Alibaba Group Holdings Ltd.

Attractive Valuation Emerges Amid Growth Moderation and Policy Catalyst Expectations

Date: November 5, 2024

Financial Insights:

1. Alibaba announced its FY2025 Q1 earnings for the quarter ending June 30, 2024, with revenue reaching RMB 243.24 billion (US$33.47 billion), representing a 4% year-over-year increase, slightly below market expectations. Adjusted net profit was RMB 40.691 billion (US$5.6 billion), down 9% year-over-year.

2. Looking at individual business segments, Alibaba International Digital Commerce Group showed strong growth with Q1 revenue increasing 32% year-over-year. The closely watched Cloud Intelligence Group revenue grew 6% year-over-year, with AI-related products showing robust performance, maintaining triple-digit year-over-year revenue growth.

3. For the core e-commerce business, order volume achieved double-digit growth year-over-year this quarter.

4. The company expects total revenue to maintain low single-digit growth in the second quarter of FY2025, with EPS showing a slight negative growth.

Key Events:

On October 25 (U.S. time), Alibaba Group announced that it has agreed to pay $433.5 million (approximately RMB 3.087 billion) to settle a class action lawsuit filed by investors in the United States. The lawsuit alleged monopolistic practices by Alibaba, but the company denied any wrongdoing and emphasized that the settlement was reached solely to avoid further costs and disruptions associated with continued litigation.

Key Events Analysis:

The case originated in December 2020 when China's State Administration for Market Regulation launched an investigation into Alibaba's suspected abuse of market dominance. In April of the following year, Alibaba was fined RMB 18.228 billion. Based on this incident, some U.S. investors filed a class action lawsuit against Alibaba, claiming that Alibaba's stock price had been artificially inflated, causing losses to investors.

In our view, this settlement is primarily Alibaba's strategy to minimize the negative impact of litigation on its stock price. In fact, China's e-commerce sector has experienced rapid development in recent years with intensifying competitive pressure. The rise of competitors like PDD has put significant pressure on Alibaba. Meanwhile, as the global AI business remains in an arms race, Alibaba will need to continue increasing investments to expand its moat and enhance its competitive advantages.

Key Points:

1. The market anticipates that the Chinese government will announce major fiscal stimulus policies in November, including consumer support measures, which could help China's economy emerge from deflation and improve the fundamentals of consumer stocks. Some traders have already begun to position themselves ahead of this announcement.

2. Following the Chinese government's plans for fiscal stimulus, Chinese internet companies' stock prices saw significant increases. However, as of now, they have all declined from their peaks, with Alibaba retreating approximately 20% from its high. The valuation has become quite attractive, with the current market capitalization representing a P/E ratio of 16x for fiscal year 2025.

3. Alibaba's internationalization strategy is crucial, and it's important to monitor whether overseas e-commerce, Alibaba Cloud, and other international businesses can become the company's second growth curve.

4. Alibaba has done well in terms of shareholder returns, with cumulative share buybacks exceeding $12 billion in fiscal year 2024, significantly outperforming its competitor Pinduoduo in this aspect.

Technical Analysis:

Alibaba's stock price has been in a wide-ranging oscillation trend over the past year, with long-term resistance around $118[1] and solid support around $67[2]. A turning point emerged in late September, when the stock price surged almost vertically accompanied by a dramatic increase in trading volume. Some hedge funds had anticipated China's fiscal stimulus policies and quickly drove up the stock price. Subsequently, profit-taking by these hedge funds led to a price correction, but the stock found support near $95, which was previously a resistance level[3].

Currently, there's no significant sign of long-term capital inflow, as these investors are waiting for specific policy implementation and signals of stabilization in China's economic fundamentals. Before these materialize, buying on dips might be a better trading strategy.

[1] Long-term resistance level: Indicates a price point where selling pressure is substantial, making it difficult for the stock price to break through.

[2] Long-term support level: Indicates a price point where the stock finds effective support, where investors typically choose to bottom-fish and buy in.

[3] Resistance turned Support: Indicates that a price level has transformed from a previous resistance level into a new support level.

Research Report Appendix

Company Concept:

Alibaba Group (NYSE: BABA) is China's largest e-commerce company and a global technology leader, operating diverse businesses including online retail platforms (Taobao, Tmall), cloud computing (Alibaba Cloud), international commerce (AliExpress, Lazada), and digital payments, while actively expanding into AI and other emerging technologies.

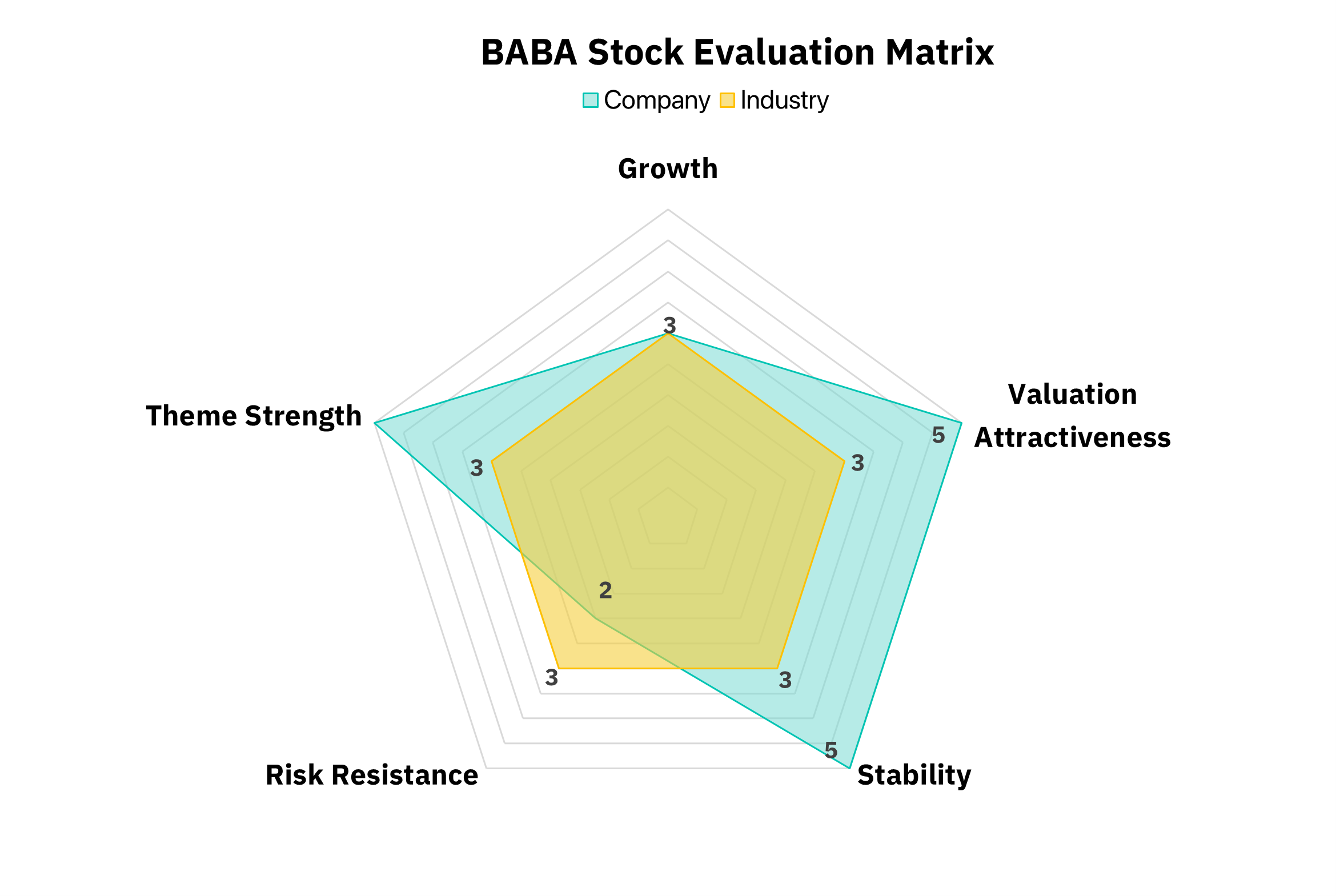

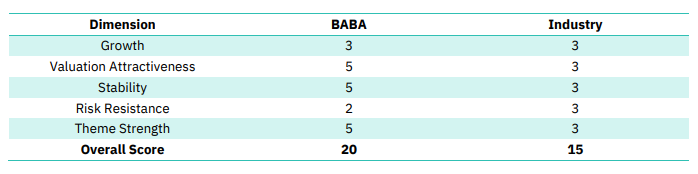

Model Explanation:

The model primarily evaluates companies and industries across five dimensions: growth ability, valuation attractiveness, stability, risk resistance ability, and theme strength. Each dimension is scored from 1-5, with 1 being the lowest and 5 the highest. Overall, higher scores indicate stronger fundamentals. For each dimension, a multi-factor model will be constructed based on industry and historical data of selected stocks, and a quantitative model will be used to automatically score each dimension.

Here are the dimensions explained:

- Growth Ability: Measures future performance potential; higher growth rates yield higher scores.

- Valuation Attractiveness: Assesses stock valuation; lower valuations earn higher scores.

- Stability: Evaluates the consistency of profit generation; greater stability means higher scores.

- Risk Resistance: Gauges the capacity to endure macroeconomic changes; better risk resistance leads to higher scores.

- Theme Strength: Rates market favor for the stock in the short term; increased favor results in higher scores.

Disclaimer:

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives. The firm and its analysts do not have any material interest or conflict of interest in Alibaba Corporation.

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.