What is short selling?

The traditional way to profit from stock trading is to “buy low and sell high”, but investors do it in reverse order when they wish to sell short. Short selling is when investors do so because they believe the price of the stock will decrease in value, and it is an advanced strategy that should only be undertaken by experienced traders and investors. Generally, short selling involves selling borrowed shares of a stock with the belief that the price will drop to a point where you want to buy the shares at a lower price to repay what you borrowed.

Let’s see a simplified illustration:

Suppose an investor thinks that Apple Inc. (AAPL) is overvalued at $200 per share and will decline in price. In this case, the investor could borrow 10 shares of Apple from their broker and then sell the shares for the current market price of $200. If the stock goes down to $150, the investor could buy the 10 shares back at this price, return the borrowed shares to their broker, and net $500 ($2,000-$1,500). However, if Apple's share price rises to $250, the investor would lose $500 ($2,000 - $2,500).

Risks of shorting selling

Selling short can be costly if the seller bets wrong about the price movement. Here are some risks of short selling investors should be cautious of:

- Unlimited potential losses. When investors take a long position of shares, the downside is limited to 100% of the money they invested. However, when investors short a stock, the stock price could just keep rising, which means there is no upper limit to the amount you'd have to pay to replace the borrowed shares.

- Higher trading cost. There are more costs with short selling than with standard stock trades. Besides trade costs, short sellers have to consider borrowing costs and interest, and they even have to pay the broker for dividends or stock splits in some cases.

- Short-covering rally. Short covering refers to the purchase of securities by an investor to close a short position in the stock market. During a short-covering rally, investors who are short-selling a specific stock rush to close their short position and buy back the stock as the stock rises instead of falls. This trading activity can drive the stock price even higher, leading even more short sellers to rush to close their short positions before the price gets even higher.

- Short squeeze. A short squeeze happens when many investors bet against a stock but the stock price shoots up instead. That increase causes short-sellers to attempt to exit their investment, which requires buying the stock. The rush of buy orders from short-sellers boosts demand for the stock, which can push the stock's price up even higher. This cycle effectively squeezes investors out of the short sale as short sellers rush to close positions.

Benefits of short selling:

- Leverage. Because investors can sell short with margin trading, only putting up a percentage of the total value of the stock they’re trading, which can make more money with a smaller investment.

- More profit opportunity. Investors can make money not only from stock price increases but also from stock price declines.

- Hedge. More experienced investors sometimes use short selling as a short-term hedging tactic to offset the risk of another investment.

What are the restrictions of short selling in the US?

Since the Great Depression in 1929, short selling has been blamed for market crashes and has been temporarily banned several times in the past around the world. More recently, at the height of the 2008 financial crisis, temporary short-selling bans and restrictions were seen in the U.S..

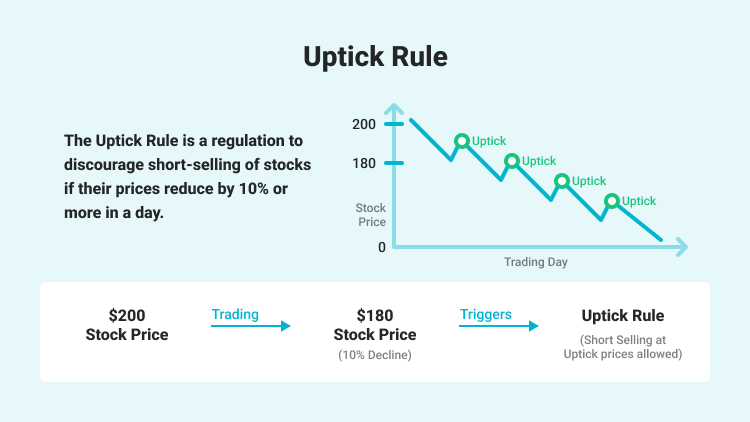

In the United States, the uptick rule is designed to limit aggressive short selling and to prevent stock manipulation and volatility by the SEC, which allows short selling to only take place on an uptick from the stock's most recent previous sale. For example, if the last trade was at $22.68, a short sale could be executed if the next bid price was at least $22.69.

However, several studies have been performed over the years, revealing no additional relief comes from the uptick rule in a bear market, so the SEC eliminated the original rule in 2007 but approved an alternative rule in 2010. The alternative uptick rule allows investors to exit a long position before short selling occurs, and the rule is triggered when a stock price falls at least 10% in one day.

For example, let’s say shares of Apple are trading at $90 after closing at $100 the previous trading day. The $90 price is 10% lower than the previous trading day’s closing of $100, so it triggers the alternative uptick rule, which means no short sale can take place unless the share price trades at $90.01 or more.

By requiring a 10% decline before taking effect, the uptick rule allows a certain limited level of legitimate short selling, which can promote liquidity and price efficiency in stocks. At the same time, it still limits short sales which could be manipulative and increase market volatility.

When is the best time to sell short?

Short selling is not a strategy many investors use, largely because the expectation is that the US stocks will rise in value over time. In the long run, the stock market tends to go up, even if it is occasionally interrupted by bear markets in which stocks tumble significantly. So buying stocks is less risky than short selling, and short selling may only make sense in certain situations. Here are three example situations in which short selling may have the potential to be profitable:

- When the market is bearish. Short selling is the most profitable when the market declines sharply. For example, the short sellers made fat profits during the global crisis of 2008–2009.

- When fundamentals worsen. Macroeconomic and microeconomic fundamentals can go weak, and the deteriorating data can indicate a potential economic slowdown and bearish market sentiments.

- When technical indicators predict a bearish trend. Trend analysis is an aspect of technical analysis that tries to predict the future movement of a stock based on past data. When the market predicts a bearish trend, the stock prices will move downwards. Therefore, this may be the best time for a short seller to kick-start their investment strategy.

Summary:

- Short selling is an investment strategy designed to profit from the price of the stock going down, rather than up.

- Short selling involves selling borrowed shares of a stock with the belief that the price will drop to a point where you want to buy shares at a lower price to repay what you borrowed.

- Short selling has more risks than traditional stock purchases since it can lose much more than 100% of the original investment.

- Short selling allows investors to only put up a percentage of the total value of the stock they’re trading, so they can make more money with a smaller investment.

- The alternative uptick rule is designed to limit aggressive short selling by the SEC, which allows investors to exit a long position before short selling occurs, and the rule is triggered when a stock price falls at least 10% in one day.

- Short selling may only make sense in certain situations, such as during a bearish market, the fundamentals are worsening, markets predict a bearish trend or a company is experiencing financial difficulties.