BrightSpire Capital (NYSE:BRSP) adds US$109m to market cap in the past 7 days, though investors from five years ago are still down 33%

BrightSpire Capital, Inc. Class A Common Stock BRSP | 5.95 5.95 | -0.34% 0.00% Pre |

BrightSpire Capital, Inc. (NYSE:BRSP) shareholders should be happy to see the share price up 17% in the last week. But over the last half decade, the stock has not performed well. After all, the share price is down 56% in that time, significantly under-performing the market.

While the stock has risen 17% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

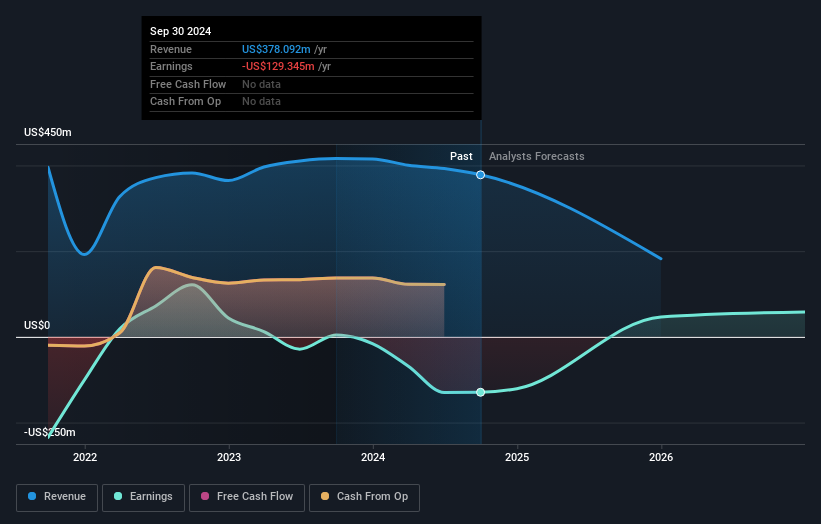

Given that BrightSpire Capital didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade BrightSpire Capital reduced its trailing twelve month revenue by 6.9% for each year. That's not what investors generally want to see. With neither profit nor revenue growth, the loss of 9% per year doesn't really surprise us. We don't think anyone is rushing to buy this stock. Ultimately, it may be worth watching - should revenue pick up, the share price might follow.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of BrightSpire Capital, it has a TSR of -33% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

BrightSpire Capital provided a TSR of 20% over the last twelve months. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 6% per year, over five years. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand BrightSpire Capital better, we need to consider many other factors. Consider risks, for instance.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.