We Value Your Feedback! Help us shape better content and experiences by participating in our survey. Join the Survey Now!

Company Overview:

Arabian Company for Agricultural and Industrial Investment ("Entaj") is a leading poultry enterprise in Saudi Arabia, established in 2004 and headquartered in the Kingdom. The company operates across the entire poultry value chain, from breeding and hatching to farming, processing, and distribution. It is dedicated to producing fresh, frozen, and portioned poultry products while expanding into egg and red meat segments.

Market Position

Industry Ranking: Ranked as the fifth-largest poultry producer in Saudi Arabia, with a 7.6% market share (2024 data).

Brand Influence: As a prominent domestic brand in Saudi Arabia, Entaj has earned consumer trust through cost-effective solutions, innovative products, and strict quality standards, including Halal certification and ISO standards. Its distribution network spans over 4,000 retail outlets.

Core Business and Production Capacity

Production Scale:

Annual Capacity: 185 million poultry units (expanded to 600,000 daily units in 2024).

Product Line: Daily production includes 226,000 fresh chickens, 74,000 frozen chickens, and 100,000 portioned products.

Infrastructure: The company operates 26 owned and leased farms, a hatchery capable of producing 200 million chicks annually, and a 200 cold chain logistics vehicles fleet.

Industry analysis:

Demand – Dual Engines: Demographic Dividend and Consumption Upgrade

Population Base and Structure:

As of 2023, Saudi Arabia’s total population stands at 36.2 million, with 43% of the population between the ages of 20 and 39. The average household size is 5.2 persons—above the global average of 4.9—indicating a youthful demographic that drives strong demand for high-protein foods.

Enhanced Purchasing Power:

Per capita disposable income rose from SAR 28,000 in 2021 to SAR 32,000 in 2023 (a CAGR of 6.9%), which increased the proportion of fresh food consumption from 18% to 21% (based on Euromonitor data).

Tourism-Economy Catalyst:

In 2023, Saudi Arabia welcomed 100 million visitors (including 73 million domestic tourists) with a target of 150 million by 2030. The HORECA (Hotels, Restaurants, and Catering) sector’s poultry procurement volume is growing at 12% per annum, with premium hotels favoring locally certified “modified atmosphere packaged fresh poultry” (a core product of Entaj).

Although policies to liberalize the entertainment sector (such as the Red Sea Project) are expected to sustain long-term demand in the food and beverage sector, short-term fluctuations might occur due to global economic volatility. Entaj is advised to enhance its customized B2B services to secure a larger share of the hotel supply chain.

Supply – Domestic Substitution Driven by Robust Policy Initiatives

Food Security Strategy:

Saudi Arabia’s Vision 2030 aims to boost the domestic poultry production rate from 65% in 2023 to 90% by 2030. The government supports this goal by providing low-interest loans (2–3%) through the Agricultural Development Fund (ADF) and granting over SAR 5 billion in agricultural subsidies in 2023.

Technology Upgrade Subsidies:

Capital expenditure for investments in automation on slaughter lines and cold chain logistics is subsidized at 15–20%. For instance, Entaj’s new slaughterhouse secured an ADF loan of SAR 3.4 billion at an interest rate of 2.5%.

Import Restriction Measures:

Starting in 2024, a 10% tariff will be levied on imported frozen poultry (while fresh poultry remains duty-free), effectively protecting domestic producers.

Although the period of policy-driven benefits is expected to continue until 2030, there is a risk of subsidy phase-out. Should international poultry prices fall sharply (for example, due to increased production in Brazil), the government may adjust tariff protections. Consequently, domestic companies need to proactively optimize costs.

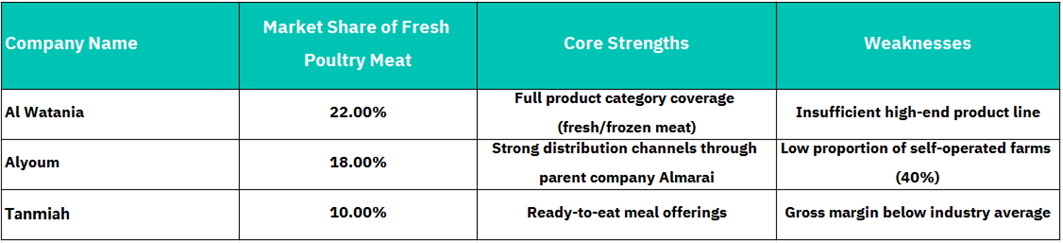

Competition Focus Analysis:

Cost Control: There are significant differences in the self-sufficiency rates of feed among leading enterprises. Al Watania's feed mill covers 80% of the demand, while Entaj is 100% reliant on ARASCO (cost is 3-5% higher than market prices).

Channel Competition: Traditional retail (supermarkets) accounts for 65%, but e-commerce is growing at a rate of 25% (2023). Entaj's online revenue share is only 8%, lagging behind Alyoum (15%).

Product Innovation: The prepared food sector is emerging. Tanmiah launched "ready-to-heat chicken curry" with a growth of 40%, while Entaj still focuses on primary processing (marinated products account for 12%). The current market presents a "high-end deficiency, mid-end competition" landscape. Suppose Entaj can transform air cooling technology into a perceptible consumer selling point (such as "cell activity retention rate of 95%"). In that case, it is expected to capture more than 5% of the high-end market share within 3-5 years. However, it needs to be vigilant about Almarai's rapid replication of technology routes with its capital advantages.

Risks and Variables:

(1) Biosafety Systemic Risks

Historical Lessons: The 2017 avian influenza outbreak in Saudi Arabia caused industry losses of 900 million riyals, with Entaj's mortality rate soaring to 31% at that time. Although the current epidemic prevention system is robust (mandatory vaccination + closed farming), the intensive farming model still poses risks.

Insurance Gap: The penetration rate of poultry farming insurance in Saudi Arabia is less than 30%, and Entaj is not insured for biological risks. If an epidemic breaks out, it may result in a quarterly loss of over 200 million riyals.

(2) Geopolitical Disruptions to the Supply Chain

Hatching Egg Imports Dependency: 86% of Entaj's hatching eggs come from the EU (Belgium, Spain), and the Red Sea shipping crisis extended the maritime transport cycle from 18 days to 32 days, forcing Entaj to reduce production by 8% in Q1 2024.

Limitations of Alternative Solutions: Saudi's local hatching enterprises can only meet 15% of the demand, and the genetic technology gap results in a 12 percentage point lower hatching rate for domestic hatching eggs.

(3) Possibility of Technological Disruption

Cultured Meat: Saudi's sovereign fund PIF has invested in U.S. UPSIDE Foods. If it achieves commercialization by 2030, it may impact the traditional farming industry. However, religious certification (Halal) issues may delay the substitution process.

The biggest risk in the industry does not come from known threats but from the lack of preparation for "nonlinear changes." For example, if mRNA vaccine technology breakthroughs shorten the poultry immunization cycle by 50%, the existing farming model will face restructuring. Entaj needs to double its investment in research and development, allocating more than 3% of annual revenue to cutting-edge fields such as AI disease monitoring and gene selection.

Valuation:

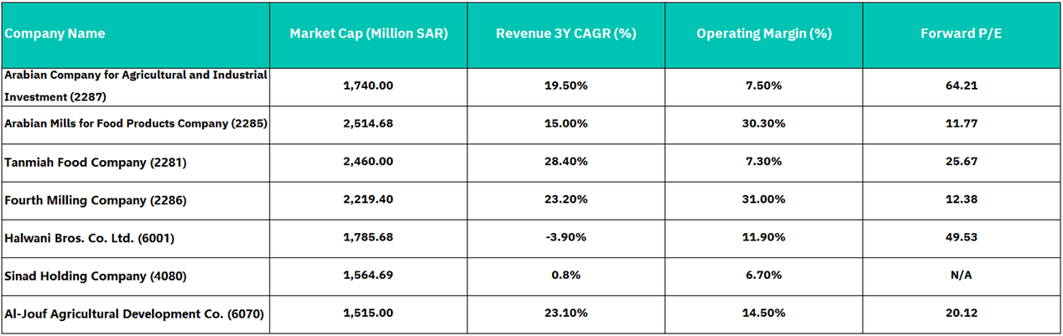

Arabian Company for Agricultural and Industrial Investment holds a mid-to-lower position in the industry with a market capitalization of 1.74 billion SAR, trailing behind peers like Arabian Mills, Tanmiah Food, and Fourth Milling. Its three-year revenue CAGR of 19.5% surpasses the industry average but lags behind top companies such as Tanmiah Food, Fourth Milling, and Al-Jouf. Arabian Company for Agricultural and Industrial Investment's operating margin of 7.5% is significantly lower than high-profit firms like Fourth Milling and Arabian Mills, indicating room for improvement in cost control and product value addition. The company's forward P/E ratio of 64.21 is the highest among its peers, reflecting high market expectations but also potential valuation bubble risks. On the positive side, Arabian Company for Agricultural and Industrial Investment's revenue growth is relatively stable, and the market's high P/E ratio suggests optimism regarding its growth potential, possibly due to agricultural industrialization, policy support, or new business expansion. However, challenges include weak profitability that could hinder profit growth, intense competition from leading high-growth and high-profit companies, and the risk of valuation correction if future performance falls short of expectations.

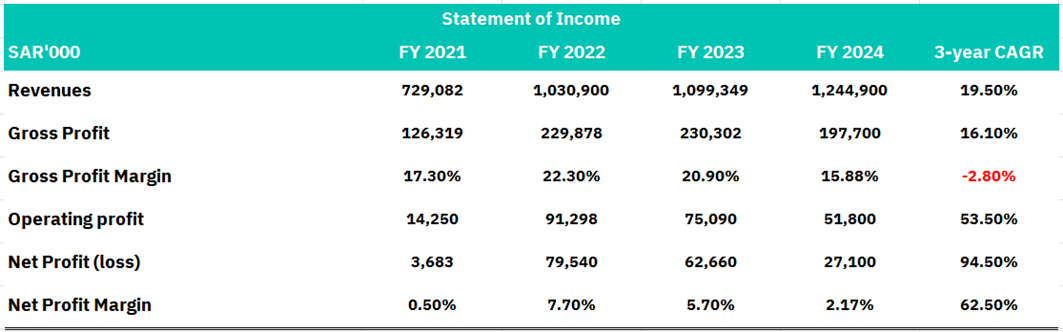

Revenue Growth:

From 2021 to 2024, revenue increased from SAR 7.29 billion to SAR 12.45 billion, with a three-year compound annual growth rate (CAGR) of 19.5%, indicating strong business expansion capabilities. However, revenue growth slowed in 2023-2024 (6.6% in 2023 and 13.2% in 2024), suggesting a potential weakening of growth momentum.

Profit Performance:

Gross Profit: The three-year CAGR was 16.1%, but the gross profit margin fell from 17.3% to 15.9%, reflecting a profit squeeze from rising raw material costs or limited pricing power.

Operating Profit: The CAGR from 2021 to 2024 was as high as 53.5%, but it declined for two consecutive years after 2022 (-17.8% in 2023 and -31.0% in 2024).

Net Profit: The three-year CAGR was 94.5% but highly volatile. The net profit margin soared to 7.7% in 2022. This was mainly because after integrating ARASCO's poultry business in 2021, the company began to fully leverage scale effects in 2022, with significant improvements in production capacity and market coverage, leading to improvements in revenue and profits. It then plummeted to 2.2% in 2024, indicating poor profit stability and questionable sustainability.

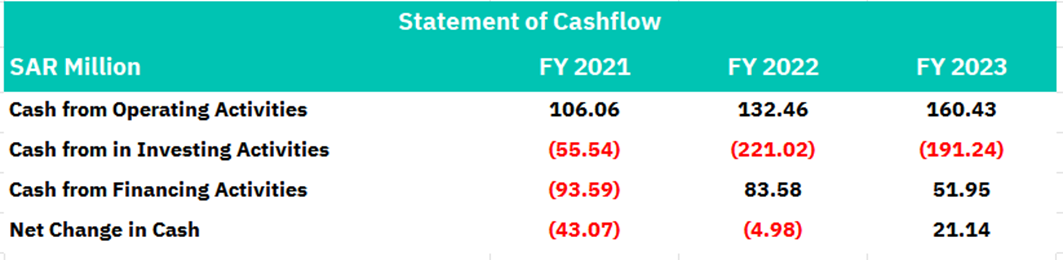

Cash flow analysis for Arabian Company for Agricultural and Industrial Investment shows a mixed picture. Operating cash flow continues to grow, from SAR 106 million in 2021 to SAR 160 million in 2023, at a compound annual growth rate (CAGR) of 23.5%, reflecting significant improvement in the profitability of its core business. Stable positive cash flow indicates that the company can support expansion needs through daily operations and reduce its reliance on external financing. However, investing cash flow has been negative for three consecutive years (-191 SAR million in 2023), indicating that Arabian Company for Agricultural and Industrial Investment has made large investments in recent years, which may lay the foundation for long-term growth. Still, there is a risk of impaired financial health if the return on investment (ROIC) is lower than the cost of capital. Financing cash flow shows reliance on financing, with inflows of SAR 84 million in 2022 and SAR 52 million in 2023. This indicates that the company uses debt or equity financing to support expansion, but needs to monitor interest burden and equity dilution risks. The increase in net cash of SAR 21 million in 2023 indicates improved liquidity, but the company must ensure that cash reserves are sufficient to cover future capital expenditures and potential fluctuations. The P/E ratio of 64.21 is much higher than its peers (such as Fourth Milling's 12.38), reflecting the market's high growth expectations. The high valuation will face correction pressure if the net profit margin cannot recover (down to 2.2% in 2024).

Conclusion:

Entaj's investment thesis presents a dichotomy of structural growth opportunities juxtaposed with acute operational and valuation risks. While the company benefits from Saudi Vision 2030's food security mandates, demographic-driven protein demand (43% core consumption cohort), and protective trade measures (10% import tariffs), its fundamental weaknesses raise material concerns. Persistent margin erosion (17.3%→15.9% gross margins 2021-2024), volatile profitability (2024 net margins collapsing to 2.17%), and critical supply chain vulnerabilities (86% EU hatching egg dependence) undermine operational stability. Despite 13.2% 2024 revenue growth, deteriorating operating profitability (-31% YoY decline) and negative cash flow reinvestment (-191M SAR) expose financial fragility. The extreme valuation premium (64.21x forward P/E vs peers) appears fundamentally disconnected from current returns, demanding flawless execution of vertical integration, digital transformation (targeting 15% e-commerce penetration), and biosafety risk mitigation to justify current pricing. Investors face asymmetric downside risk given the valuation's implicit pricing of both policy tailwinds and operational perfection simultaneously.

Disclaimer:

Sahm is subject to the supervision and control of the CMA, pursuant to its license no. 22251-25 issued by CMA.

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives. The firm and its analysts do not have any material interests or conflicts of interest in any companies mentioned in this report.

Performance data provided is accurate and sourced from reliable platforms, including Argaam, ENTAJ Company Prospectus, Saudi Arabian Poultry Market Research Report, Saudi Arabia Poultry Market.

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.