Please use a PC Browser to access Register-Tadawul

Benign Growth For eHealth, Inc. (NASDAQ:EHTH) Underpins Stock's 30% Plummet

eHealth, Inc. EHTH | 4.42 | 0.00% |

The eHealth, Inc. (NASDAQ:EHTH) share price has softened a substantial 30% over the previous 30 days, handing back much of the gains the stock has made lately. Looking at the bigger picture, even after this poor month the stock is up 32% in the last year.

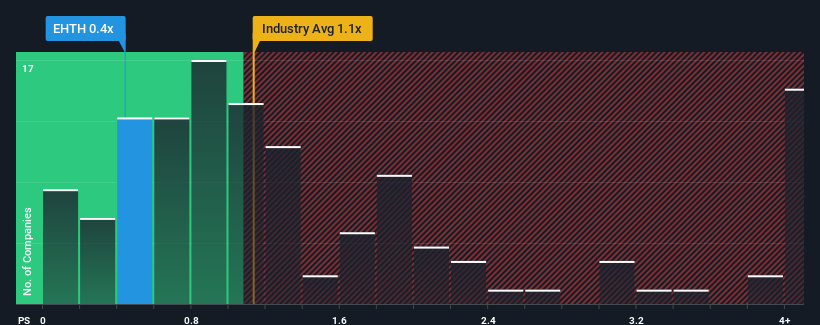

After such a large drop in price, given about half the companies operating in the United States' Insurance industry have price-to-sales ratios (or "P/S") above 1.1x, you may consider eHealth as an attractive investment with its 0.4x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How eHealth Has Been Performing

Recent times have been advantageous for eHealth as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think eHealth's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as eHealth's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 18% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 1.1% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 3.7% per annum over the next three years. That's shaping up to be materially lower than the 7.2% per annum growth forecast for the broader industry.

With this in consideration, its clear as to why eHealth's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

eHealth's P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that eHealth maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

If you're unsure about the strength of eHealth's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.