NIO Inc.

NIO: Dual-Brand Strategy Unlocks New Growth Curve, Chinese Economic Policies Boost Industry Recovery

Date: October 18, 2024

Financial Insights:

1. In Q2 2024, NIO's delivery volume and revenue reached a new historical high for the same period. Q2 revenue was 17.45 billion yuan ($2.42 billion), slightly higher than the market expectation of 17.38 billion yuan ($2.41 billion). A total of 57,373 vehicles were delivered, setting a new record. The operating loss was 4.7 billion yuan ($653 million), better than the market expectation of 4.86 billion yuan ($675 million). The gross profit margin was 9.7%.

2. In terms of performance guidance, the delivery volume in Q3 this year will be between 61,000-63,000 units, a year-on-year increase of 10%-13.7%. The total revenue will be between 19.109 billion - 19.669 billion yuan ($2.65 billion - $2.73 billion), both hitting historical highs.

3. NIO's CEO stated that in the long term, NIO's monthly sales in China could reach 30,000-40,000 units, with a target gross profit margin of 25%.

4. Regarding the battery swap station business, the break-even point is about 60 swaps per day. Currently, the average daily swap volume is 30-40, and it's expected to become profitable soon.

Key Events:

At the end of September, the Chinese government announced a series of economic support policies, including reducing interest rates on existing mortgages, lowering overall interest rates, introducing new policy tools to support the stock market, and for the first time mentioning the need to stabilize and reverse the decline in the real estate market. These measures led to a continued increase in market risk appetite, resulting in a significant rise in Chinese assets.

Key Events Analysis:

The market believes that regulators have recognized the negative impact of deflation on the economy and view this action as a policy shift. Investors are now trading Chinese assets based on recovery expectations. We observed that in the days following the policy announcements, both Hong Kong and mainland A-share markets experienced a short squeeze-like surge, with brokerage, real estate, and consumer stocks showing even larger gains. NIO's stock price had already entered an upward trend in early September, rising nearly twofold from its low point.

Overall, we believe the negative beta scenario for Chinese assets has ended. If subsequent fiscal policies can promote a recovery in economic fundamentals, it may be an opportune time for strategic allocation to Chinese assets.

Key Points:

1. Currently, Chinese assets have experienced a correction, and trading volume has narrowed compared to the peak at the end of last month. We have observed that some overseas hedge funds have already started to take profits. We believe that the "buy everything" phase has ended. Even if subsequent fiscal policies are successfully implemented, it's unlikely that the market will see the same collective rise as before. Market divergence is the most probable outcome.

2. On the positive side, NIO's second brand, ONVO, is about to launch its first new car, the L60. Unlike NIO, ONVO is targeting the mass market. If combined with the Battery-as-a-Service (BaaS) program, the entry price for the L60 will be reduced to under 200,000 RMB (about 30,000 USD). In the global automotive market, the mass market segment accounts for over 50% of the total, significantly larger than the premium market. This means that if ONVO successfully establishes itself in this market, its performance potential could be substantially greater than the NIO brand.

3. In the short term, at the macro level, we suggest paying attention to the fiscal stimulus plans announced by the Chinese government. If there is additional support for consumption, it would be positive news. At the micro level, observe high-frequency data such as NIO's weekly and monthly sales volumes, as well as the number of pre-orders for the ONVO L60 after its launch. If these exceed expectations, NIO will have established a second growth curve investment logic.

Technical Analysis:

NIO's stock price entered an upward trend in early September, possibly because overseas hedge funds had already anticipated China's economic support policies and pushed the stock price up in advance. On September 30th, trading volume increased significantly, indicating a widening disagreement between bulls and bears. The stock price closed at the lower end of the day's range, suggesting strong selling pressure. There were signs that investors who had bought at the bottom were taking profits.

In the following trading days, selling pressure remained strong, resulting in a noticeable correction in the stock price. Currently, there's a tug-of-war around the 20-day moving average. At this point, it's crucial to watch whether the stock price can firmly establish itself above the resistance level of around $6.3. If so, this price could potentially become a mid-term support level.

[1] Long-term upward channel: A pattern where the price moves between two parallel upward trendlines, with the lower line serving as support and the upper line as resistance.

[2] Resistance level: Indicates that the stock price will face strong selling pressure around this price point.

[3] Support level: Indicates that there is strong buying pressure around this price point, providing some support for the stock price.

Research Report Appendix

Company Concept:

NIO is a leading Chinese electric vehicle manufacturer, known for its premium smart electric cars, innovative battery swap technology, and ambitious global expansion plans in the competitive EV market.

Model Explanation:

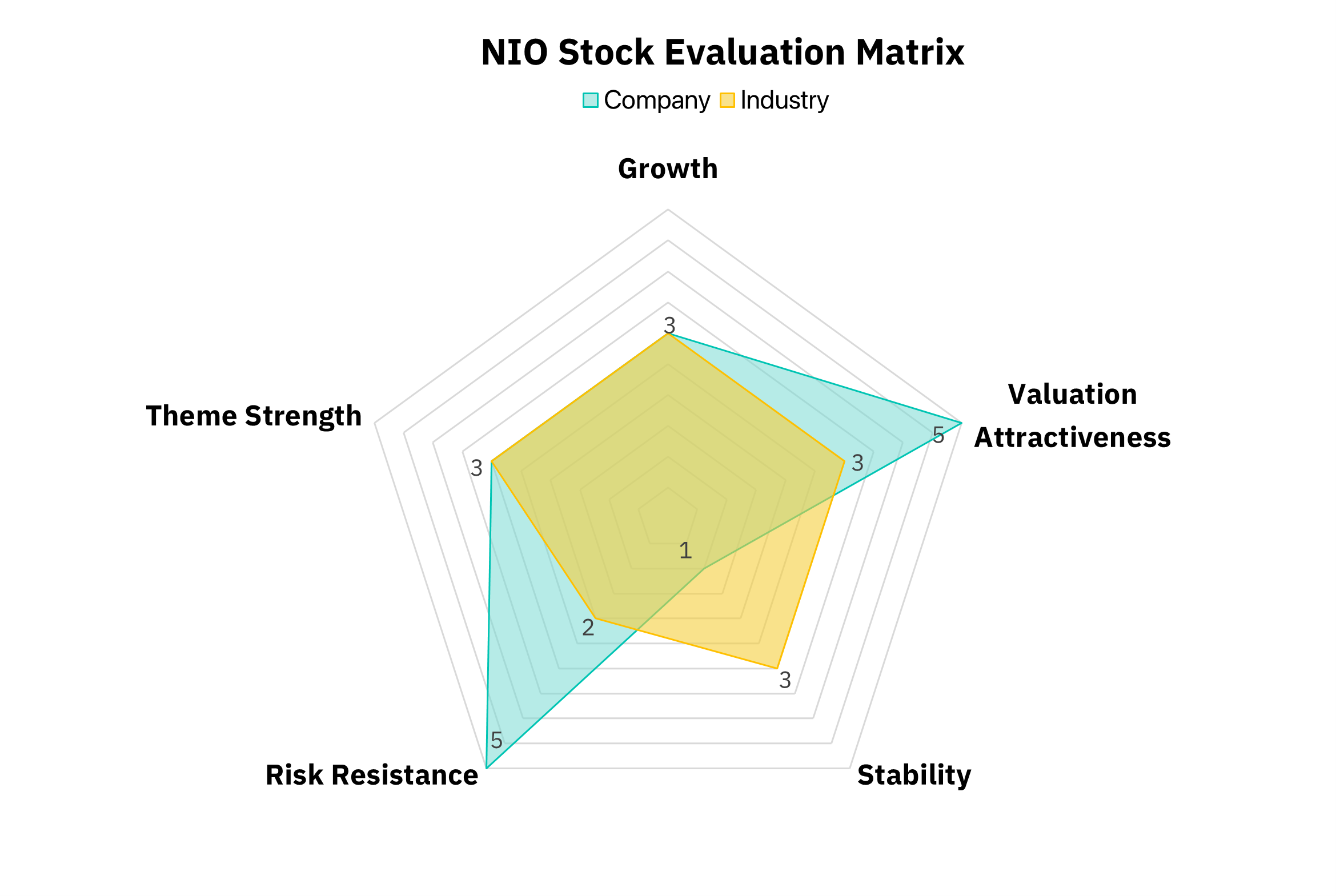

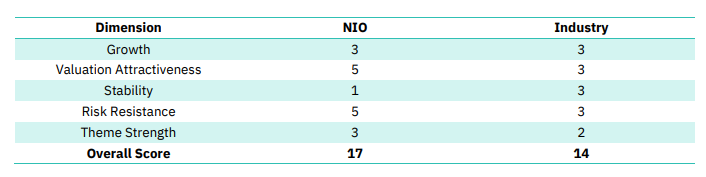

The model primarily evaluates companies and industries across five dimensions: growth ability, valuation attractiveness, stability, risk resistance ability, and theme strength. Each dimension is scored from 1-5, with 1 being the lowest and 5 the highest. Overall, higher scores indicate stronger fundamentals. For each dimension, a multi-factor model will be constructed based on industry and historical data of selected stocks, and a quantitative model will be used to automatically score each dimension.

Here are the dimensions explained:

1. Growth Ability: Measures future performance potential; higher growth rates yield higher scores.

2. Valuation Attractiveness: Assesses stock valuation; lower valuations earn higher scores.

3. Stability: Evaluates the consistency of profit generation; greater stability means higher scores.

4. Risk Resistance: Gauges the capacity to endure macroeconomic changes; better risk resistance leads to higher scores.

5. Theme Strength: Rates market favor for the stock in the short term; increased favor results in higher scores.

Disclaimer:

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives. The firm and its analysts do not have any material interest or conflict of interest in NIO Inc.

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.