PDD Holdings Inc

Challenger or Challenged? PDD's Growth Dilemma and Path to Breakthrough

Date: September 12, 2024

Key Events:

1. PDD's Q2 revenue was 97.06 billion yuan, an 86% year-over-year increase, falling short of the market expectation of 99.9 billion yuan.

2. Net profit attributable to shareholders was 32.0094 billion yuan, a year-over-year increase of 144%, exceeding market expectations.

3. Looking at individual business segments, revenue growth fell short of market expectations across the board. In Q2, online marketing services and other revenues were 49.12 billion yuan, a year-over-year increase of 29%, below the expected 33%. Transaction services revenue was 47.9 billion yuan, a year-over-year increase of 234%, compared to the expected growth of 248%.

4. PDD announced that it will waive 10 billion yuan in transaction fees over the next year.

Earnings Report Analysis:

In fact, although PDD's earnings report fell short of expectations, the overall deviation was not significant, with profit growth even exceeding expectations. However, after the results were announced, the stock price plummeted by nearly 30% and continued its downward trend over the next two days. The actual reason for this was the management's pessimistic statements triggering market panic. Specifically:

(1) Management stated that the profit growth over the past few quarters was a result of asynchronous short-term investment cycles and financial reporting periods and should not be viewed as a long-term trend. Future profits will gradually enter a downward trend, which is a necessary cost for long-term health.

(2) PDD's non-commercial challenges are becoming increasingly severe.

(3) PDD will not conduct share buybacks or pay dividends in the coming years.

These statements sparked concerns among long-term investors about the deterioration of PDD's fundamentals. The decision not to pay dividends or conduct share buybacks undermined investor confidence, triggering panic selling.

Key Focus:

(1) We understand the market's concerns, but PDD's current valuation of only 9 times PE has largely priced in potential risks, including geopolitical risks.

(2) Although PDD has emphasized the risk of long-term profit decline, it remains the fastest-growing e-commerce company in China, and its current valuation is already lower than that of its main competitors, Alibaba and JD.com.

Investment Risks:

(1) Management has refused to reward shareholders through dividends and share buybacks in the coming years, which is very important to US institutional investors. As a result, the valuation center may shift downward.

(2) Management's unexpectedly pessimistic statements triggered a sharp decline in the stock price, which presents an additional risk for the market.

Technical Analysis

From a technical perspective, the stock's trend was quite good initially. Despite fluctuations, it generally displayed a pattern where each low was higher than the previous low, and each high was higher than the previous high, indicating an overall upward trend. However, the latest earnings report falling short of expectations, coupled with pessimistic statements from management, caused the stock price to plummet nearly 30% in a single day, breaking through the long-term trend line at $120. From a technical standpoint, this is quite dangerous, especially with the massive surge in trading volume, which is likely to trigger panic selling among long-term investors. Although the valuation is already very low, considering only the technical aspects without factoring in fundamentals, it is advisable to wait until the stock price stabilizes above the 10-day moving average before taking any action.

[1] Long-term uptrend support line: This refers to the support level in an upward price channel. In an effective uptrend, the support level continuously moves higher and is not effectively broken downwards.

[2] Long-term uptrend resistance level: This refers to the resistance level in an upward price channel. In an effective uptrend, the resistance level continuously moves higher, and the stock price may trade above this resistance level.

[3] Long-term trend line: This refers to important price levels from the stock's previous trading history. Once broken downwards, the previous trend may reverse.

Research Report Appendix

Company Concept:

PDD is a rapidly growing Chinese e-commerce giant that combines social shopping, competitive pricing, and agriculture-focused initiatives, challenging established players like Alibaba and expanding globally through its international platform, Temu.

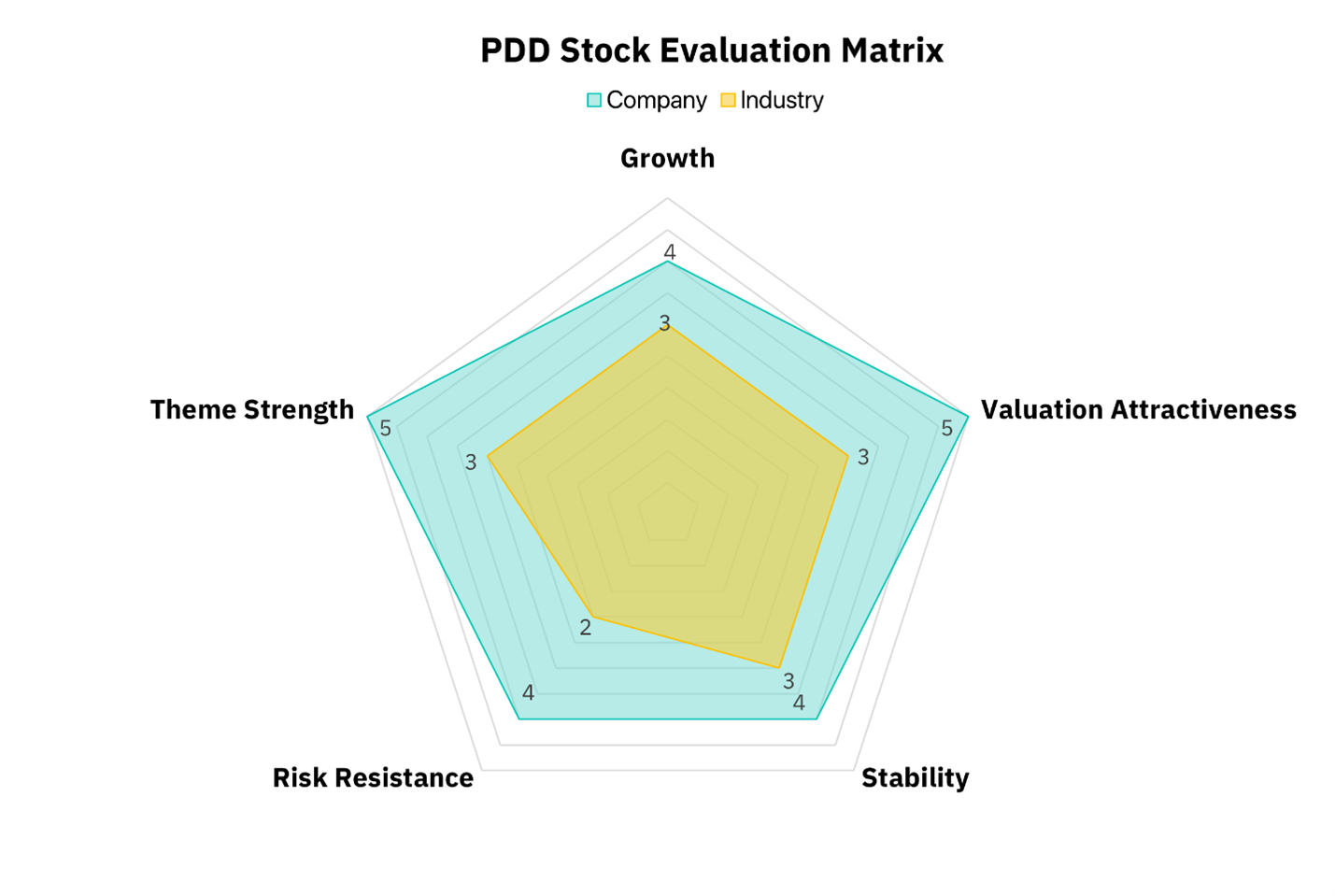

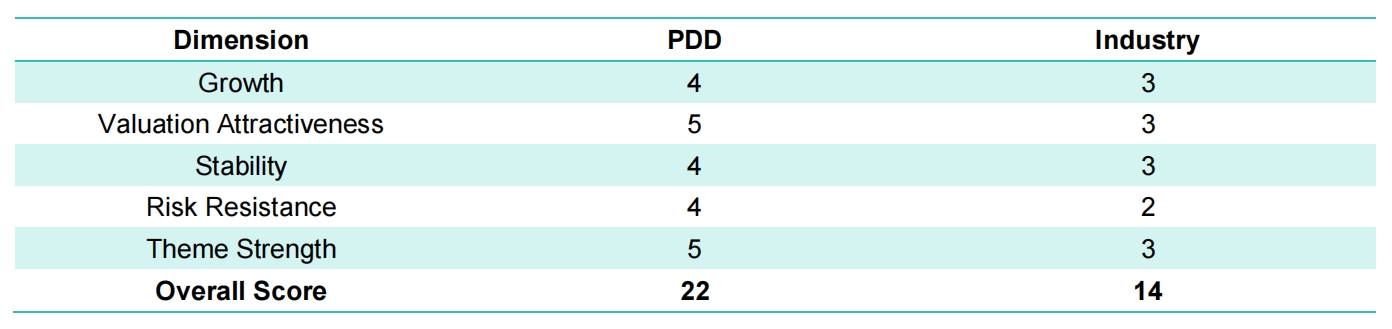

Model Explanation: The model primarily evaluates companies and industries across five dimensions: growth ability, valuation attractiveness, stability, risk resistance ability, and theme strength. Each dimension is scored from 1-5, with 1 being the lowest and 5 the highest. Overall, higher scores indicate stronger fundamentals. For each dimension, a multi-factor model will be constructed based on industry and historical data of selected stocks, and a quantitative model will be used to automatically score each dimension.

Here are the dimensions explained:

1. Growth Ability: Measures future performance potential; higher growth rates yield higher scores.

2. Valuation Attractiveness: Assesses stock valuation; lower valuations earn higher scores.

3. Stability: Evaluates the consistency of profit generation; greater stability means higher scores.

4. Risk Resistance: Gauges the capacity to endure macroeconomic changes; better risk resistance leads to higher scores.

5. Theme Strength: Rates market favor for the stock in the short term; increased favor results in higher scores.

Disclaimer:

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives. The firm and its analysts do not have any material interest or conflict of interest in PDD Corporation.

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.