Saudi Market

TASI Technical Analysis:

Tasi is currently in an upward channel, fluctuating within an ascending channel indicates that market sentiment is bullish in the short term. It broke through the previous resistance at 12,225.353 points and faced a new resistance near 12,318.329 points. Investors should watch for a sustained move above SMA 10 and SMA 20 and a breakout of the resistance at 12,318.329 points. If the price can break out of 12,318.329 points and stabilize above it, further gains towards 12,400,000 points are possible.

The current value of RSI 14 is 67.92, which is close to the overbought area of 70, indicating that the market may be overbought and there may be a risk of a correction in the short term.

TASI Index Weekly Market Summary (January 12 to January 16)

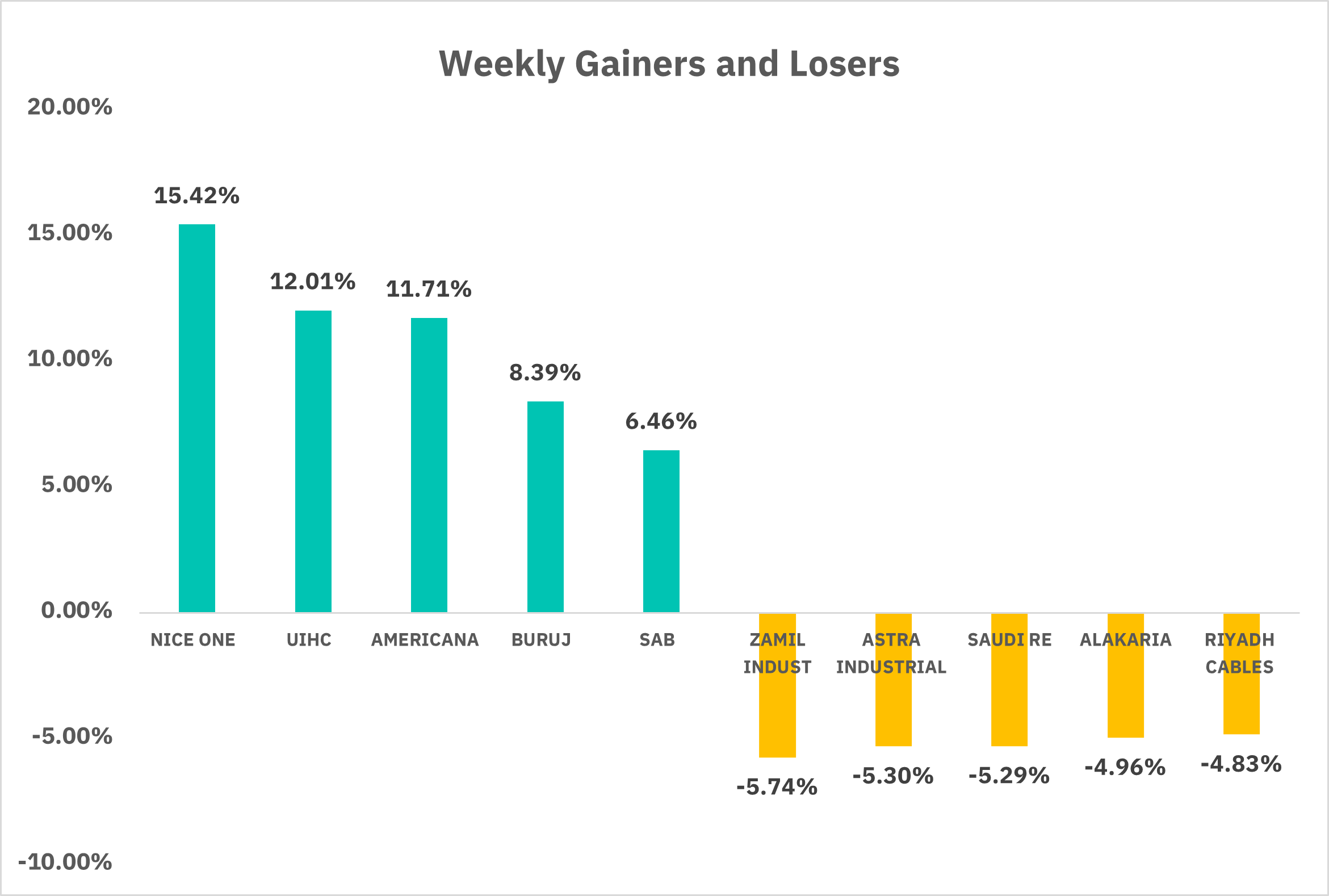

The TASI index closed up 1.06% last week, showing an upward trend, especially on January 7, when it rose to the highest point of the week at 12,212 points. The average daily turnover is 5,892million Saudi Riyals (SAR), Market liquidity surged last week. In terms of individual stock performance, 150 companies saw their share prices rise, while 104 companies experienced declines. NICE ONE and UIHC were the top gainers, with gains of 15.42% and 12.01%. Conversely, ZAMIL INDUST and ASTRA INDUSTRIAL, with loss of 5.74% and 5.30%.

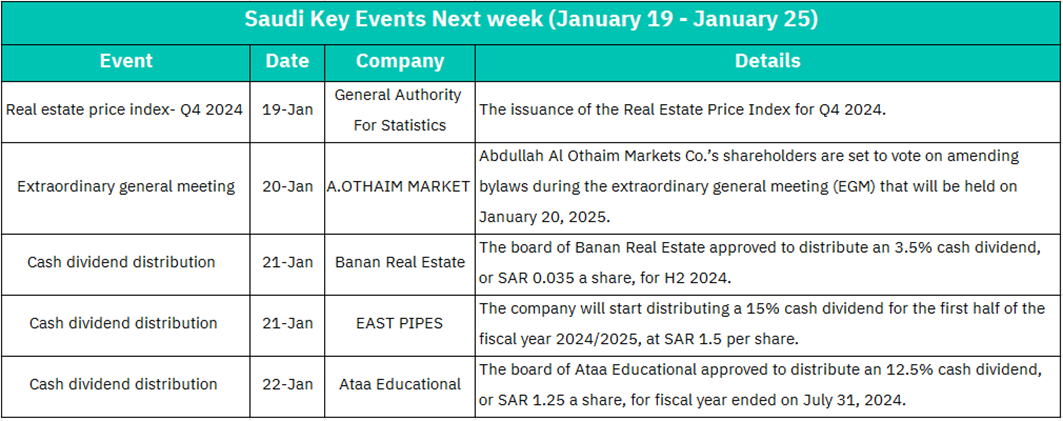

1. January 19: The real estate price index for the fourth quarter of 2024 is released by the General Statistics Office, providing the latest trends in the real estate market.

2. January 20: A.OTHAIM MARKET shareholders will vote to amend the company's articles of association at the Extraordinary General Meeting of Shareholders to be held on January 20, 2025. Amendments to the articles of association may affect the company's operations and governance structure, and investors need to pay attention to whether these changes are in line with their investment strategy.

3. January 21: The Banan Real Estate's board of directors approved a 3.5% cash dividend of 0.035 SAR per share for the second half of 2024. EAST PIPES will distribute a 15% cash dividend of 1.5 SAR per share for the first half of the 2024/2025 fiscal year. The higher cash dividend rate may attract investors, especially those who prefer income-oriented investments.

4. January 22: Ataa Educational's Board of Directors approved a 12.5% cash dividend of SAR 1.25 per share for the fiscal year ending July 31, 2024.

U.S. Market

S&P500 Technical Analysis:

The S&P 500 increased by 1.89% last week, the current price is close to SMA 30 and investors should watch to see if the price can break above this resistance level. If the price can break out of 5,972.96 points and stabilize above it, it could rise further to 6,099.67 points.

RSI 14 is 50.26, indicating that the market is in a neutral to weak state, with no obvious overbought or oversold signals.

The latest inflation report released last Wednesday showed that the overall CPI in December was in line with expectations, while the core CPI eased. The monthly rate of the U.S. CPI after seasonal adjustment in December was 0.4%, the highest since March 2024, higher than market expectations and the previous value of 0.3%; the annual rate of the U.S. CPI without seasonal adjustment in December was 2.9%, in line with expectations, and higher than the previous value of 2.7%. After the CPI data was released, interest rate futures traders bet on the Federal Reserve to cut interest rates in June and expected about a 50% chance of a second rate cut by the end of 2025.

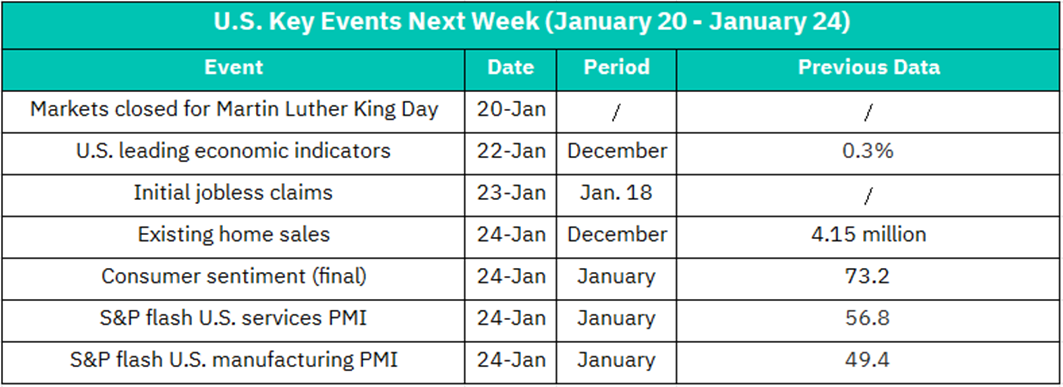

1. Market Closed for Martin Luther King Day - January 20: The U.S. financial markets will be closed for one day on Martin Luther King Day.

2. U.S. Leading Economic Indicators - January 22: The U.S. Leading Economic Indicators data for December will be released, with the previous value of 0.3% and any changes beyond expectations may affect investor sentiment and market trends.

3. Initial Jobless Claims -January 23: The number of initial jobless claims for the week of January 18 will be released. The number of unemployment claims is a key indicator of the health of the labor market. An increase in the number may indicate a weak job market

4. Existing Home Sales - January 24: To release the December existing home sales data, the previous value is 4.15 million units. Existing home sales data reflects the demand situation in the real estate market. Increased sales may indicate a healthy economy, while decreased sales may indicate a slowdown.

5. Consumer Confidence Index (Final Value) - January 24: To release the final value of the Consumer Confidence Index for January, the previous value is 73.2. Consumer confidence is a driver of consumer spending. Increased confidence may indicate increased consumer spending, which is a positive signal for both the stock market and the economy.

6. S&P Global US Services PMI and Manufacturing PMI - January 24: To release the January services and manufacturing PMI data, the previous values are 56.8 and 49.4, respectively. PMI data is an important indicator of manufacturing and service industry activities. Improved data may indicate increased economic activity, which is positive for both the stock market and the US dollar.

Crypto ETF Technical Analysis:

The current price of Invesco Galaxy Bitcoin ETF (BTCO) is $100.28, which is slightly above the 10-day and 20-day moving averages. The price has shown volatility recently, but the overall trend seems to be trying to break out upwards near the $108.31 resistance level. The relative strength index (RSI) is 56.78, which shows that the market has no obvious overbought or oversold signals. If the price can break through the $108.31 resistance level, it is likely to rise further.

Trump is about to be sworn in on January 20 and may launch a series of policy initiatives on cryptocurrencies. The market is paying close attention to Trump's inflationary tariffs, immigration policies, and Trump pledged to make the United States "the global leader in the field of cryptocurrencies.

Disclaimer:

Sahm is subject to the supervision and control of the CMA, pursuant to its license no. 22251-25 issued by CMA.

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives. The firm and its analysts do not have any material interests or conflicts of interest in any companies mentioned in this report.

Performance data provided is accurate and sourced from reliable platforms, including Argaam, TradingView, MarketWatch.

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.