Participating IPOs-Over 70% Success Rate

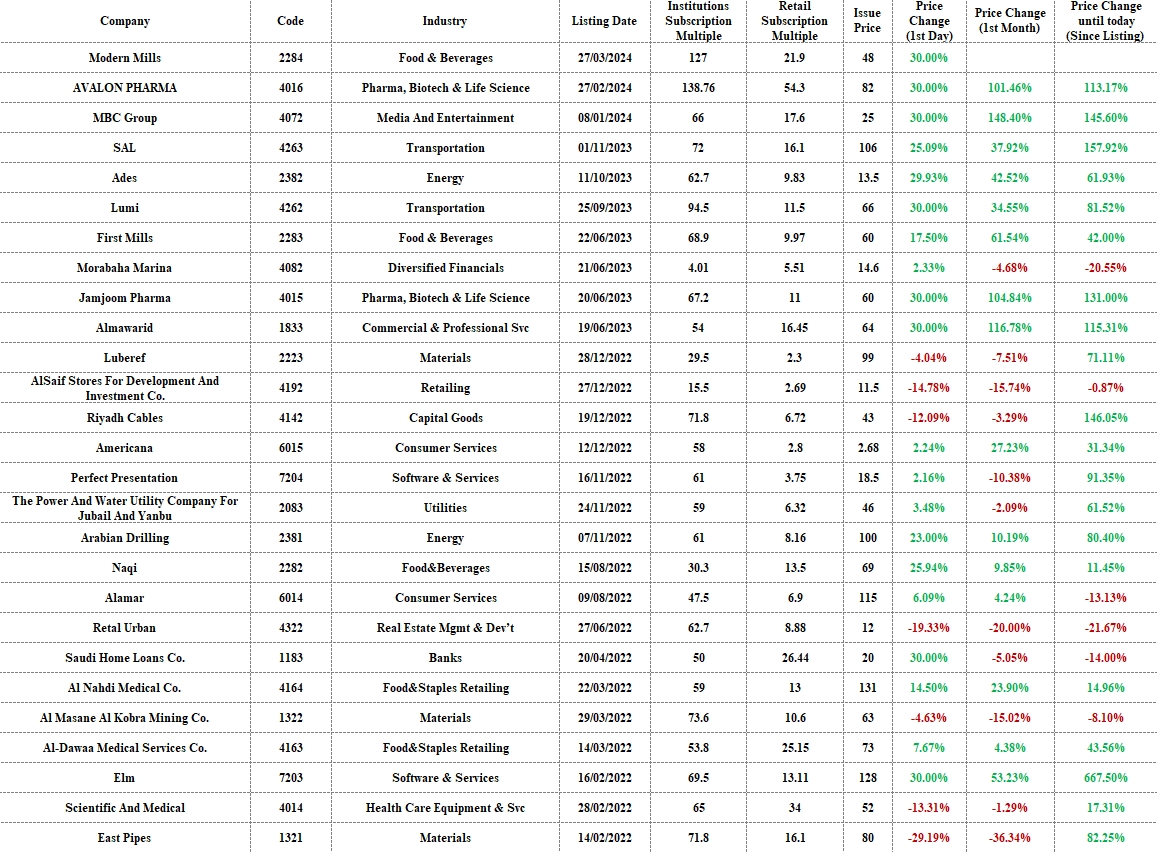

On the Saudi Main Market, 27 companies have announced IPOs in the past two years. Imagine being one of the investors; you'd have a 73% chance of witnessing an average 19.5% price increase on the first trading day. Moreover, there’s more than a 30% chance of achieving a 30% return on the same day. Investing in new stocks is not just a numbers game, but a real opportunity for ordinary people to significantly increase their wealth overnight.

Core Elements of Saudi IPOs

1. Company Transformation

An IPO signifies the process where a private company first sells its shares to you (the public investors). For the private company, an IPO is not just a financial transformation but also a major cultural and structural overhaul. Imagine a startup raising public funds and suddenly gaining the ability to expand operations, attract top talent, and improve credit conditions.

2. Why Investing in IPOs is a Shortcut to Wealth Growth

For you, investing in IPOs isn't as simple as just buying and selling stocks. Participating in an IPO is a strategic investment that lets you grow with the company from its early stages to maturity, sharing in the fruits of its development.

Historical data shows the strong performance of IPOs in the Saudi stock market, offering rich returns to investors. Early price fluctuations provide opportunities for short-term trading, while long-term holdings can lead to a commendable investment saga. Whether you seek short-term or long-term wealth appreciation, IPOs offer unique opportunities.

3. Getting Allocated or Not—Where There’s Risk, There’s Reward

Participating in an IPO results in two scenarios: getting allocated or not, which is different from just flipping a coin. For those allocated, as illustrated, 19 out of the 26 companies that went public on the Saudi Main Market in the past two years saw their stock prices rise on the first trading day, equating to a 73% chance, with an average increase of nearly 20%.

If you're not allocated shares in an IPO, it doesn’t mean the chance to make money is gone. Investors who purchase stocks within a month after the IPO can still witness an astonishing average increase of 39.4%, almost like a market-provided second chance to share in wealth growth. Below is the IPO performance in the Saudi market from 2022 to early 2024: