What is an option?

An option is a financial derivative, a contract that gives the buyer the right, but not the obligation, to buy or sell the underlying asset at a specified price (the exercise price or strike price) and a certain date. Each option contract has a specific expiration date by which the holder must exercise their option. The stated price on an option is known as the strike price or exercise price. However, since the options contract isn't an obligation to buy or sell the underlying security, option buyers also have the option to let the contract expire. But when buying options, you’ll pay what’s known as a “premium” up front, which you’ll lose if you let the contract expire.

Traders and investors buy and sell options for several reasons. Options speculation allows a trader to hold a leveraged position in an asset at a lower cost than buying shares of the asset. On another hand, investors use options to hedge or reduce the risk exposure of their portfolios. Although there are many opportunities to profit with options, investors should carefully weigh the risks.

Types of options

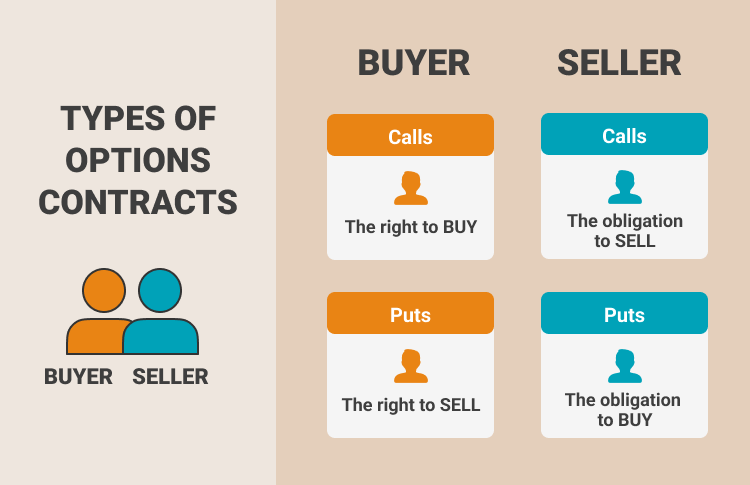

There are two types of options: calls and puts. American-style options can be exercised at any time prior to their expiration. European-style options can only be exercised on the expiration date. See below for the details:

- Call options

Call options give the holder (buyer) the right to buy a specified number of shares of a stock at the strike price, at any time until the contract expires. Investors buy calls when they believe the price of the underlying asset will increase and sell calls if they believe it will decrease. Conversely, as the seller of a call option, investors will have the obligation to sell the market at the strike price if the option is executed by the buyer on expiry.

- Put options

Opposite to call options, put options give the holder the right to sell a specified number of shares of a stock at the strike price, at any time until the contract expires.

A long put is a short position in the underlying security since the put gains value as the price of the underlying asset falls. Conversely, the seller of the put option is obligated to buy the asset if the put buyer exercises their option. The more the market value decreases, the more profit you make.

- American options & European options

American option is a style of options contract that allows holders to exercise their rights at any time before and including the expiration date. This additional flexibility is an obvious advantage to the owner of an American style contract. In contrast, another type of option, called the European option, only allows execution on the day of expiration.

How risky are options?

Options trading is not for everyone, and the risk you take on as an options investor ultimately depends on your role in the contract (which side you’re on) and your strategy. Here are the risks that you need to understand:

- Call holders: If you buy a call, you are buying the right to purchase the stock at a specific price. The upside potential is unlimited, and the downside potential is the premium that you spent.

- Call sellers (writers): If you sell a put, you are selling the right to sell to someone else. The upside potential is the premium for the option, the downside potential is the amount the stock is worth.

- Put holders: If you buy a put, you are buying the right to sell a stock at a specific price. The upside potential is the difference between the share prices. For example, if you buy the right to sell at $5 per share and it drops to $3 per share, you make $2 per share. The downside potential is the premium that you spent.

- Put sellers (writers): If you sell a put, you are selling the right to sell to someone else. The upside potential is the premium for the option, the downside potential is the amount the stock is worth. You want the price to stay above the strike price so that the buyer doesn’t force you to sell at a price higher than the stock is worth.

Other risks associated with trading options include:

- Market risk. Extreme market volatility near an expiration date could cause price changes that result in the option expiring worthless.

- Underlying asset risk. Since options derive their value from an underlying asset, which may be a stock or securities index, any risk factors that impact the price of the underlying asset will also indirectly impact the price and value of the option.

Option trading examples

- Call option example

Let's say you buy a call option for Apple Inc. with a strike price of $100 and an expiration date of a month from now. The lower this strike price is in relation to Apple's current price, the higher the premium you'll have to pay.

If your premium is $5 per share, and the options contract is for the standard 100 shares. This means you'll have to pay a total premium of $500 for the option. However, if shares of Apple rise to $120 before the expiration date, you will make a profit of $20 per share, or $1500 ($2,000 minus the $500 premium) in total.

- Put option example

Conversely, buying a put option means that you're counting on the price of Apple falling before the expiration date. If you have the same strike price of $100, yet shares of Apple fall to $80, you will make a profit of $1,500. Most importantly, if the underlying stock doesn't fall the way you hoped, meeting or exceeding your strike price, you simply let your options contract expire because the option didn't obligate you to buy or sell anything. The only thing you will lose would be the money you paid for the $500 premium.

Summary:

- Options are contracts giving the owner the right to buy or sell an underlying asset, at a fixed price, on or before a specified future date.

- A call option is a contract that gives the buyer the right to buy shares of an underlying stock at the specified price (strike price) for a specified period of time.

- As the seller of a call option, investors will have the obligation to sell the market at the strike price if the option is executed by the buyer on expiry.

- A put option is a contract that gives the buyer the right to sell shares of an underlying stock at the strike price for a specified period of time.

- The seller of the put option is obligated to buy those shares from the buyer of the put option who exercises their option to sell on or before the expiration date.

- American option is a style of options contract that allows holders to exercise their rights at any time before and on the expiration date. In contrast, another type of option, called the european option, only allows execution on the day of expiration.