,000 nonfarm jobs, with the unemployment rate remaining steady at 4.1%. In September, the US economy added 254,000 jobs as the unemployment rate dipped to 4.1%.

Michael Reid of RBC Capital Markets wrote in a client report last Thursday that after experiencing two hurricanes, a strike, and consecutive holidays, Friday's October jobs report is expected to have a lot of noise.

However, taking into account the various factors that could affect job growth, Reid suggested that the Unemployment Rate will provide the best insight into this month's labour market.

| Riyadh Time | Indicator | Previous | Consensus | Forecast |

|---|---|---|---|---|

| 11:30 AM | Fed Balance Sheet OCT/30 | $7.03T | ||

| 03:30 PM | Non Farm Payrolls OCT | 254K | 115K | 180.0K |

| 03:30 PM | Unemployment Rate OCT | 4.1% | 4.1% | 4.2% |

| 03:30 PM | Average Hourly Earnings MoM OCT | 0.4% | 0.3% | 0.3% |

| 04:45 PM | S&P Global Manufacturing PMI Final OCT | 47.3 | 47.8 | |

| 05:00 PM | ISM Manufacturing PMI OCT | 47.2 | 47.6 | 47.5 |

| 05:00 PM | ISM Manufacturing Employment OCT | 43.9 | 44 |

Major Earnings

Major tech firms such as Alphabet Inc. Class A(GOOGL.US), Advanced Micro Devices, Inc.(AMD.US), Microsoft Corporation(MSFT.US), Meta Platforms(META.US), Apple Inc.(AAPL.US), Amazon.com, Inc.(AMZN.US), and Intel Corporation(INTC.US) are releasing their earnings reports.

In this earnings season, AI investments will be a key focus, particularly the scale of investments in infrastructure by these tech giants.

Expected Q3 capital expenditures for Microsoft, Alphabet, Amazon, and Meta Platforms total US$56 billion, marking a 52% year-over-year increase.

US Presidential Election Enters Final Stage

The US presidential election has intensified, with Democratic candidate Kamala Harris's polling support being overtaken by Republican rival Donald Trump, whose support has risen steadily since late September.

According to RCP average polls as of October 28, Trump leads Harris by 0.2 percentage points at 48.6% to 48.4%.

Election tension is most pronounced in the US debt, cryptocurrency, and gold markets. The "Trump trade" is dominating once again, with billions flowing into US bank stocks, cryptocurrencies, and energy stocks in anticipation of Trump's potential return to the White House.

Notably, Bitcoin has surpassed US$70,000 for the first time since June, buoyed by ETF funds and election speculation.

Fed Decision and US Bond Sell-Off

The Fed's November rate decision may be heavily influenced by the PCE price index and the October nonfarm payroll report.

With US inflation slowing, recent comments from Fed officials indicate a close watch on the labour market's health.

San Francisco Fed President Mary Daly mentioned last week that there is no current information suggesting that the Fed will not continue to lower rates. She noted that in an economy seeing inflation ease, the policy remains "very tight" and emphasized the criticality of not seeing further deterioration in the labour market.

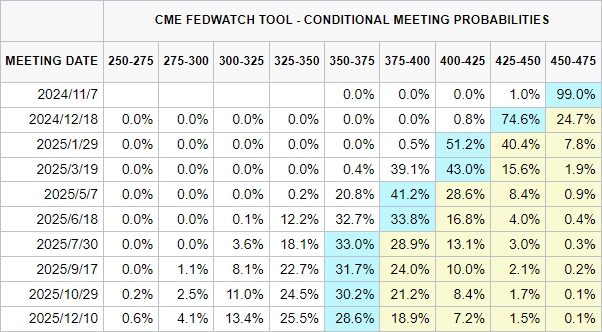

According to the FedWatch Tool, the market anticipates a 99% probability of a 25 basis point rate cut by the Fed on November 7.

Morgan Stanley strategist Ellen Zentner sees no reason why the Fed wouldn't cut rates by another 25 basis points in November unless the employment report presents a major surprise.