Please use a PC Browser to access Register-Tadawul

95% chance of profit if you hold for a year? My ideal time to buy US stocks 💡

S&P 500 index SPX | 0.00 | |

ETF-S&P 500 SPY | 0.00 | |

PowerShares QQQ Trust,Series 1 QQQ | 0.00 | |

ETF-Dow Jones Industrial Average DIA | 0.00 | |

NASDAQ IXIC | 0.00 |

Peace be upon you, my dear investor friends! 🌟

I hope you are all in good health and that your investment portfolios are delivering the results you desire! 📈💼

Following S&P 500 index(SPX.US) 's stunning performance on April 9, when it surged nearly 10% in a single day, I'm personally curious to see if these indicators indicate we've hit a short-term bottom. I'm both curious and cautious about whether this is the right moment to enter and participate in the market. 🤔

Historical data analysis 📊

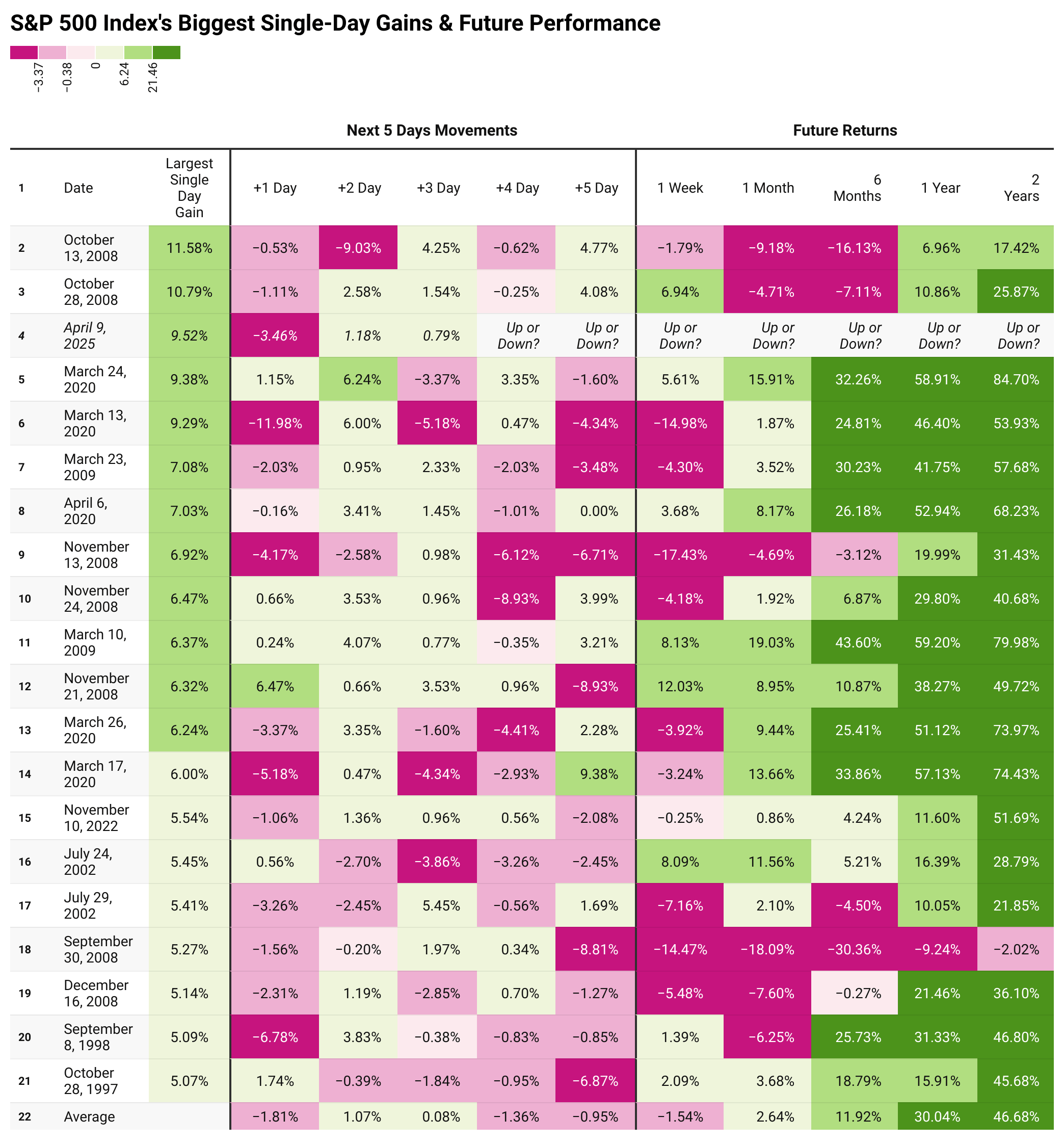

I collected and analyzed historical data to see how the index performed after days of significant increases (more than 5% in a single day). I found that the recent increase ranks among the top 3 highest increases in the index's history!

What does the data tell us? 🧐

Despite this significant rise, I noticed that the five days following the large rises did not show a clear pattern that could be relied upon to predict the market's direction (up or down).

Especially since the S&P 500 has already recovered nearly 50% of its decline since the end of February, making direct entry now may not provide an ideal risk/reward ratio. ⚖️

A glimmer of hope in long-term data ✨

In the long term, the data shows some positive indicators:

- Average return after one month: +2.6% 📈

- Average return after 6 months: approximately +12% 📈

- Average return after one year: about +30% (which may outperform many active investment strategies) 🚀

I believe this could be a worthy passive investment option, provided I use a portion of my long-term savings, not all of my money. I feel time is on my side in this case.

My personal strategy 🧠

At the same time, I must advise myself not to sell randomly until the end of the period I have set, whether it is one, two, or more. I want to be on the side of the prevailing trend, and history shows that the US market is on an upward trend over the long term.

Risk factors I take into consideration ⚠️

However, tariff issues and the possibility of the US economy entering a recession remain factors that could push the market back to new lows, and I believe we all need to be aware of these risks. Especially with the new earnings season approaching, the possibility of companies lowering their earnings forecasts further than the market anticipates should also be considered.

Investment options I'm considering 💹

Unless clear opportunities arise in specific stocks, I believe that ETFs linked to the S&P 500 or Nasdaq 100 may be a balanced option, as individual stock selection is highly likely to be flawed. Indexes offer more room for error, and even with minor pullbacks in the near future, historical data still reinforces my confidence in a rebound and upside, because that's what the historical data tells me. ( ETF-S&P 500(SPY.US) PowerShares QQQ Trust,Series 1(QQQ.US) )

Bottom line 💡

In short, if you're a patient investor, it may be best to monitor the market for any downturn before making a purchase decision to secure a better risk/reward ratio. However, if surprising positive news emerges, the market may continue to rise to higher levels. Everyone has their own risk tolerance, so always remember to make your decisions based on your personal circumstances. 🧠

One last word 🌙

Successful investing is a combination of patience, planning, and knowledge, not just hasty decisions. Do your research and consult your financial advisors before making any investment decisions.

I ask Allah to grant you success in your investments and to bless all your livelihoods. 🤲✨