Please use a PC Browser to access Register-Tadawul

Dollar General (NYSE:DG) Has Affirmed Its Dividend Of $0.59

Dollar General Corporation DG | 0.00 |

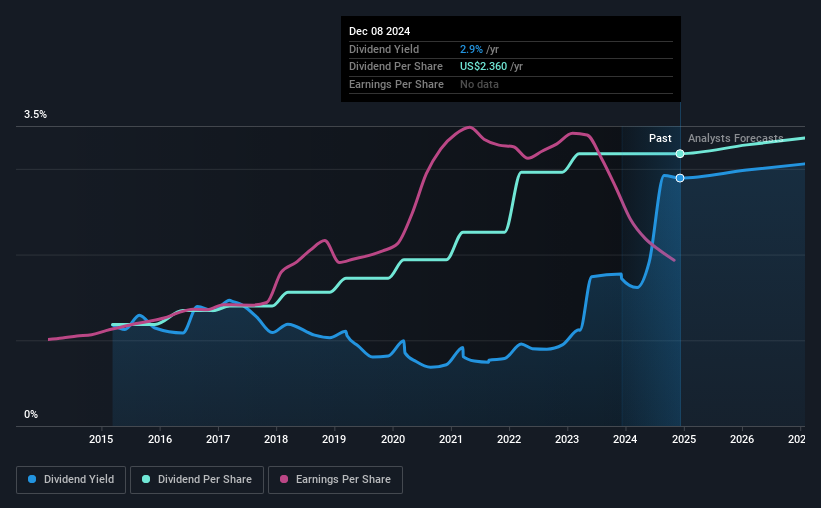

The board of Dollar General Corporation (NYSE:DG) has announced that it will pay a dividend of $0.59 per share on the 21st of January. This makes the dividend yield 2.9%, which will augment investor returns quite nicely.

Dollar General's Projected Earnings Seem Likely To Cover Future Distributions

A big dividend yield for a few years doesn't mean much if it can't be sustained. However, Dollar General's earnings easily cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

Looking forward, earnings per share is forecast to rise by 27.7% over the next year. Assuming the dividend continues along recent trends, we think the payout ratio could be 35% by next year, which is in a pretty sustainable range.

Dollar General Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The annual payment during the last 10 years was $0.88 in 2014, and the most recent fiscal year payment was $2.36. This means that it has been growing its distributions at 10% per annum over that time. It is good to see that there has been strong dividend growth, and that there haven't been any cuts for a long time.

The Dividend's Growth Prospects Are Limited

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Unfortunately things aren't as good as they seem. Dollar General hasn't seen much change in its earnings per share over the last five years.

Our Thoughts On Dollar General's Dividend

Overall, we think Dollar General is a solid choice as a dividend stock, even though the dividend wasn't raised this year. With shrinking earnings, the company may see some issues maintaining the dividend even though they look pretty sustainable for now. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.