Understand long straddle strategy

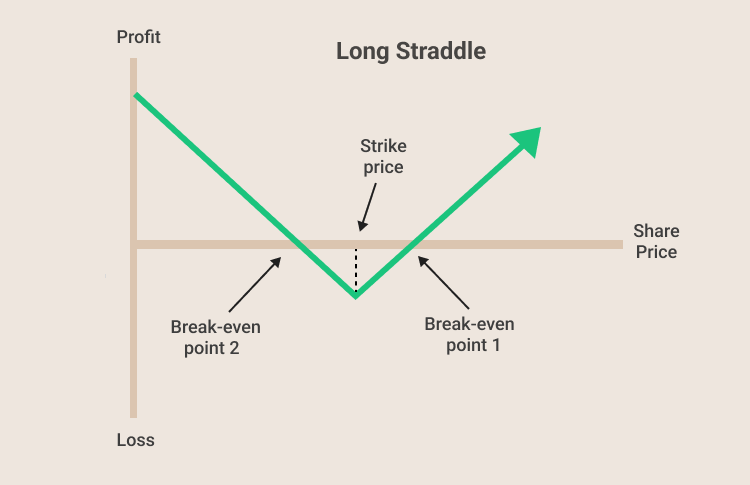

A long straddle is an options trading strategy that consists of a long call and a long put with the same underlying stock, expiration date, and strike price. The purpose of a long straddle is to profit either from the underlying stock rising above the upper break-even point or falling below the lower break-even point. As seen below:

Typically, investors buy a straddle because they predict a big price move and/or a great deal of volatility in the near future. The profit potential of a long straddle is unlimited on the upside, and the potential loss is limited to the total cost of the straddle plus commissions and other fees.

Long straddle profits and losses

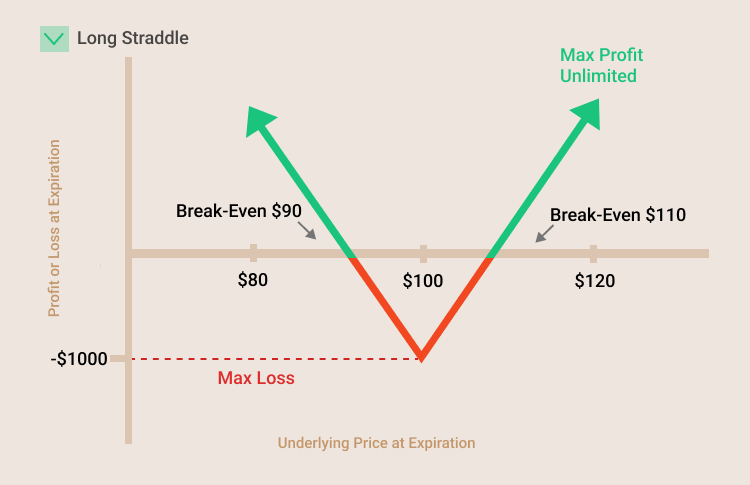

Let’s understand how the long straddle strategy works with the help of an example from stock options trading. Consider an Apple stock that has $100 per share. A call option with a strike price of $100 is at a $10 premium per share, and the cost of a put option with the same strike is also $10. An investor enters into a straddle by purchasing one of each option. As seen below:

As shown above, the position will profit at expiration if the stock is priced above $110 or below $90 on or before expiration to make money. The maximum loss of $20 per share ($20 * 100 = $2,000 for one call and one put contract) occurs only if the stock is priced precisely at $100 on the close of the expiration day. The trader will experience a smaller loss than this if the price is anywhere between $120 ($100 strike price plus both call and put option premium) and $80 ($100 minus both call and put option premium) per share. The trader will experience gain if the stock is higher than $120 or lower than $80. For example, If the stock moves to $135 at expiration, the position profit is (Profit = $135 - $100 - $20 = $15).

In either case, the maximum risk is the total cost to enter the position, which is the premium of the call option plus the price of the put option. The following is the formula for calculating the profit of long straddle options:

- When the price of the underlying asset is increasing

Profit (up) = Price of the underlying asset - the strike price of a call option - premium paid - When the price of the underlying asset is decreasing

Profit (down) = Strike price of a put option - the price of the underlying asset - premium paid

How does a long straddle strategy benefit a trader?

Investors can get profit from the stock moves in either direction by using a long straddle strategy. Call options benefit from an upward move, while put options benefit from a downward move in the underlying asset. If the price of the underlying asset continues to increase, the potential advantage is unlimited. If the price of the underlying asset goes to zero, the profit is limited to the strike price minus the premiums paid for the options. Moreover, when using a long straddle strategy, there’s no need to accurately predict how a stock price will fluctuate; investors just need to be right about it moving before it expires.

What are the risks of a long straddle strategy?

Buying both a call option and a put option increases the cost of your position, especially for a volatile stock. The risk of a long-straddle strategy is that the market may not react strongly enough to the event or the news it generates. This is compounded by the fact that option sellers know the event is imminent which increases the prices of put and call options in anticipation of the event. This means that the cost of attempting the strategy is much higher than simply betting on one direction alone, and also more expensive than betting on both directions if no newsworthy event were approaching. Thus, investors will need a fairly significant price swing just to break even price.

Summary:

- A long straddle consists of one long call and one long put. Both options have the same underlying stock, the same strike price, and the same expiration date.

- A long straddle options strategy is a bet that the underlying asset will move significantly in price, either higher or lower.

- The profit potential of a long straddle is unlimited on the upside, and the potential loss is limited to the total cost of the straddle plus commissions or other fees.

- A long straddle profits when the price of the underlying stock rises above the upper breakeven point or falls below the lower breakeven point.

- The risk of a long-straddle strategy is that the market may not react strongly, and the maximum risk is the total cost to enter the long straddle position, which is the premium of the call option plus the price of the put option.