Please use a PC Browser to access Register-Tadawul

3 Middle Eastern Dividend Stocks Yielding Up To 8%

SNB 1180.SA | 0.00 |

Amidst recent geopolitical tensions impacting most Gulf markets, investors are increasingly seeking stability and income through dividend stocks in the Middle East. In such a volatile environment, stocks with strong dividend yields can offer a reliable source of returns, making them an attractive option for those looking to navigate the current market landscape.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Emaar Properties PJSC (DFM:EMAAR) | 7.52% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 8.94% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.41% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.78% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.63% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 5.82% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 5.51% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 5.14% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 9.44% | ★★★★★☆ |

| Nuh Çimento Sanayi (IBSE:NUHCM) | 3.28% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

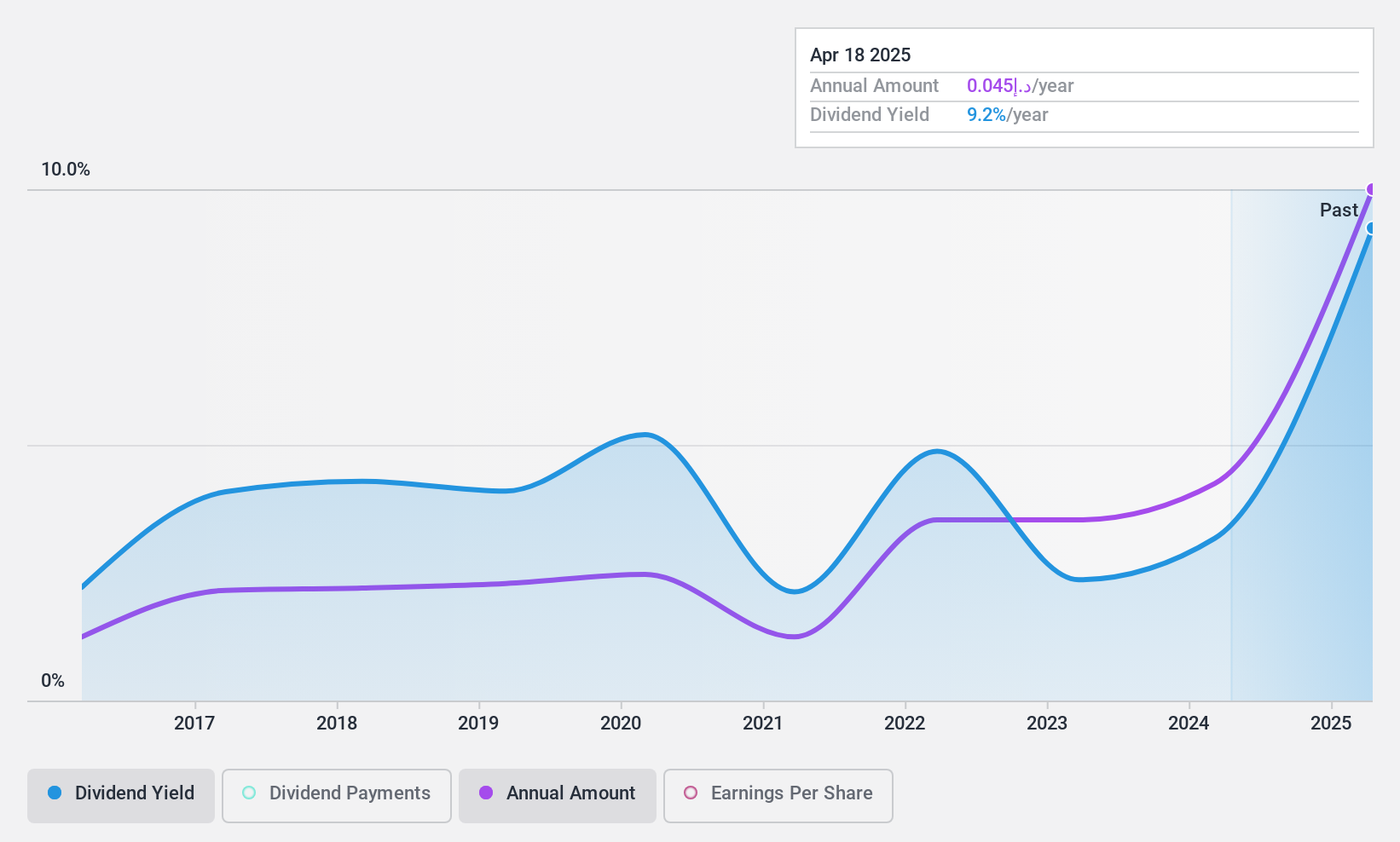

Abu Dhabi National Hotels Company PJSC (ADX:ADNH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Abu Dhabi National Hotels Company PJSC owns and manages hotels in the United Arab Emirates, with a market cap of AED7.07 billion.

Operations: The revenue segments for Abu Dhabi National Hotels Company PJSC are comprised of AED1.40 billion from hotels, AED1.26 billion from catering services, and AED304.09 million from transport services.

Dividend Yield: 8%

Abu Dhabi National Hotels Company PJSC recently announced an annual dividend of AED 0.0450 per share, with a record date of April 21, 2025. Despite a strong earnings growth of AED 1,327.1 million for the year ending December 31, 2024, and a reasonably low payout ratio of 42.7%, its dividends are not well covered by free cash flows due to a high cash payout ratio (140.5%). The dividend yield is in the top tier at 8.02%, but past payments have been volatile and unreliable over the last decade.

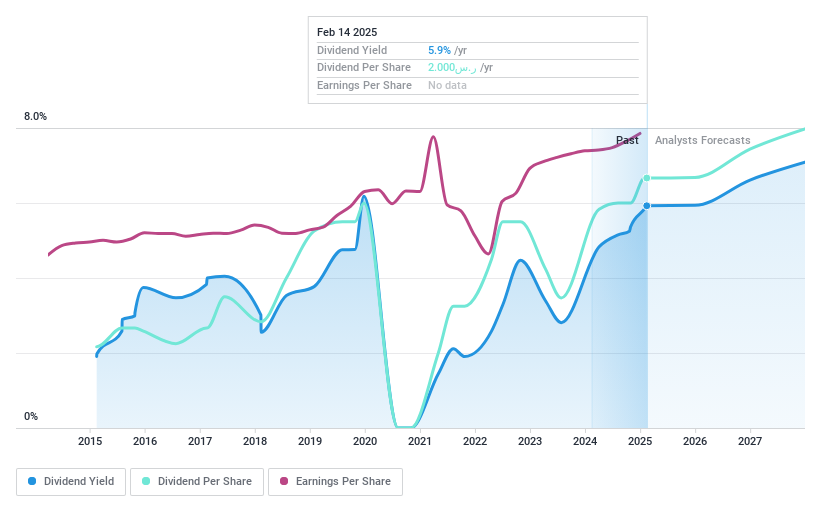

Saudi National Bank (SASE:1180)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Saudi National Bank, with a market cap of SAR211.05 billion, operates through its subsidiaries to offer banking and investment management services both within the Kingdom of Saudi Arabia and internationally.

Operations: The Saudi National Bank generates revenue through its segments, with Retail contributing SAR15.67 billion, Wholesale SAR15.42 billion, International SAR1.65 billion, and Capital Market SAR2.28 billion.

Dividend Yield: 5.6%

Saudi National Bank's dividend yield is attractive, ranking in the top 25% of the Saudi Arabian market at 5.63%. Despite its past volatility and unreliability, dividends are currently and forecasted to be covered by earnings with a payout ratio around 55-56%. The bank's earnings have shown consistent growth, with recent net income reaching SAR 21.19 billion for 2024. Its price-to-earnings ratio of 10.3x suggests good value compared to the broader market at 22.5x.

Menora Mivtachim Holdings (TASE:MMHD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Menora Mivtachim Holdings Ltd, along with its subsidiaries, operates in the insurance and finance sectors in Israel and has a market capitalization of ₪12.16 billion.

Operations: Menora Mivtachim Holdings Ltd generates its revenue through its operations in the insurance and finance sectors within Israel.

Dividend Yield: 3.8%

Menora Mivtachim Holdings' dividends have been historically volatile and unreliable, yet they remain well-covered by earnings and cash flows, with payout ratios of 50.8% and 33.9%, respectively. Although the dividend yield of 3.8% is below Israel's top tier, dividends have grown over the past decade. Recent financial results show robust growth, with net income rising to ILS 1.08 billion for 2024, indicating strong earnings support for future payouts at a reasonable price-to-earnings ratio of 11.3x.

Make It Happen

- Access the full spectrum of 66 Top Middle Eastern Dividend Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.