Please use a PC Browser to access Register-Tadawul

Augmedix, Inc. (NASDAQ:AUGX) Stock's 38% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Augmedix Inc AUGX | 0.00 |

To the annoyance of some shareholders, Augmedix, Inc. (NASDAQ:AUGX) shares are down a considerable 38% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 84% loss during that time.

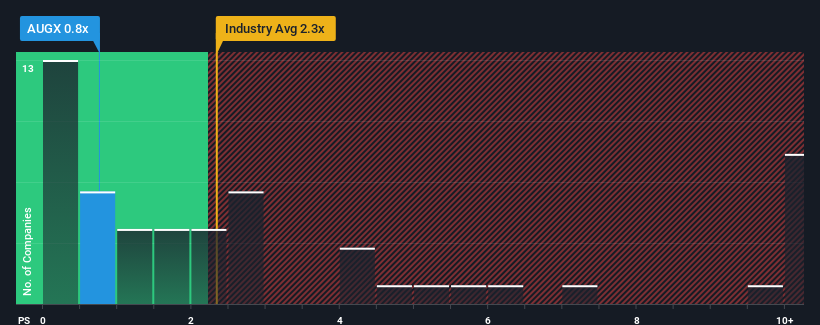

After such a large drop in price, Augmedix may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.8x, since almost half of all companies in the Healthcare Services industry in the United States have P/S ratios greater than 2.3x and even P/S higher than 6x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does Augmedix's Recent Performance Look Like?

Recent times have been advantageous for Augmedix as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Augmedix.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Augmedix's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 45% gain to the company's top line. The latest three year period has also seen an excellent 181% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 16% as estimated by the six analysts watching the company. With the industry only predicted to deliver 9.9%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Augmedix's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Augmedix's P/S?

Augmedix's P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To us, it seems Augmedix currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

If these risks are making you reconsider your opinion on Augmedix, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.