Please use a PC Browser to access Register-Tadawul

3 Middle Eastern Dividend Stocks With Up To 8.7% Yield

BSF 1050.SA | 0.00 |

As most Gulf markets recently ended higher, buoyed by cooler-than-expected U.S. inflation data, investors are keeping a close eye on monetary policies influenced by the Federal Reserve's decisions. In this dynamic environment, dividend stocks in the Middle East can offer attractive yields and stability, making them an appealing choice for those looking to balance growth with income amidst economic uncertainties.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Arab National Bank (SASE:1080) | 6.03% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 8.79% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.58% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.46% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.80% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 5.67% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.05% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.96% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 6.34% | ★★★★★☆ |

| Nuh Çimento Sanayi (IBSE:NUHCM) | 3.13% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

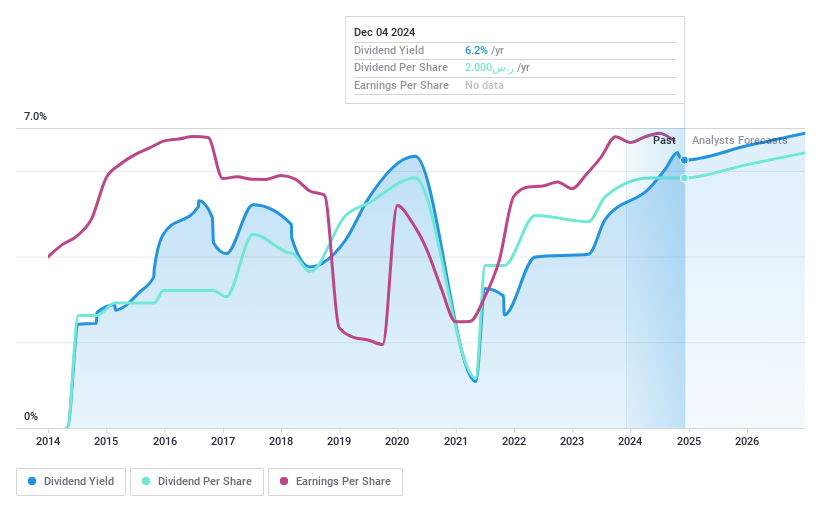

Dubai Investments PJSC (DFM:DIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dubai Investments PJSC operates in property, investment, manufacturing, contracting, and services sectors both in the United Arab Emirates and internationally, with a market cap of AED9.69 billion.

Operations: Dubai Investments PJSC generates revenue through three main segments: Property (AED2.21 billion), Investments (AED330.77 million), and Manufacturing, Contracting, and Services (AED1.24 billion).

Dividend Yield: 5.5%

Dubai Investments PJSC's dividend payments have been volatile over the past decade, with a payout ratio of 55.1% indicating dividends are covered by earnings. The cash payout ratio stands at 52.6%, suggesting coverage by cash flows as well. Despite an increase in dividend payments over the last ten years, their yield of 5.48% is below top-tier payers in the AE market. Upcoming board discussions may impact future dividend distributions following fiscal year results on March 13, 2025.

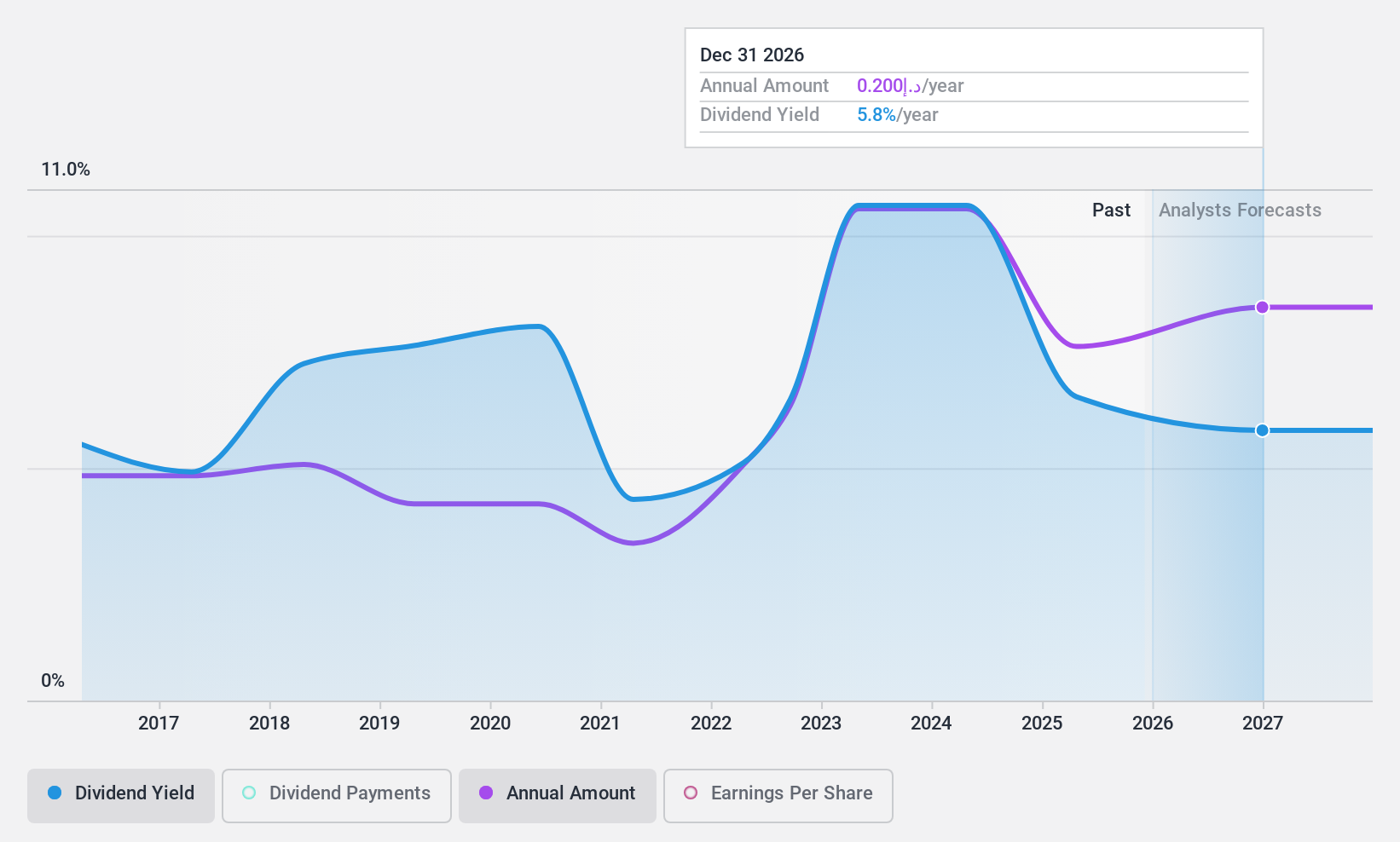

Banque Saudi Fransi (SASE:1050)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banque Saudi Fransi offers banking and financial services to individuals and businesses both in the Kingdom of Saudi Arabia and internationally, with a market cap of SAR42.38 billion.

Operations: Banque Saudi Fransi's revenue segments include Retail Banking at SAR6.98 billion, Corporate Banking at SAR6.30 billion, and Investment Banking & Brokerage at SAR549.12 million.

Dividend Yield: 5.9%

Banque Saudi Fransi's dividend yield of 5.85% ranks it among the top 25% of dividend payers in Saudi Arabia, supported by a payout ratio of 57.2%, indicating dividends are covered by earnings. Despite an unstable dividend track record over the past decade, recent earnings growth and a favorable price-to-earnings ratio of 9.9x compared to the market average suggest potential for sustainable payouts, though volatility remains a concern for investors seeking reliability.

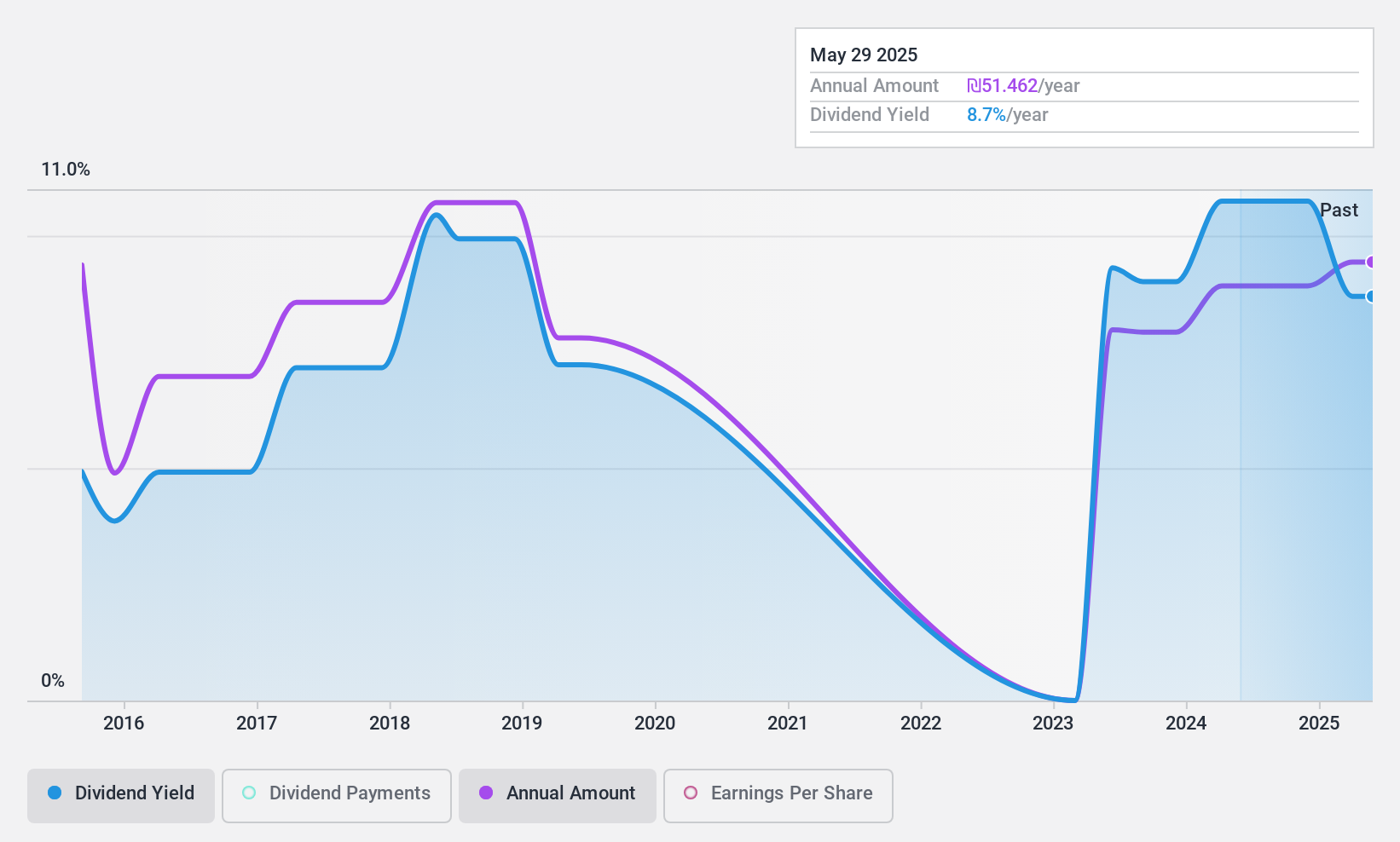

Delek Group (TASE:DLEKG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Delek Group Ltd. is an energy company involved in the exploration, development, production, and marketing of oil and gas both in Israel and internationally, with a market cap of ₪10.16 billion.

Operations: Delek Group Ltd.'s revenue primarily comes from the development and production of oil and gas assets in the North Sea, contributing ₪6.45 billion, and oil and gas exploration and production in Israel and its surroundings, contributing ₪3.74 billion.

Dividend Yield: 8.8%

Delek Group's dividend yield of 8.79% places it in the top 25% of Israeli dividend payers, with a payout ratio of 85.4%, indicating coverage by earnings and a low cash payout ratio of 24.7%. Despite past volatility in dividends over the last decade, recent earnings growth at 65.7% suggests potential for sustainability. The company trades at a significant discount to estimated fair value but maintains high debt levels, which may impact future stability. Recent shelf registration filings indicate potential capital raising activities.

Summing It All Up

- Click through to start exploring the rest of the 57 Top Middle Eastern Dividend Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.