What is a stock split?

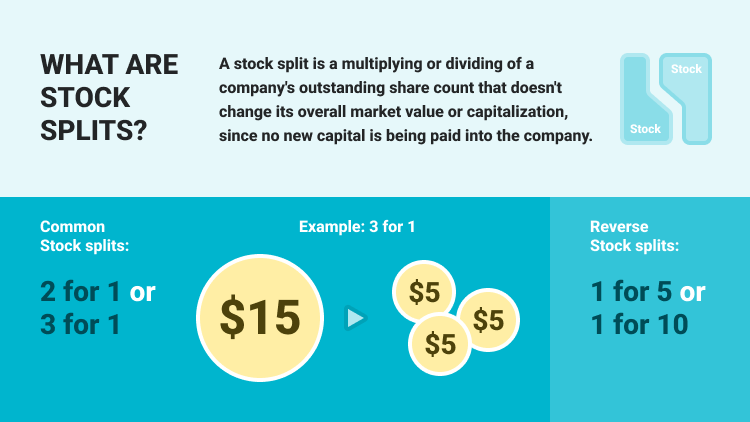

A stock split is a corporate action in which a company’s board of directors increases the number of shares outstanding by issuing more shares to current shareholders. In a stock split, the number of outstanding shares increases and the price per share decreases proportionally, while the market capitalization and the value of the company do not change.

Split ratio means for every share held before the split, a stockholder will have how many shares for each share afterwards. Generally, the most common split ratios are 2-for-1 and 3-for-1, which means a stockholder would receive two or three shares, respectively, for every share held.

Let’s say you have one share of a company’s stock. If the company opts for a 3-for-1 stock split, the company would grant you an additional two shares. After the split, your three shares would be worth the same as the one share you started with.

Why do stocks split?

The reason for a company choosing to split its stock is to lower its trading price to a more comfortable range for most investors and to increase the liquidity of trading in its shares. For example, most investors are more comfortable purchasing 100 shares of $10 stock instead of 1 share of a $1,000 stock. Thus, when the stock price has risen significantly, many public companies end up declaring a stock split to reduce it.

Importantly, a stock split doesn't have any effect on the overall value of your investment, at least in theory. But in the real world, the circumstances surrounding the split can certainly move a stock higher or lower. For example, when a company decides to split its shares in order to make shares more affordable, it can have a positive effect. However, the process of a stock split is expensive, requires legal oversight, and must be performed in accordance with regulatory laws.

A real-world example of a stock split

Companies carry out stock splits with the intent of making their stock prices more attractive to retail investors. In recent years, big Tech companies, including Apple (AAPL), Tesla (TSLA), Nvidia (NVDA), and Amazon (AMZN), have announced or carried out stock splits, having seen their share prices soar.

Although stock splits do not directly affect a company’s market capitalization, as investors anticipate increased retail interest after stock splits, a company announcing a stock split could see its share price rise on the news. For example, Google-parent Alphabet announced that its board of directors had approved and declared the stock split for the company’s shares in February 2022. Investors cheered the Google stock split news as Alphabet Class A shares surged over 7.5% on the following day to see its best intraday gain of 2022.

What is reverse stock split?

A reverse stock split, as opposed to a stock split, is a reduction in the number of a company’s outstanding shares in the market. When a company completes a reverse stock split, each outstanding share of the company is converted into a fraction of a share. For instance, if a company declares a 1-for-10 reverse stock split, every ten shares that you own will be converted into a single share. If you owned 1,000 shares of the company before the reverse stock split, you will own a total of 100 shares after the reverse stock split. Like a stock split, a reverse stock split does not impact a company’s market capitalization, and it simply increases share price while decreasing the number of shares outstanding.

Why do companies do reverse stock splits?

The main reason companies execute reverse splits is to meet the requirements to be listed on a major stock exchange like the Nasdaq or the NYSE. To be listed on the Nasdaq, a stock must start at $5 or more per share, and to remain on the NASDAQ, a stock must maintain a price of at least $1 per share. Similarly, a stock must remain at or above $1 to trade on the NYSE. If a stock’s price remains below its exchange’s minimum for 30 days, it risks being delisted.

A reverse split isn't necessarily good or bad by itself. It is simply a change in the stock structure of a business and doesn't change anything related to the business itself. However, a reverse stock split can be a red flag that a company is in financial trouble because it boosts the price of otherwise low-value shares. In some reverse stock splits, small shareholders are “cashed out” so that they no longer own the company’s shares. Investors may lose money as a result of fluctuations in trading prices following reverse stock splits.

A real-world example of a reverse stock split

On July 30, 2021, General Electric (GE) announced that it completed the 1-for-8 reverse stock split, a corresponding proportionate reduction in the number of shares of GE common stock. According to the company, GE’s business has changed so drastically over recent years, mainly through major divestments from firms like NBCUniversal and GE Oil and Gas.

Therefore, a reverse split would reduce the share count to a point where the stock price better reflects the actual size of the current business.

Summary:

- A stock split is a corporate action in which a company’s board of directors increases the number of shares outstanding by issuing more shares to current shareholders.

- Split ratio means for every share held before the split, a stockholder will have how many shares for each share.

- The reason for a company choosing to split its stock is to lower its trading price to a more comfortable range for most investors and to increase the liquidity of trading in its shares.

- A reverse stock split, as opposed to a stock split, is a reduction in the number of a company’s outstanding shares in the market.

- When a company completes a reverse stock split, each outstanding share of the company is converted into a fraction of a share.

- The main reason companies execute reverse splits is to meet the requirements to be listed on a major stock exchange like the Nasdaq or the NYSE.

- A reverse stock split can be a red flag that a company is in financial trouble because it boosts the price of otherwise low-value shares.