Please use a PC Browser to access Register-Tadawul

A Look At Avery Dennison (AVY) Valuation After Q3 Beat And Walmart RFID Partnership

Avery Dennison Corporation AVY | 191.51 | -0.71% |

Avery Dennison (AVY) is back in focus after fiscal Q3 2025 results topped analyst expectations on adjusted EPS and revenue, and management issued an upbeat adjusted EPS outlook for Q4 2025.

The upbeat Q3 release and Walmart RFID partnership have coincided with a 17.24% 90 day share price return and a US$186.02 share price, while the 5 year total shareholder return of 24.99% points to steadier long term compounding rather than surging momentum.

If Avery Dennison’s RFID push has caught your eye, it could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

With Avery Dennison delivering upside on Q3 expectations, a 90 day return of 17.24% and the stock at US$186.02, is the RFID story still mispriced, or are markets already baking in much of the future growth?

Most Popular Narrative: 10% Undervalued

Compared to Avery Dennison’s last close of US$186.02, the most followed narrative is working off a fair value estimate of US$206.80 and a detailed long term earnings path.

The analysts are assuming Avery Dennison's revenue will grow by 4.0% annually over the next 3 years.

Analysts expect earnings to reach $909.0 million (and earnings per share of $12.14) by about September 2028, up from $711.0 million today.

Curious what earnings profile and margin outlook underpin that higher fair value, and what future P/E level the narrative leans on to make the math work?

Result: Fair Value of $206.80 (UNDERVALUED)

However, the narrative could be tested if apparel and retail demand stays weak, or if competitive smart label offerings eventually pressure margins and pricing power.

Another View: What Market Ratios Are Saying

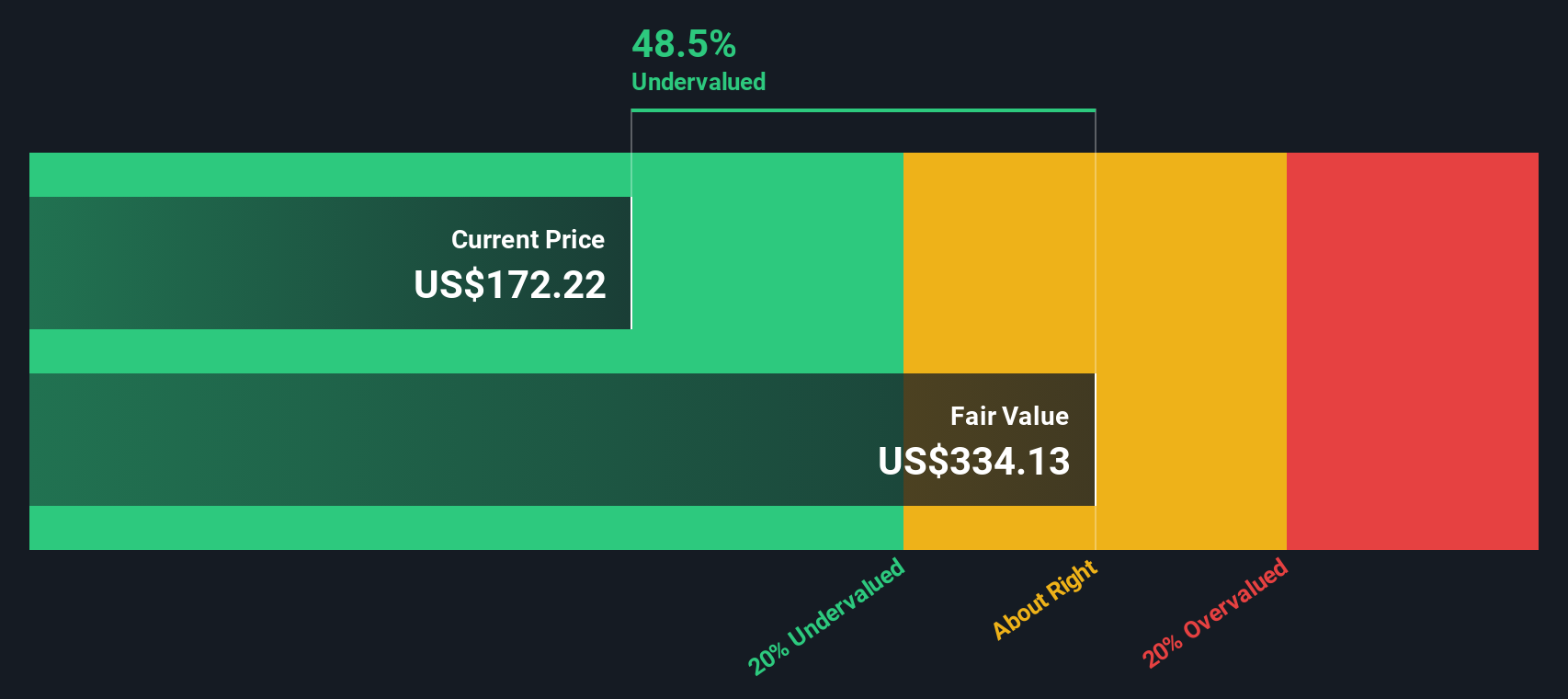

Our DCF model points to a fair value of US$350.02 for Avery Dennison, which implies a large gap versus the current US$186.02 share price and flags the stock as undervalued. Yet the P/E of 20.7x is almost identical to the 20.6x fair ratio, so the market multiple looks closer to fully priced. That raises a simple question for you: is the DCF too optimistic, or are current earnings multiples too cautious?

Build Your Own Avery Dennison Narrative

If you think the market is getting Avery Dennison wrong, or simply want to run your own numbers and story, you can build a full narrative in just a few minutes with Do it your way.

A great starting point for your Avery Dennison research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Avery Dennison has sharpened your interest, do not stop here. Broaden your opportunity set with a few focused stock ideas that match your style.

- Chase high potential by scanning these 3545 penny stocks with strong financials that might turn small price tags into meaningful positions in your portfolio.

- Zero in on long term compounding potential with these 11 dividend stocks with yields > 3% that prioritize reliable income alongside capital growth.

- Position yourself early in major tech shifts by checking out these 28 AI penny stocks at the intersection of artificial intelligence and public markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.