Cerus And 2 Other US Penny Stocks To Watch

CureVac N.V. CVAC | 3.02 | +1.00% |

The U.S. stock market recently experienced a stumble, particularly in technology shares, as investors assessed earnings reports and economic data amidst fluctuating interest rates and inflation expectations. In such a climate, the appeal of penny stocks remains significant for those seeking affordable entry points with potential growth prospects. While the term "penny stocks" may seem outdated, these typically smaller or newer companies can offer unique opportunities when supported by strong financial health.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.802475 | $5.67M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $167.65M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.72 | $143.18M | ★★★★★☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.22 | $8.3M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $4.90 | $702.04M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.58 | $51.81M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.952 | $85.54M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.84 | $424.98M | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Cerus (NasdaqGM:CERS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cerus Corporation is a biomedical products company with a market cap of $326.86 million.

Operations: The company's revenue is primarily derived from its Blood Safety segment, totaling $176.23 million.

Market Cap: $326.86M

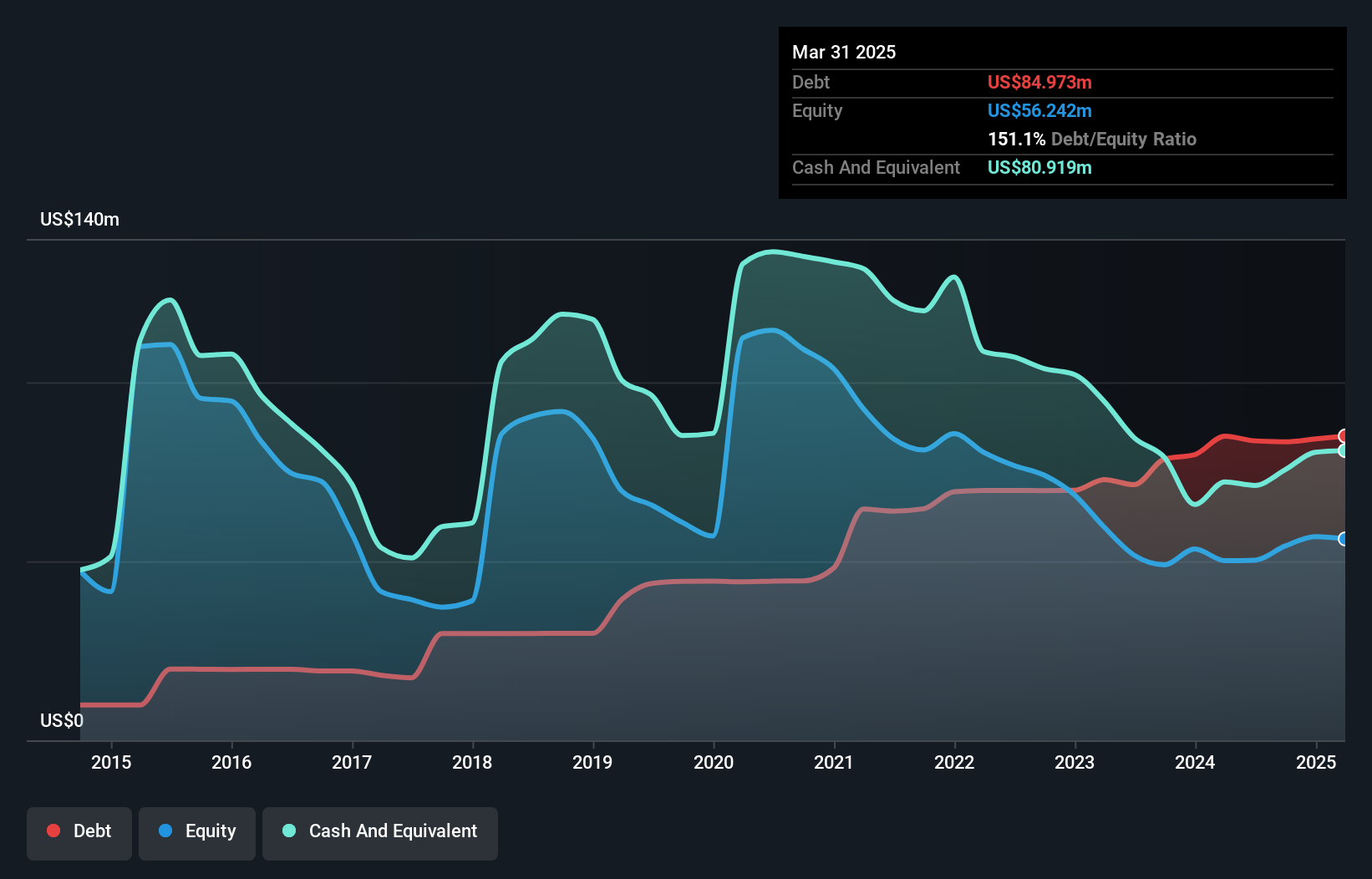

Cerus Corporation, with a market cap of US$326.86 million, primarily generates revenue from its Blood Safety segment, reporting US$176.23 million in total revenue. The company recently raised its full-year 2024 product revenue guidance and secured a significant contract with BARDA valued at up to US$248 million for the development of its INTERCEPT RBC system. Despite being unprofitable, Cerus has reduced losses over the past five years and maintains sufficient cash runway for more than three years. However, shareholder dilution and increased debt-to-equity ratio pose challenges to consider when evaluating this penny stock investment opportunity.

CureVac (NasdaqGM:CVAC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CureVac N.V. is a biopharmaceutical company that develops transformative medicines using messenger ribonucleic acid (mRNA) technology, with a market cap of approximately $614.62 million.

Operations: CureVac generates revenue of €65.86 million from the discovery and development of biotechnological applications.

Market Cap: $614.62M

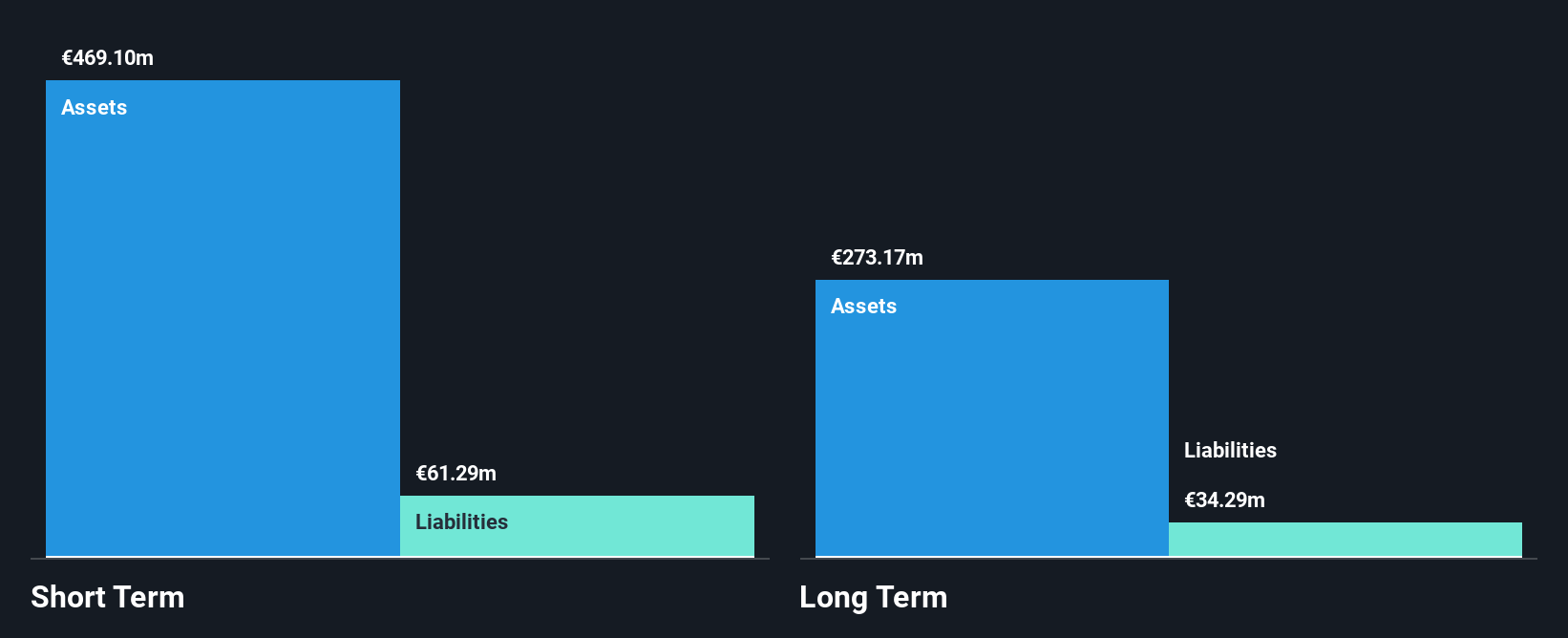

CureVac N.V., with a market cap of approximately $614.62 million, is navigating the biotech landscape with its mRNA technology despite being unprofitable. The company reported revenue of €65.86 million, reflecting ongoing development efforts rather than commercial product sales. Recent executive changes include the appointment of Axel Sven Malkomes as CFO, bringing significant strategic and financial expertise to bolster CureVac's growth initiatives. While CureVac's short-term assets exceed both short and long-term liabilities, it faces challenges with less than one year of cash runway and negative return on equity (-73.95%). Nonetheless, earnings are forecasted to grow significantly at 31.91% annually.

Clover Health Investments (NasdaqGS:CLOV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Clover Health Investments, Corp. offers Medicare Advantage plans in the United States and has a market cap of approximately $1.70 billion.

Operations: The company's revenue is derived entirely from its operations in the United States, totaling $2.12 billion.

Market Cap: $1.7B

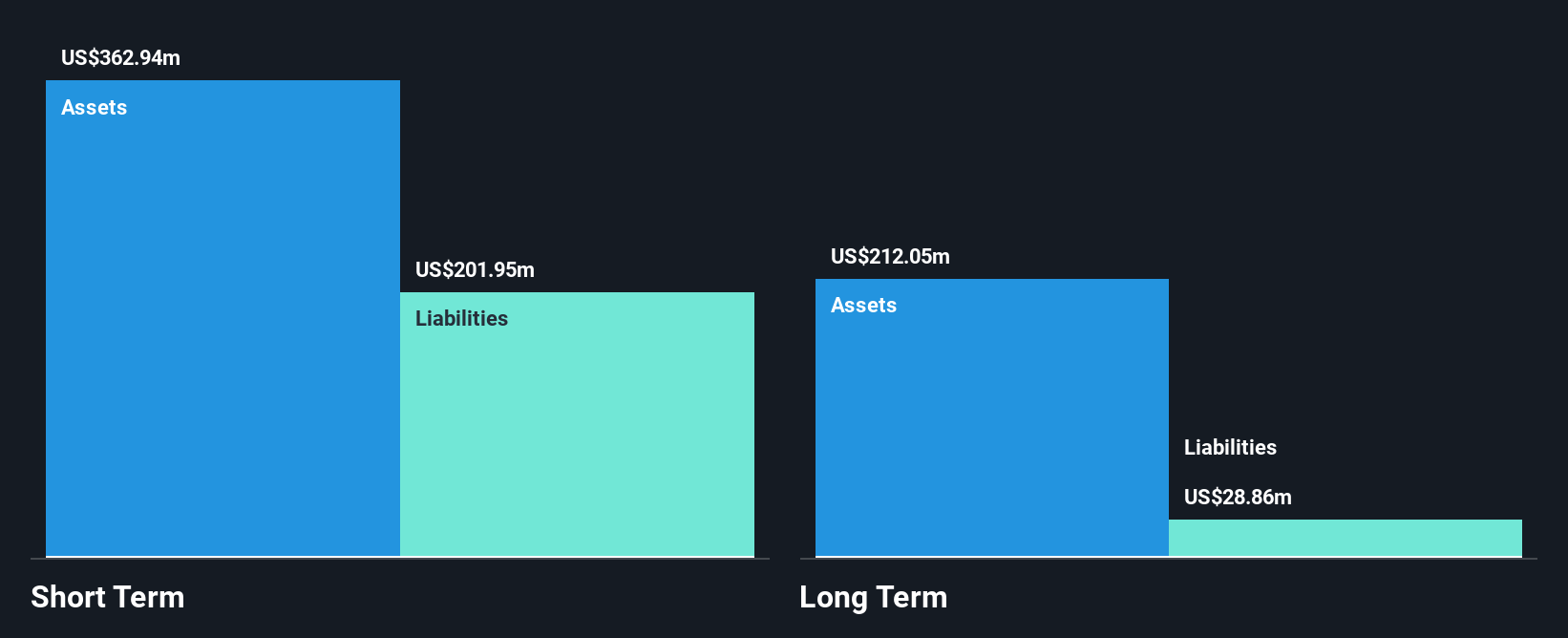

Clover Health Investments, Corp., with a market cap of US$1.70 billion, is actively reducing its losses, reporting a net loss of US$9.16 million for Q3 2024 compared to US$41.47 million a year ago. The company remains unprofitable but has no debt and sufficient cash runway exceeding three years based on current free cash flow trends. Recent strategic moves include the introduction of new Medicare Advantage plans in New Jersey and the appointment of Joseph Brand as COO to enhance operational efficiency and healthcare delivery through technological innovation, particularly in the New Jersey market where Clover is strengthening its presence.

Summing It All Up

- Unlock our comprehensive list of 713 US Penny Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.