Advanced Petrochemical (SASE:2330) Reports Q3 Earnings Growth and Faces Dividend Sustainability Challenges

ADVANCED 2330.SA | 32.25 | 0.00% |

Unique Capabilities Enhancing Advanced Petrochemical's Market Position

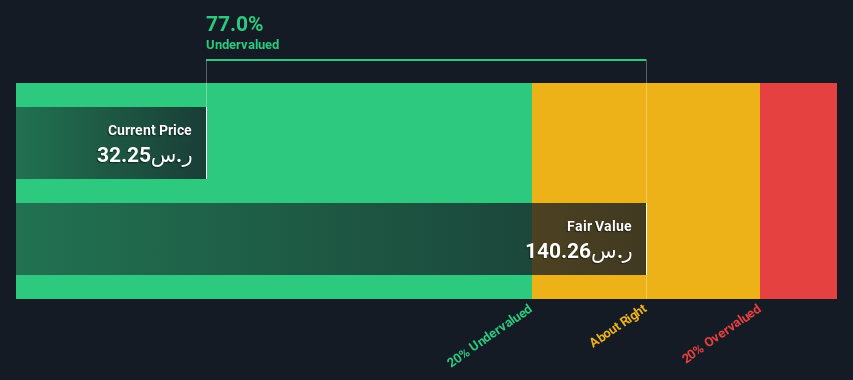

Advanced Petrochemical is poised for substantial growth, with an expected revenue increase of 45.4% per year, significantly outpacing the SA market's 1.3%. This growth is underscored by a projected earnings surge of 86.7% annually. The company also boasts a dividend yield of 6.05%, placing it among the top 25% of dividend payers in the SA market. Leadership plays a pivotal role, with a seasoned board averaging 5.1 years of tenure, guiding strategic initiatives and fostering stability. Notably, shareholders have not faced dilution over the past year, reflecting strong financial stewardship. The company's strategic positioning is further evidenced by its trading at 75% below SWS fair value, suggesting potential for price appreciation.

See what the latest analyst reports say about Advanced Petrochemical's future prospects and potential market movements.Internal Limitations Hindering Advanced Petrochemical's Growth

Despite promising growth metrics, Advanced Petrochemical faces challenges, notably a 33.5% annual decrease in earnings over the past five years. Current net profit margins stand at 2.4%, a decline from the previous year's 5.9%, highlighting operational inefficiencies. Rising operational costs, particularly raw material expenses, pose additional hurdles. The high payout ratio of 275.3% raises concerns about dividend sustainability. Furthermore, the company's Price-To-Sales Ratio suggests it is expensive compared to peers and industry averages, indicating financial challenges that need addressing.

To dive deeper into how Advanced Petrochemical's valuation metrics are shaping its market position, check out our detailed analysis of Advanced Petrochemical's Valuation.Future Prospects for Advanced Petrochemical in the Market

Opportunities abound for Advanced Petrochemical, with significant potential for revenue and earnings growth exceeding 20% annually. The company's commitment to product innovation and development positions it well to capture emerging market segments. Strategic alliances and product-related announcements are expected to enhance its market position and capitalize on these growth prospects.

To gain deeper insights into Advanced Petrochemical's historical performance, explore our detailed analysis of past performance.External Factors Threatening Advanced Petrochemical

External challenges include a high net debt to equity ratio of 214.3%, raising financial risk concerns. Economic headwinds and potential regulatory changes could impact demand and operational stability. Additionally, supply chain vulnerabilities necessitate contingency planning to mitigate disruptions. The sustainability of dividend payments remains a pressing issue, as they are not adequately covered by earnings or cash flows.

Learn about Advanced Petrochemical's dividend strategy and how it impacts shareholder returns and financial stability.Conclusion

Advanced Petrochemical is positioned for significant growth, with projected revenue and earnings increases that far exceed market averages, driven by strategic leadership and a strong dividend yield. However, the company faces internal challenges such as declining profit margins and high payout ratios, which raise concerns about operational efficiency and dividend sustainability. Despite these hurdles, the company's stock is trading significantly below its estimated fair value, implying potential for price appreciation if it can address its operational inefficiencies and manage external risks like high debt levels and supply chain vulnerabilities. While its Price-To-Sales Ratio suggests it is costly compared to peers, the potential for growth and strategic market positioning could justify this premium if the company successfully capitalizes on emerging opportunities and mitigates existing threats.

Next Steps

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.