What is ETF?

An exchange-traded fund, or ETF, is an investment fund that can be bought and sold on the stock market just like individual stocks. Think of an ETF as a bundle of stocks, which can track any index, whether it be a large index like the S&P 500 or a more niche, thematic index.

ETFs are offered on virtually every conceivable asset class from traditional investments to so-called alternative assets like bonds, commodities, or currencies. ETFs are a great place to start for beginners since they provide a well-diversified portfolio with low minimum investment requirements and fees. In addition, innovative ETF structures allow investors to short markets, and to gain leverage.

Why invest in ETFs?

If you’re looking for an affordable, efficient way to access a broad range of asset classes, investing in ETFs might be right for you. Here are some reasons ETFs work for many investors:

- Diversification

ETFs let you access a diverse mix of asset classes, including domestic and international stocks, bonds, commodities, and currencies. - Trading flexibility

ETFs combine the trading versatility of individual securities with the diversified qualities of other funds (like mutual funds) to meet a variety of investment needs. Meanwhile, ETFs give you flexibility that allows you to enter and exit at any time. - Transparency

ETFs generally disclose their daily portfolios, which helps the investors maintain better awareness of exactly how their money is being invested. - Lower costs and fees

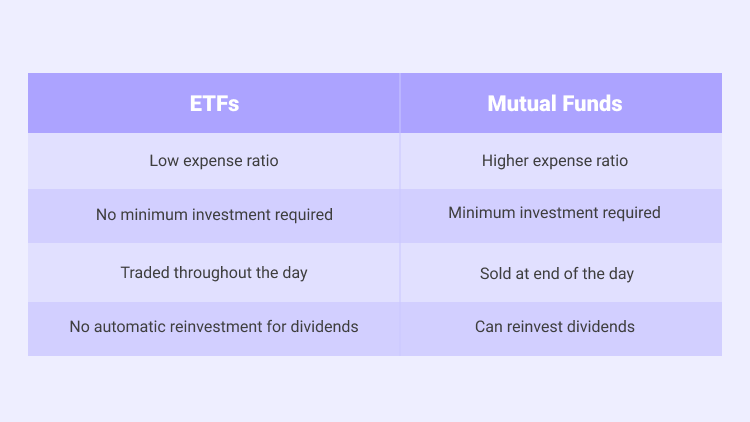

Compared to many actively managed mutual funds, ETFs typically have significantly lower expense ratios.

ETFs V.S. Mutual Funds

Mutual funds are investment products that pool together money from a range of investors. A fund manager is then responsible for researching and making decisions about how to invest this money into a basket of different assets and securities – often stocks. Investors pay the managers in the hope they drive better performance than the market performance. While ETFs and mutual funds both provide investment diversification, they differ in their structure, benefits, and risks. Here are a couple of their differences:

How to buy and sell ETFs?

ETFs are an easy way to begin investing. Follow the steps outlined below to start investing in ETFs.

- Find an Investing Platform

ETFs are available on many online investing apps. For example, Sahm app enables ETF share purchasing/selling at the tap of a button. - Choose your first ETFs

Although passive index funds are generally the best way to go for beginners, you still need to do diligent research. Considering the whole picture in terms of sector or industry is very important when you commit to an ETF. - Place the trade

The process of buying ETFs is very similar to the process of buying stocks. You just need to navigate to the “trading” section of your investing app.

Summary:

- An exchange-traded fund (ETF) tracks multiple stocks or other securities to let you invest in a sector, industry, or even region, and it can be bought and sold on the stock market just like individual stocks.

- ETFs are a great place to start for beginners since they provide a well-diversified portfolio with low minimum investment requirements and fees.

- ETFs provide a variety of benefits relative to other types of funds (e.g. mutual funds), such as lower expense ratio, intraday trading, diversification, etc.

- Mutual funds are investment products that pool together money from a range of investors. A fund manager is then responsible for researching and making decisions about how to invest this money into a basket of different assets and securities – often stocks.

- Stock ETFs provide exposure to a portfolio of publicly traded stocks and may be divided into several categories by where the stock is listed, the size of the company, whether it pays a dividend, or what sector it’s in.