Behind the Scenes of Eli Lilly's Latest Options Trends

Eli Lilly and Company LLY | 794.14 793.56 | -0.19% -0.07% Post |

Financial giants have made a conspicuous bearish move on Eli Lilly. Our analysis of options history for Eli Lilly (NYSE:LLY) revealed 8 unusual trades.

Delving into the details, we found 12% of traders were bullish, while 75% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $179,046, and 5 were calls, valued at $247,750.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $400.0 to $1000.0 for Eli Lilly during the past quarter.

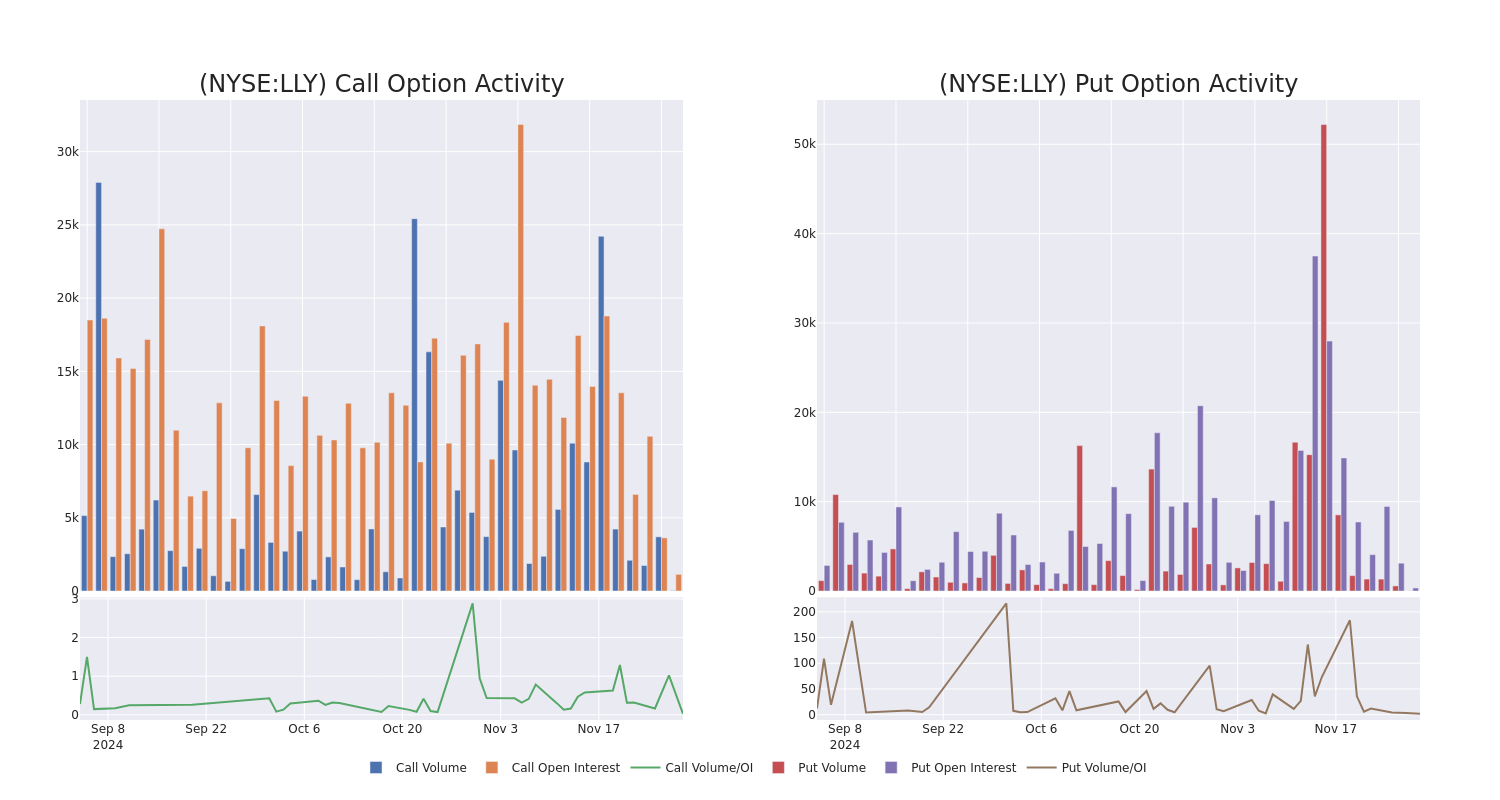

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Eli Lilly's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Eli Lilly's whale trades within a strike price range from $400.0 to $1000.0 in the last 30 days.

Eli Lilly Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LLY | CALL | TRADE | BEARISH | 01/15/27 | $101.8 | $98.0 | $98.0 | $1000.00 | $98.0K | 91 | 10 |

| LLY | PUT | TRADE | BEARISH | 12/06/24 | $84.05 | $77.35 | $84.04 | $875.00 | $75.6K | 15 | 10 |

| LLY | PUT | TRADE | BEARISH | 12/19/25 | $71.55 | $67.0 | $71.55 | $750.00 | $71.5K | 320 | 10 |

| LLY | CALL | TRADE | NEUTRAL | 01/17/25 | $400.9 | $393.6 | $397.0 | $400.00 | $39.7K | 371 | 1 |

| LLY | CALL | TRADE | BEARISH | 11/29/24 | $41.05 | $36.25 | $37.75 | $755.00 | $37.7K | 199 | 10 |

About Eli Lilly

Eli Lilly is a drug firm with a focus on neuroscience, cardiometabolic, cancer, and immunology. Lilly's key products include Verzenio for cancer; Mounjaro, Zepbound, Jardiance, Trulicity, Humalog, and Humulin for cardiometabolic; and Taltz and Olumiant for immunology.

Current Position of Eli Lilly

- With a volume of 8,286, the price of LLY is up 0.07% at $788.76.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 67 days.

What The Experts Say On Eli Lilly

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $1022.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Eli Lilly, targeting a price of $975. * An analyst from B of A Securities persists with their Buy rating on Eli Lilly, maintaining a target price of $1100. * An analyst from Wolfe Research has revised its rating downward to Outperform, adjusting the price target to $1000. * An analyst from Deutsche Bank has decided to maintain their Buy rating on Eli Lilly, which currently sits at a price target of $1015.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Eli Lilly, Benzinga Pro gives you real-time options trades alerts.