Please use a PC Browser to access Register-Tadawul

CrowdStrike (CRWD) Advances AI Security and Partners with KPMG Is There More to This Strategic Push?

CrowdStrike CRWD | 504.78 | -2.49% |

- In September 2025, CrowdStrike announced significant advancements including new AI-powered security solutions for data protection and identity, as well as a partnership with KPMG to integrate its Falcon Next-Gen SIEM platform into enterprise cybersecurity services.

- The recent appointment of a chief resilience officer underscores CrowdStrike’s focus on operational reliability and highlights the company’s emphasis on adapting to the demands of AI-driven cybersecurity environments.

- We'll explore how this wave of AI-first product launches and enterprise collaboration is influencing CrowdStrike's overall investment outlook.

Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

CrowdStrike Holdings Investment Narrative Recap

To be a CrowdStrike shareholder, you need to believe in the company’s ability to lead cybersecurity’s shift to AI-powered, cloud-native platforms and grow its customer and partner base. The recent appointment of a chief resilience officer supports CrowdStrike’s focus on operational reliability, but does not materially change the biggest catalysts, accelerating Falcon Flex adoption and enterprise partnerships, or the main risks, such as pressures on operating margins and execution of new products.

The expanded collaboration with KPMG is especially relevant, as it showcases CrowdStrike’s growing traction among enterprises seeking to modernize security operations and highlights key short-term drivers like broader use of the Falcon platform for efficiency and automation. By amplifying reach and customer integration through partners, CrowdStrike strengthens its position as organizations prioritize advanced AI-driven security and vendor consolidation.

On the flip side, investors should be aware that operating margins may still face pressure as CrowdStrike...

CrowdStrike Holdings' outlook anticipates $7.9 billion in revenue and $691.1 million in earnings by 2028. This scenario assumes annual revenue growth of 22.1% and an earnings increase of $988.1 million from current earnings of -$297.0 million.

Uncover how CrowdStrike Holdings' forecasts yield a $481.53 fair value, a 3% downside to its current price.

Exploring Other Perspectives

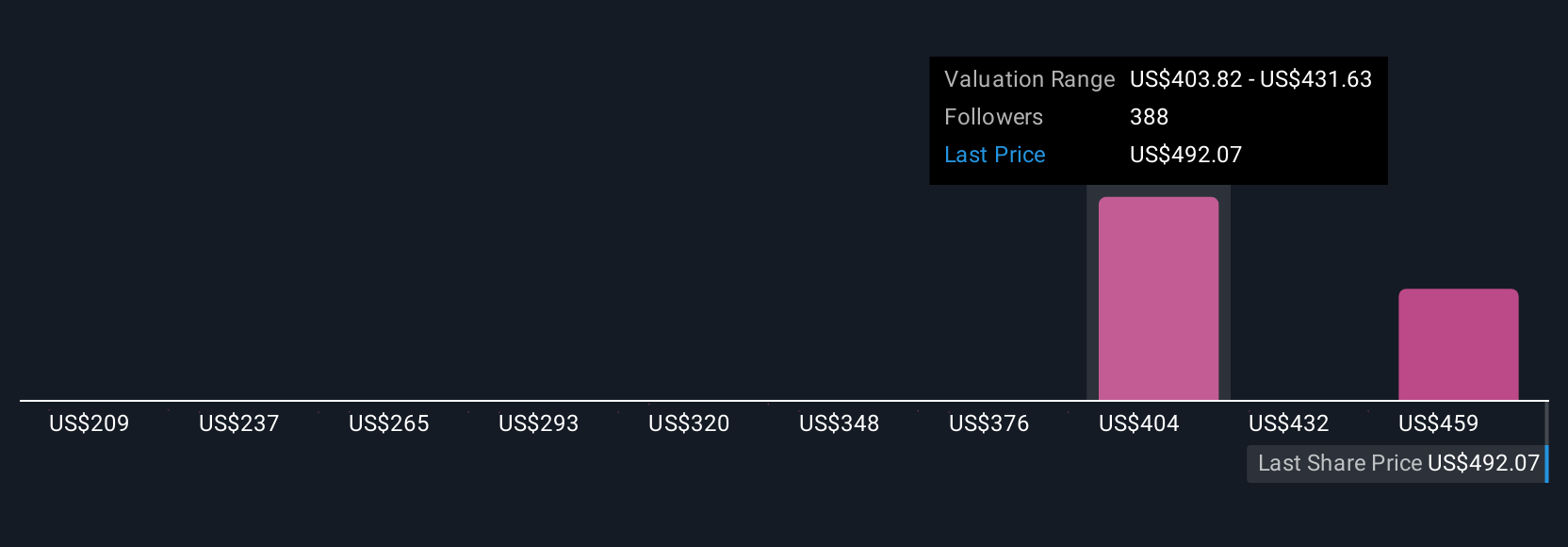

Thirty-five fair value estimates from the Simply Wall St Community range between US$200 and US$544.42 per share. With execution on new product launches in focus, investors can explore several contrasting viewpoints on CrowdStrike’s next steps and future potential.

Explore 35 other fair value estimates on CrowdStrike Holdings - why the stock might be worth as much as 10% more than the current price!

Build Your Own CrowdStrike Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CrowdStrike Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free CrowdStrike Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CrowdStrike Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.