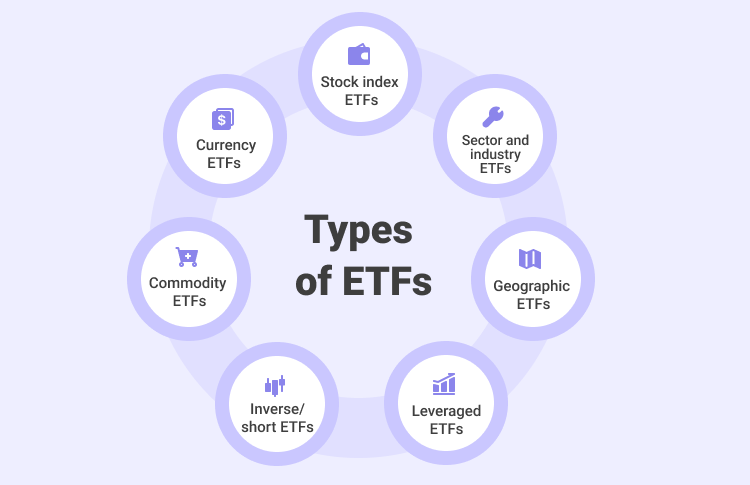

ETFs have grown in demand as a way for investors to gain access to a diversified bundle of securities that track a specific asset class, index, or industry sector. Because ETFs trade on exchanges much like stocks, investors can gain exposure to certain asset classes that would otherwise be difficult to access, such as commodities, bonds, real estate, or currencies. Here, we look at just a few examples of ETF types you may want to consider adding to your portfolio.

1. Equity ETFs/Stock ETFs

Most equity ETFs track an index of stocks. Investors can choose ETFs covering large companies, small companies, or stocks from a particular country. Equity ETFs also let you target sectors that might be doing well at that time, like tech stocks or banking stocks, which makes them a popular choice. Therefore, whether you want to capture a particular portion of the world's stocks, a broad sector, or a niche market, there's always an ETF for that.

2. Fixed Income/Bond ETFs

Fixed-income/Bond ETFs exclusively trade in fixed-income assets like treasury bonds and corporate bonds. They are a collection of investments with different prices and maturity dates. Most professionals invest in fixed-income and bond ETFs because bonds tend to reduce a portfolio's volatility, while also providing an additional stream of income.

3. Commodity ETFs

Usually, commodities are harder to access than stocks, but ETFs are a great way to get into commodities. Investors can buy a commodity ETF that tracks the price changes of particular commodities like gold, silver, or oil, or in a commodity stock ETF that invests in the common shares of commodity producers. These are attractive to further diversify your portfolio and risk. However, commodity ETFs can be less transparent than index or stock ETFs, and investors in these ETFs are typically exposed to additional political, currency, and market risks.

4. Currency ETFs

Currency ETFs provide exposure to investors in the foreign exchange market and allow investors to invest in either a single currency, like the US dollar or a basket of currencies. Currency ETFs are seemingly simple investment vehicles that track foreign currency, similar to how a market ETF tracks its underlying index. However, there are also more complex currency ETFs that purchase currency derivatives. Using derivatives can potentially add more risk to the ETF, so you need to be sure of what you’re buying.

5. REIT ETFs

Real estate investment trusts, also known as REITs, are ETFs that invest the majority of their assets in equity REIT securities and related derivatives. REIT ETFs are passively managed around an index of publicly-traded real estate owners. REITs offer a way to include real estate in one’s investment portfolio. Additionally, some REITs may offer higher dividend yields than some other investments.

6. Specialty ETFs

Two fund types that have emerged in recent times to meet very specific needs are leveraged ETFs and inverse ETFs. These specialty ETFs offer much greater growth potential but also a much higher risk.

● Leveraged ETFs: A leveraged ETF uses financial derivatives and debt to amplify the returns of an underlying index. These ETFs as they typically say buy how much they are leveraged. For example, double leveraged will borrow an extra $1 for every $1 investors put into the fund.

● Inverse ETFs: Inverse ETFs, or short funds, are created by using various derivatives to gain profits through short selling when there is a decline in the value of a basket of securities or other target indexes.