Please use a PC Browser to access Register-Tadawul

Delta Air Lines (NYSE:DAL) Partners With JetZero On Sustainable Aircraft

Delta Air Lines, Inc. DAL | 0.00 |

Delta Air Lines (NYSE:DAL) formed a partnership with JetZero to collaborate on a sustainable aircraft project featuring a groundbreaking blended-wing-body design aimed at significantly reducing fuel consumption. This strategic move aligns with industry trends focused on sustainable innovation. However, during the same period, Delta's stock price dropped by 10.31%, a piece of the broader market downturn. Major stock indexes, including the S&P 500 and Nasdaq, faced considerable declines, fueled by renewed tariff concerns and economic apprehensions, further exacerbating investor sentiment. This dip is indicative of a larger market trend affecting several sectors, including airlines.

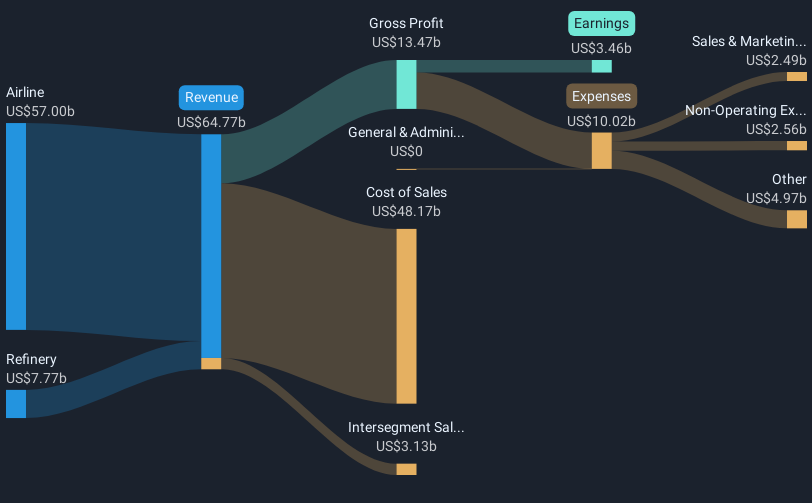

Over the past five years, Delta Air Lines' total shareholder returns reached 99.99%. Several developments have influenced these returns. Delta's 2025 forecast predicts record profitability driven by revenue growth and margin expansion, alongside new partnerships, such as with YouTube and Uber, aiming to enhance customer experience. In early 2025, Delta announced a quarterly dividend, maintaining investor interest through consistent payouts. Meanwhile, in March 2025, Delta’s joint venture with JetZero on a sustainable aircraft initiative demonstrated its commitment to long-term environmental goals, which investors may view favorably.

However, Delta has faced challenges, including a lawsuit related to a recent flight incident, which might influence market perceptions negatively. Despite these hurdles, Delta has maintained an optimistic outlook, supported by robust connectivity plans with Riyadh Air and anticipated earnings growth for 2025. Integrating sustainability and strategic partnerships alongside its financial strategies has shaped investor sentiment over the five-year period.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.