Please use a PC Browser to access Register-Tadawul

EDAP TMS S.A. (NASDAQ:EDAP) Stock's 27% Dive Might Signal An Opportunity But It Requires Some Scrutiny

EDAP TMS SA Sponsored ADR EDAP | 0.00 |

EDAP TMS S.A. (NASDAQ:EDAP) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 76% loss during that time.

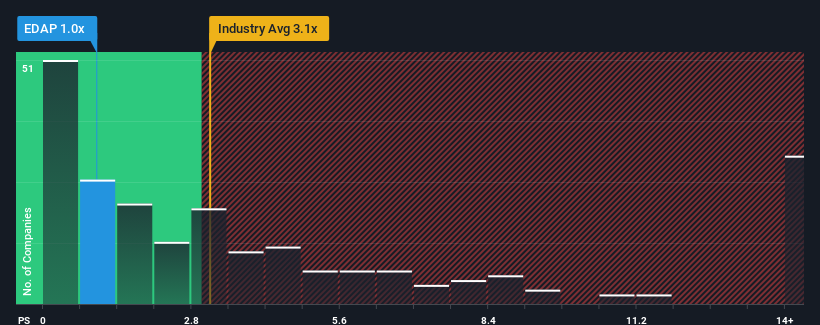

Since its price has dipped substantially, EDAP TMS may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1x, since almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.1x and even P/S higher than 7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

What Does EDAP TMS' P/S Mean For Shareholders?

Recent times haven't been great for EDAP TMS as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on EDAP TMS .Is There Any Revenue Growth Forecasted For EDAP TMS?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like EDAP TMS' to be considered reasonable.

Retrospectively, the last year delivered a decent 6.1% gain to the company's revenues. Pleasingly, revenue has also lifted 45% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 18% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 9.1% each year, which is noticeably less attractive.

In light of this, it's peculiar that EDAP TMS' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

EDAP TMS' P/S looks about as weak as its stock price lately. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

EDAP TMS' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.