Risks of options trading

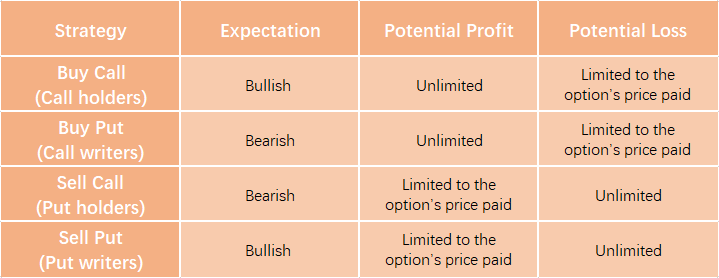

Despite trading options can be a profitable practice for bulls and bears, options contracts are notably risky because of their complex nature, so knowing how options work can reduce the risk somewhat. There are two types of options contracts, call options and put options, each with essentially the same degree of risk. As shown below:

Based on which side of the contract the investor is on, risk can range from a small prepaid amount of the premium to unlimited losses. Therefore, knowing how each side works help determine the risk of an option position.

Risks of call option holders and writers

- Call holders

Traders who are buying call options are betting on the stock to rally above the strike price before the contract's expiration. This is seen as the closest thing to simply purchasing the shares, but long calls can often provide more leverage than buying a stock outright, as the maximum risk is limited to the initial premium paid, while the maximum reward is theoretically unlimited.

For example, when the current stock price is higher than the strike price (in the money), call holders can exercise their right to buy the stock. So call holders can secure unlimited profit, as the share price can go up constantly. However, if the current stock price is lower than the strike price (out-of-the-money), the call holders may let the option contract expire, and they won’t exercise their rights. Thus, the buyers will have a limited loss, such as premium, commission, or other fees paid for the buy.

- Call writers

Call buyers are given the right to buy an underlying security, within a certain time frame, at a specified price by the option seller or writer. For this right, the option has a cost, called the premium. The premium is what call option writers are after. They get paid upfront but face high risk if the call option becomes very valuable to the call buyer.

For example, a call writer is hoping an underlying stock will drop below the strike price, but the call buyer is hoping it will not. The further increase in the call’s strike price, the larger the loss for the call writer, and the bigger the profit for the call buyer. Therefore, the upside potential for call writers is the premium for the option, and the downside potential is unlimited.

Risks of put option holders and writers

- Put holders

A put option gives the buyer the right to sell the underlying asset at the option strike price. When buying put options, a trader is expecting to profit from the stock's decline. In this scenario, a profit is made when the stock drops below the strike price before the contract's expiration. The maximum risk is limited to the initial premium paid for the options.

For example, when the underlying stock price is lower than the strike price, put holders can exercise their right to sell the stock. So put holders can secure unlimited profit, as the share price can go down constantly. However, if the current stock price is higher than the strike price, the put holders will not exercise their right to sell, and they have to lose the premium they paid.

- Put writers (sellers)

Put writers are betting that the underlying stock will remain above the strike price through expiration. If it occurs, the writer profits off the premium received at the initiation. However, there is significant risk involved, since the put sellers are obligated to buy the shares at the strike price before expiration if assigned. So for a put writer, the maximum gain is limited to the premium collected, while the maximum loss would occur if the underlying stock price fell to zero.

For example, when an investor is bullish on a stock, and the stock price stays above the strike price, the investor would get the premium since the put option buyer would expire out of the money and be worthless. Conversely, if the stock price moves below the strike price, the investor is on the hook for purchasing the stock at the strike price or even lower than the strike price. No matter how far the stock falls, the put option writer is liable for purchasing the shares, meaning they face a theoretical risk.

Summary:

- An option contract has two sides - buyer and writer (seller), and each side carries different risks. If you are the writer you have a different risk than that of the holder.

- For call holders, the maximum risk is limited to the initial premium paid, while the maximum reward is theoretically unlimited.

- The upside potential for call writers is the premium for the option, and the downside potential is unlimited.

- Put option traders are expecting to profit from the stock's decline. In this scenario, a profit is made when the stock drops below the strike price before the contract's expiration. The maximum risk is limited to the initial premium paid for the options.

- Put writers profit off the premium when the underlying stock will remain above the strike price through expiration. But if the stock price moves below the strike price, the downside potential is the amount the stock is worth.