Please use a PC Browser to access Register-Tadawul

Day's Trending USA Stocks | EVER: Overnight gain 27.2%, Strong Q4 performance and optimistic Q1 outlook drive significant stock surge

EverBank Financial Corp. EVER | 24.10 23.87 | +3.88% -0.95% Pre |

ADAPTHEALTH CORP AHCO | 9.11 9.11 | +6.24% 0.00% Pre |

LogicBio Therapeutics LOGC | 7.52 7.52 | +2.59% 0.00% Pre |

Dream Finders Homes, Inc. Class A DFH | 23.68 23.68 | +3.91% 0.00% Pre |

FARO Technologies, Inc. FARO | 42.16 42.16 | -0.35% 0.00% Pre |

25/02/2025 Eastern Time in USA The Dow Jones Industrial Average rose by 0.37%, closing at 43621.16 points; the Nasdaq Composite dropped by 1.35%, closing at 19026.39 points; the S&P 500 Index dropped by 0.47%, closing at 5955.25 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the USA market.

EverBank Financial Corp.: Overnight gain 27.2%, Strong Q4 performance and optimistic Q1 outlook drive significant stock surge

EverQuote, Inc., a leading online insurance marketplace operator founded in 2008, has been revolutionizing the insurance industry through its innovative approach to customer acquisition. The company leverages cutting-edge data analytics, proprietary technology, and expert advisory services to streamline the insurance purchasing process, offering consumers more affordable and personalized coverage options. The firm's state-of-the-art technology platform serves as an efficient conduit between insurance providers and consumers, effectively disrupting traditional customer acquisition models in the insurance sector. By facilitating seamless connections between insurers and potential policyholders, EverQuote is positioning itself at the forefront of the digital transformation in insurance distribution. With a strategic vision to become the premier source for online insurance policies, EverQuote aims to drive innovation and enhance convenience across the insurance marketplace. The company's data-driven approach and commitment to technological advancement continue to reshape the landscape of insurance shopping, potentially yielding significant benefits for both consumers and insurance providers alike. As EverQuote expands its market presence and refines its offerings, industry observers will be closely monitoring its impact on the broader insurance ecosystem and its potential to redefine consumer expectations in the digital age.

EverBank Financial Corp. (EVER) experienced a significant stock price surge following its impressive fourth-quarter performance and optimistic outlook for Q1 2025. The company reported GAAP earnings per share of $0.33, surpassing expectations by $0.13. Revenue soared 165% year-over-year to $147.45 million, exceeding forecasts by $13.59 million. Looking ahead, EverBank projects Q1 2025 revenue between $155-160 million, representing a 73% year-over-year increase and outpacing market estimates. The company anticipates adjusted EBITDA of $19-21 million, a robust 163% year-over-year growth. These factors collectively propelled EVER's stock price, resulting in a substantial 27.2% single-day gain and a 28.2% year-to-date increase. The strong financial results and positive outlook underscore EverBank's solid growth trajectory and market confidence in its future performance.

ADAPTHEALTH CORP: Overnight gain 24.4%, Strong Q4 results and positive guidance boost investor confidence, driving stock surge.

AdaptHealth Corp. (NYSE: AHCO), a Delaware-based company founded in 2017, is a leading provider of home healthcare equipment and medical supplies in the United States. The company specializes in chronic care management solutions, with its core business segments encompassing sleep therapy equipment, diabetes supplies, home medical equipment, oxygen therapy services, and other medical supplies for chronic conditions. AdaptHealth primarily caters to patients with obstructive sleep apnea, diabetes, and those requiring home medical equipment following hospital discharge. The company serves beneficiaries of Medicare, Medicaid, and commercial insurance plans, positioning itself as a key player in the home healthcare equipment and medical supplies sector. With a focus on addressing the growing demand for in-home healthcare solutions, AdaptHealth has established a strong presence in the market for chronic disease management products and services. The company's strategic approach to meeting the needs of patients with long-term health conditions has contributed to its prominence in the rapidly evolving home healthcare industry. As healthcare trends continue to shift towards home-based care, AdaptHealth's diverse product portfolio and service offerings position the company to capitalize on market opportunities and drive growth in the expanding home healthcare equipment and supplies market.

ADAPTHEALTH CORP (AHCO) shares surged following the company's impressive fourth-quarter financial results, which significantly exceeded market expectations. The medical equipment provider reported Q4 operating income of $97.67 million, substantially outperforming analyst estimates of $78.30 million. Revenue reached $856.65 million, surpassing analyst projections by 3.31%. Notably, AHCO's GAAP earnings per share for Q4 2024 came in at $0.34, beating analyst expectations by 25.93% and demonstrating a marked improvement in profitability. Despite a marginal 0.18% year-over-year decline in sales, the company's performance was viewed as relatively stable given the current economic climate. AdaptHealth's positive guidance for fiscal year 2025 further bolstered investor confidence, propelling the stock price up by 24.4% and contributing to an 11.8% year-to-date gain.

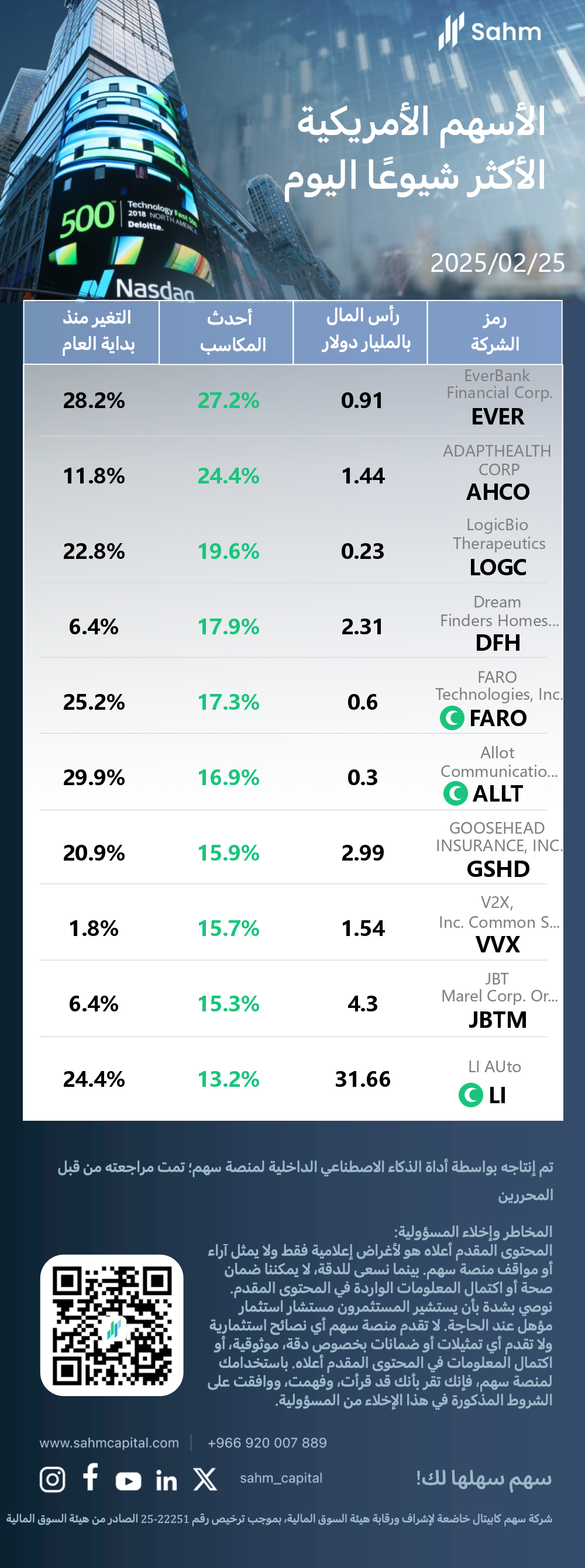

The Top 10 Daily Gainers in the USA market are listed as follows:

Company&Ticker | Cap$bn | Daily Change | YTD Change |

| EverBank Financial Corp.(EVER.US) | 0.91 | 27.2% | 28.2% |

| ADAPTHEALTH CORP(AHCO.US) | 1.44 | 24.4% | 11.8% |

| LogicBio Therapeutics(LOGC.US) | 0.23 | 19.6% | 22.8% |

| Dream Finders Homes, Inc. Class A(DFH.US) | 2.31 | 17.9% | 6.4% |

| FARO Technologies, Inc.(FARO.US) | 0.6 | 17.3% | 25.2% |

| Allot Communications Ltd.(ALLT.US) | 0.3 | 16.9% | 29.9% |

| GOOSEHEAD INSURANCE, INC.(GSHD.US) | 2.99 | 15.9% | 20.9% |

| V2X, Inc. Common Stock(VVX.US) | 1.54 | 15.7% | 1.8% |

| JBT Marel Corp. Ordinary Shares(JBTM.US) | 4.3 | 15.3% | 6.4% |

| LI Auto(LI.US) | 31.66 | 13.2% | 24.4% |

Editor's note: This content was generated by Sahm's in-house AI-enabled SaaS tool and was reviewed by our editing team. Risk and Disclaimer: The content provided above is solely for informational purposes and does not represent the views or positions of Sahm Platform. While we strive for accuracy, we cannot guarantee the authenticity or completeness of the information contained in the provided content. We strongly recommend that investors consult with a qualified investment advisor when deemed necessary. Sahm Platform neither provides investment advice nor makes any representations or warranties concerning the accuracy, reliability, or completeness of the information in the content provided above. By using Sahm Platform, you acknowledge that you have read, understood, and agreed to the terms set forth in this disclaimer.