What are ADRs?

The stocks of most foreign companies that trade in the U.S. markets are traded as American Depositary Receipts (ADRs). ADRs allow U.S. investors to invest in non-U.S. companies and give non-U.S. companies easier access to the U.S. capital markets. Moreover, ADRs represent some of the most familiar companies in the global market, including household names such as Alibaba Group, Taiwan Semiconductor Manufacturing Company (TSMC), Unilever, HSBC Holdings, Toyota Motor, etc.

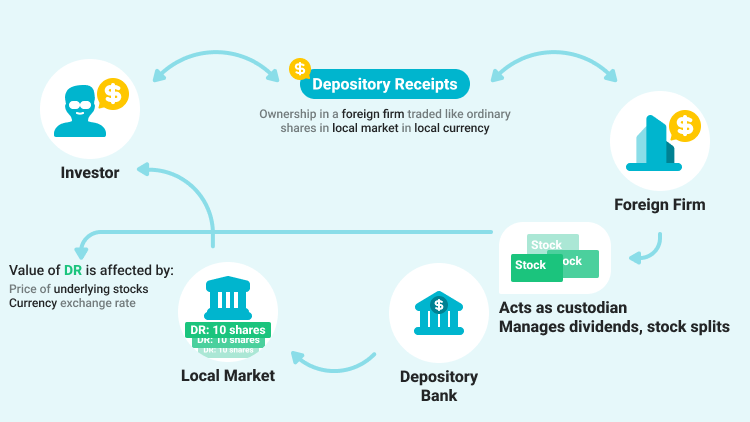

ADRs are a form of equity security that was created specifically to simplify foreign investing for American investors. Each ADR is issued by an American bank or broker, and it represents one or more shares of foreign-company stock held by that bank in the home stock market of the foreign company. For example, one ADR of the Chinese online retailer Alibaba is equal to one underlying share of the company, while one Toyota ADR represents 10 of the Japanese automaker's underlying shares.

If you own an ADR, you have the right to obtain the foreign stock it represents. The price of an ADR corresponds to the price of the foreign stock in its home market, adjusted to the ratio of the ADRs to foreign company shares.

How do ADRs work?

The first ADR was created in 1927 by a U.S. bank to allow domestic investors to invest in shares of a British department store. Nowadays, there are more than 2,000 ADRs available representing shares of companies located in more than 70 countries.

In order to create a new ADR, a U.S. bank must purchase shares on a foreign stock exchange. The bank holds the stock as inventory and issues an ADR to an investor in the U.S. and the investor will be able to re-sell the ADRs on a U.S. exchange or the over-the-counter market.

Individual Investors willing to invest in ADRs can purchase them from brokers or dealers. The brokers and dealers obtain ADRs by buying already-issued ADRs in the US financial markets or by creating a new ADR. ADRs trade in U.S. dollars and clear through U.S. settlement systems, allowing ADR holders to avoid foreign currency transaction. Meanwhile, investors who purchase the ADRs are paid dividends in the US dollar.

What are ADR levels?

ADRs are categorized into three levels, depending on the extent to which the underlying foreign company has access to the U.S. markets:

- Level 1 ADR

Level 1 ADRs are the most basic type of ADR where foreign companies either don't qualify or don't want to have their ADR listed on an exchange, and they establish a trading presence but may not be used to raise capital. ADRs found only on the over-the-counter market have the loosest requirements from the SEC and they are typically highly speculative. - Level 2 ADR

Level 2 ADRs can be used to establish a trading presence on a national securities exchange, but they can’t be used to raise capital. Level 2 ADRs have slightly more requirements from the SEC than Level 1 ADRs do, but as Level 2 ADRs can be traded in the exchange, they can get higher visibility and trading volume. - Level 3 ADR

Level 3 ADRs can be listed on a US exchange and be used to raise capital for the foreign issuer. The reporting requirements are similar to those of US companies, and issuers are subject to full reporting with the SEC, so Level 3 ADRs are the most prestigious.

Summary:

- ADRs are a form of equity security that was created specifically to simplify foreign investing for American investors. ADRs allow U.S. investors to invest in non-U.S. companies and give non-U.S. companies easier access to the U.S. capital markets.

- Each ADR is issued by an American bank or broker, and it represents one or more shares of foreign-company stock held by that bank in the home stock market of the foreign company.

- ADRs trade in U.S. dollars and clear through U.S. settlement systems, allowing ADR holders to avoid having to transact in a foreign currency.