A Closer Look at Teradyne's Options Market Dynamics

Teradyne, Inc. TER | 125.95 | +0.61% |

High-rolling investors have positioned themselves bullish on Teradyne (NASDAQ:TER), and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in TER often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 8 options trades for Teradyne. This is not a typical pattern.

The sentiment among these major traders is split, with 50% bullish and 37% bearish. Among all the options we identified, there was one put, amounting to $28,860, and 7 calls, totaling $624,727.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $95.0 to $130.0 for Teradyne during the past quarter.

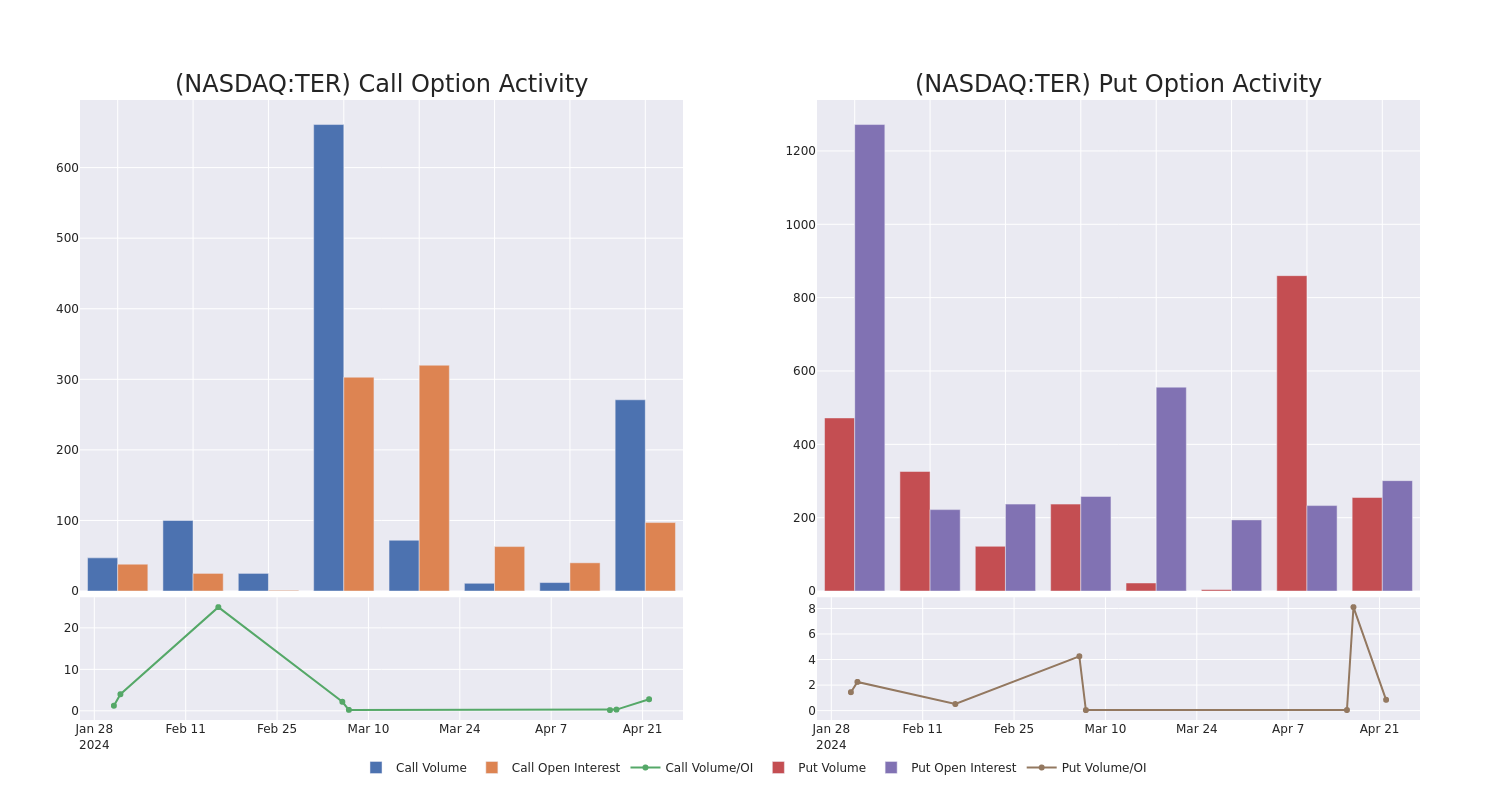

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Teradyne's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Teradyne's whale trades within a strike price range from $95.0 to $130.0 in the last 30 days.

Teradyne Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TER | CALL | TRADE | BEARISH | 08/16/24 | $5.2 | $4.7 | $4.8 | $130.00 | $360.0K | 253 | 761 |

| TER | CALL | TRADE | BEARISH | 01/16/26 | $38.7 | $36.3 | $36.4 | $95.00 | $58.2K | 141 | 16 |

| TER | CALL | SWEEP | BEARISH | 05/17/24 | $7.5 | $7.4 | $7.4 | $110.00 | $55.5K | 1.2K | 80 |

| TER | CALL | TRADE | BULLISH | 05/17/24 | $7.8 | $7.6 | $7.8 | $110.00 | $39.0K | 1.2K | 355 |

| TER | CALL | TRADE | BULLISH | 05/17/24 | $7.6 | $7.5 | $7.6 | $110.00 | $38.0K | 1.2K | 255 |

About Teradyne

Teradyne provides testing equipment, including automated test equipment for semiconductors, system testing for hard disk drives, circuit boards, and electronics systems and wireless testing for devices. The firm entered the industrial automation market in 2015, into which it sells collaborative and autonomous robots for factory applications. Teradyne serves numerous end markets and geographies directly and indirectly with its products, but its most significant exposure is to semiconductor testing. Teradyne serves vertically integrated, fabless, and foundry chipmakers with its equipment.

Following our analysis of the options activities associated with Teradyne, we pivot to a closer look at the company's own performance.

Present Market Standing of Teradyne

- Trading volume stands at 856,237, with TER's price up by 2.49%, positioned at $116.97.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 86 days.

Expert Opinions on Teradyne

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $117.6.

- Consistent in their evaluation, an analyst from Susquehanna keeps a Positive rating on Teradyne with a target price of $130.

- Maintaining their stance, an analyst from Baird continues to hold a Outperform rating for Teradyne, targeting a price of $120.

- An analyst from Cantor Fitzgerald has revised its rating downward to Neutral, adjusting the price target to $110.

- An analyst from Goldman Sachs has decided to maintain their Neutral rating on Teradyne, which currently sits at a price target of $118.

- An analyst from JP Morgan persists with their Neutral rating on Teradyne, maintaining a target price of $110.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Teradyne with Benzinga Pro for real-time alerts.