A Glimpse Into The Expert Outlook On Snap Through 22 Analysts

Snap SNAP | 11.20 11.18 | +0.18% -0.18% Post |

Ratings for Snap (NYSE:SNAP) were provided by 22 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 3 | 17 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 1 | 10 | 0 | 0 |

| 2M Ago | 0 | 2 | 2 | 0 | 0 |

| 3M Ago | 1 | 0 | 4 | 0 | 0 |

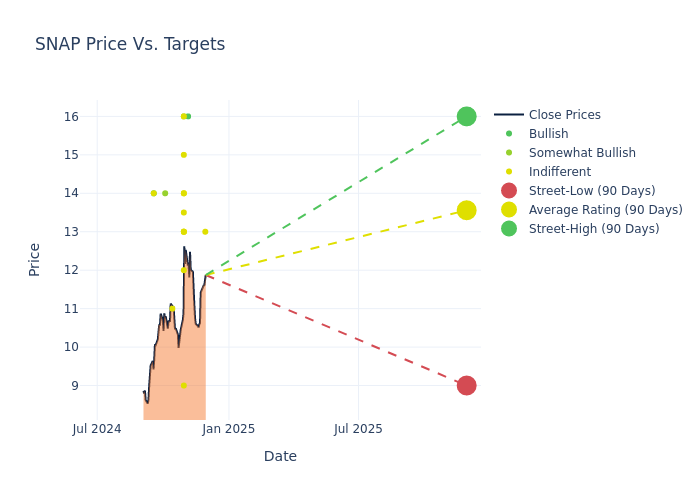

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $12.84, with a high estimate of $17.00 and a low estimate of $8.00. This upward trend is evident, with the current average reflecting a 3.8% increase from the previous average price target of $12.37.

Interpreting Analyst Ratings: A Closer Look

The perception of Snap by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ronald Josey | Citigroup | Raises | Neutral | $13.00 | $11.00 |

| Rob Sanderson | Loop Capital | Raises | Buy | $16.00 | $14.00 |

| Andrew Boone | JMP Securities | Lowers | Market Outperform | $16.00 | $17.00 |

| Justin Post | B of A Securities | Raises | Neutral | $14.00 | $13.00 |

| Maria Ripps | Canaccord Genuity | Raises | Hold | $13.00 | $12.00 |

| Deepak Mathivanan | Cantor Fitzgerald | Raises | Neutral | $9.00 | $8.00 |

| Eric Sheridan | Goldman Sachs | Raises | Neutral | $13.50 | $12.00 |

| Naved Khan | B. Riley Securities | Raises | Neutral | $12.00 | $11.00 |

| Brad Erickson | RBC Capital | Maintains | Sector Perform | $16.00 | $16.00 |

| Thomas Champion | Piper Sandler | Raises | Neutral | $13.00 | $12.00 |

| Youssef Squali | Truist Securities | Raises | Hold | $14.00 | $13.00 |

| Mark Mahaney | Evercore ISI Group | Raises | In-Line | $15.00 | $12.00 |

| Lloyd Walmsley | UBS | Raises | Neutral | $13.00 | $12.00 |

| Andrew Boone | JMP Securities | Announces | Market Outperform | $17.00 | - |

| Mark Kelley | Stifel | Lowers | Hold | $11.00 | $13.00 |

| Ken Gawrelski | Wells Fargo | Lowers | Overweight | $14.00 | $15.00 |

| Deepak Mathivanan | Cantor Fitzgerald | Maintains | Neutral | $8.00 | $8.00 |

| Deepak Mathivanan | Cantor Fitzgerald | Maintains | Neutral | $8.00 | $8.00 |

| Naved Khan | B. Riley Securities | Announces | Neutral | $11.00 | - |

| Benjamin Black | Deutsche Bank | Maintains | Buy | $14.00 | $14.00 |

| Rohit Kulkarni | Roth MKM | Maintains | Neutral | $14.00 | $14.00 |

| Deepak Mathivanan | Cantor Fitzgerald | Announces | Neutral | $8.00 | - |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Snap. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Snap compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Snap's stock. This analysis reveals shifts in analysts' expectations over time.

For valuable insights into Snap's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Snap analyst ratings.

About Snap

Snap is a technology company best known for its marquis social media application Snapchat, a visual messaging application that has amassed hundreds of millions of users. The app was initially only used to communicate with family and friends through photographs and short videos (known as "Snaps"). Users can now enjoy augmented reality, or AR, lenses, content from famous creators and celebrities, updates about local events, and more. Although the app offers a paid subscription option with premium features, advertising sales produce most of the app's revenue. The firm also sells wearable devices called AR Spectacles, which can capture photos and videos overlayed with AR lenses, but these make up a small portion of Snap's overall sales.

Breaking Down Snap's Financial Performance

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Snap displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 15.48%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Communication Services sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of -11.16%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -7.17%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Snap's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -2.04%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Snap's debt-to-equity ratio stands notably higher than the industry average, reaching 1.92. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

What Are Analyst Ratings?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.