Adaptimmune Therapeutics (NASDAQ:ADAP) shareholders are up 18% this past week, but still in the red over the last three years

Adaptimmune Therapeutics PLC Sponsored ADR ADAP | 0.59 | -0.91% |

It is a pleasure to report that the Adaptimmune Therapeutics plc (NASDAQ:ADAP) is up 99% in the last quarter. But only the myopic could ignore the astounding decline over three years. To wit, the share price sky-dived 71% in that time. So it sure is nice to see a bit of an improvement. Only time will tell if the company can sustain the turnaround.

The recent uptick of 18% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for Adaptimmune Therapeutics

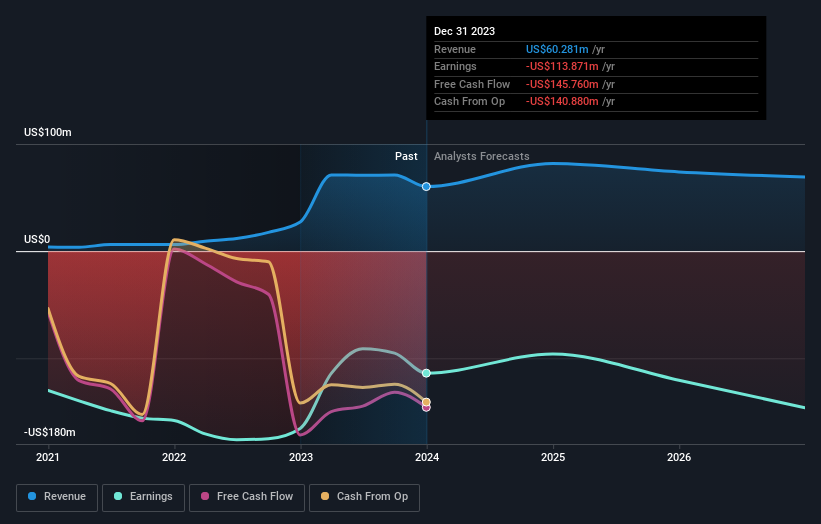

Because Adaptimmune Therapeutics made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Adaptimmune Therapeutics saw its revenue grow by 92% per year, compound. That is faster than most pre-profit companies. So on the face of it we're really surprised to see the share price down 20% a year in the same time period. The share price makes us wonder if there is an issue with profitability. Sometimes fast revenue growth doesn't lead to profits. Unless the balance sheet is strong, the company might have to raise capital.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We're pleased to report that Adaptimmune Therapeutics shareholders have received a total shareholder return of 49% over one year. Notably the five-year annualised TSR loss of 11% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 6 warning signs we've spotted with Adaptimmune Therapeutics (including 2 which are a bit concerning) .

We will like Adaptimmune Therapeutics better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.