Stocks are considered the basic building blocks of investing. When most people think of stocks, they typically think of listed stocks traded on the stock exchange. However, it is important for investors to know different stock categories, make more informed investment decisions and reduce portfolio risks. Here is what you need to know about the various stock categories.

1. Common stocks and preferred stocks

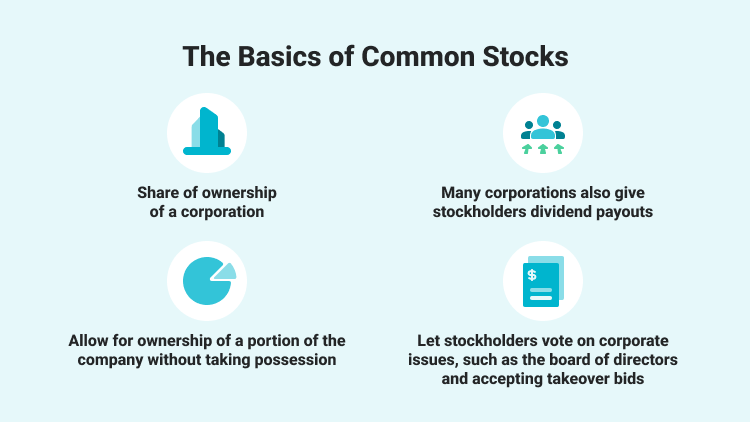

- Common stocks:

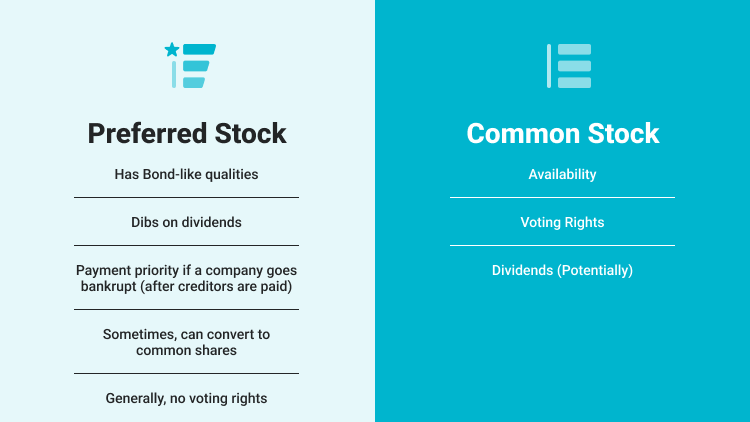

Publicly traded companies issue different classes of stock, and common stock is the most basic type. Common stock is sometimes referred to as ordinary shares, which represents partial ownership in a company. When you own common stocks, you may get regular dividends paid, but payouts are never guaranteed. Additionally, common stocks give you the right to vote on board members and other corporate issues at a company’s annual meeting. However, one downside of common stock is that its shareholders are last in line to be repaid if the company goes bankrupt.

- Preferred stocks

Preferred stock works differently from common stocks, and it is more like a bond than a stock. Typically, if you hold preferred stocks, you won’t have any voting rights, but you can receive fixed dividend payments before common stockholders. Preferred stock prices are less volatile than common stock prices, so the risk is considerably lower too. Moreover, preferred shareholders get repaid first if the company dissolves or enters bankruptcy. Preferred stock may be redeemed prior to maturity, and some preferred shares can be converted into a certain number of common shares.

2. Large-cap, mid-cap and small-cap stocks

- Large-cap stocks: In the United States, large cap refers to a company with a market capitalization value of more than $10 billion, so large-cap stocks are often considered the stable or blue chips of the stock market, which are likely to be well established and dominant in their respective industry. Investors often add large-cap stocks to their portfolios as a hedge against riskier investments. Some examples of large-cap stocks include Apple, Amazon, Wal-Mart Stores, and JPMorgan Chase.

- Mid-cap stocks: Mid-cap stocks are shares of companies with total market capitalization in the range of about $2 billion to $10 billion. Mid-cap companies include fast-growing, young companies that have outgrown their small-cap origins, as well as mature companies operating in stable and profitable corners of the market. However, the mid-cap category also includes former large-cap companies that have fallen in size and dominance.

- Small-cap stocks: Small-cap stocks are shares of companies with total market capitalization in the range of about $300 million to $2 billion. Small-cap companies are often young companies, and they tend to have significant growth potential, but the stocks may experience more volatility and pose higher risks to investors. Generally, small-caps often underperform during bear markets but outperform in bull markets.

3. Growth stocks and value stocks

- Growth stocks: Growth stocks refer to equities expected to grow at a faster rate compared to the market at large. The goal when investing in growth stocks is to see strong price appreciation over time. Generally, growth stocks tend to outperform during times of economic expansion and when interest rates are low. For example, technology stocks have significantly outperformed during the quantitative easing period of 2020-2021. However, growth stocks offer more potential for volatility since these companies are more likely to take risks to achieve that growth.

- Value stocks: Compared to growth stocks, value stocks are seen as being more conservative investments because the companies are often mature, well-known ones that have already grown into industry leaders and therefore don't have as much room left to expand further. Value stocks tend to outperform during periods of economic recovery, as they usually generate reliable income streams.

4. Income stocks (Dividend stocks)

An Income stock also can be a dividend stock because it pays a dividend consistently. A dividend is the distribution of corporate earnings to eligible shareholders, and it is paid regularly, such as monthly, quarterly, or annually, so Investors buy them for the income they generate. Typically, income stocks have lower volatility and less capital appreciation than growth stocks, making them suitable for risk-averse investors who seek a regular income stream.

5. Cyclical stocks V.S. Defensive stocks (Non-cyclical stocks)

- Cyclical stocks: A cyclical stock’s price is affected by macroeconomics or correlates with the overall economy. Cyclical stocks are known for following the cycles of an economy through expansion, peak, recession, and recovery.

Most cyclical stocks involve companies that sell consumer discretionary items, such as luxury goods, hotels, furniture retailers, and restaurants because consumers tend to buy more during a booming economy but spend less during a recession. If a recession is severe enough, cyclical stocks can become completely worthless, and those companies may go out of business. Therefore, cyclical stocks usually have higher volatility and are expected to produce higher returns during periods of economic strength. - Defensive stocks: Defensive stocks are also known as non-cyclical stocks, which are generally the opposite of cyclical stocks. A defensive stock is a stock that provides consistent dividends and stable earnings regardless of the state of the overall stock market. Since defensive stocks are less volatile, they offer the substantial benefit of similar long-term gains with lower risk than other stocks.

However, the low volatility of defensive stocks often leads to smaller gains during bull markets and a cycle of mistiming the market. The example of defensive stocks are utilities stocks, consumer staples stocks and healthcare stocks.

6. Penny stocks

A penny stock is a common share of a small public company that is traded less than $5 per share in the United States. Most penny stocks trade over the counter (OTC) market. While there can be sizable gains in trading penny stocks, there are also equal risks of losing a significant amount of an investment in a short period.

7. Blue chip stocks

Blue chip stocks are huge companies with excellent reputations, often have solid business models and impressive track records of returns for investors. Investors turn to blue chip stocks because these companies have dependable financials and often pay dividends. However, since these companies are well-established, the cost-per-share is expected to be higher. And keep in mind that blue chip stocks aren’t likely to experience meteoric growth. Some examples of blue chip stocks are IBM Corp., Coca-Cola Co., and Boeing Co.

8. ESG stocks

ESG is an acronym for Environmental, Social, and Governance. ESG investing is a form of sustainable investing that considers environmental, social and governance factors to judge an investment’s financial returns and its overall impact. ESG stocks are judged by third-party rating systems to determine which conduct their business in environmentally sustainable and socially responsible ways while also maintaining good corporate governance that encourages diversity and pay equity within the company.

Generally, investors focus on returns and earnings of a firm before investing in its stock. But now, with the focus of the world moving towards issues like climate change, deforestation, carbon emissions, etc, there is an urgent need to drive social changes and provide financial support to such issues. Thus, ESG stocks allow investors to invest in companies whose corporate values align with their personal values.