Company Overview:

Rasan is a leading technology firm in Saudi Arabia, led by a founder-led management team. It specializes in fintech and insurance tech solutions. Founded in 2016, the company has rapidly established itself as a market leader by revolutionizing the insurance and financial services sectors through innovative digital platforms. With over 8 million customers and a robust partner network, Rasan continues to drive digital transformation in the region.

Business Model

Rasan Information Technology Company operates as a FinTech and InsurTech enterprise with several key business segments:

Insurance Technology (InsurTech) Services

1. Tameeni Motor: An insurance aggregation platform allowing customers to compare and purchase motor insurance policies from various providers. The platform offers:

Third-Party Liability Motor Insurance (TPL) - the minimum required coverage

Third-Party Insurance With Additional Coverage (TPL+)

Comprehensive Motor Insurance (COMP)

Value-Added Insurance Products from specific insurance companies

2. Tameeni Health: A platform focused on health insurance solutions.

3. Awal Mazad: A platform that appears to be related to vehicle auctions, likely for Salvaged Vehicles (vehicles deemed impractical to repair by insurance companies) and Repossessed Vehicles (vehicles reclaimed due to failure of payment obligations).

Financial Technology (FinTech) Services

1. Treza: A software-as-a-service (SaaS) platform that enables banks and leasing companies to integrate with insurance company systems. Treza operates through two channels:

Direct Channel: A white-label custom SaaS product for banks and leasing companies

Broker Channel: A web-based SaaS platform for banks and leasing companies that are customers of insurance brokers

2. Payment Solutions: The company has agreements with various payment service providers including:

Saudi National Bank (E-Payment Portal Services Agreement)

HyperPay Company (Electronic Payment Services)

Tabby Company (Installment Payment Services)

Tamara Company (Buy-now-pay-later Platform)

Corporate Structure

Rasan operates through a network of wholly-owned subsidiaries:

1. Awal Mozawadah Company: A Saudi single-person limited liability company with a capital of SAR 100,000, focusing on information technology.

2. Tameeni Company: A Saudi single-person limited liability company with a capital of SAR 500,000, operating as an electronic insurance brokerage.

3. Treza Company: A Saudi single-person limited liability company with a capital of SAR 500,000.

4. Regional Subsidiaries:

Rasan – Dubai: A UAE-based limited liability company with a capital of AED 300,000, wholly owned by the Company.

Rasan LLC – Egypt: An Egyptian limited liability company with a capital of EGP 100,000, 99% owned by the Company and 1% owned by Moayad Abdullah Suleiman AlFallaj.

Earnings Analysis:

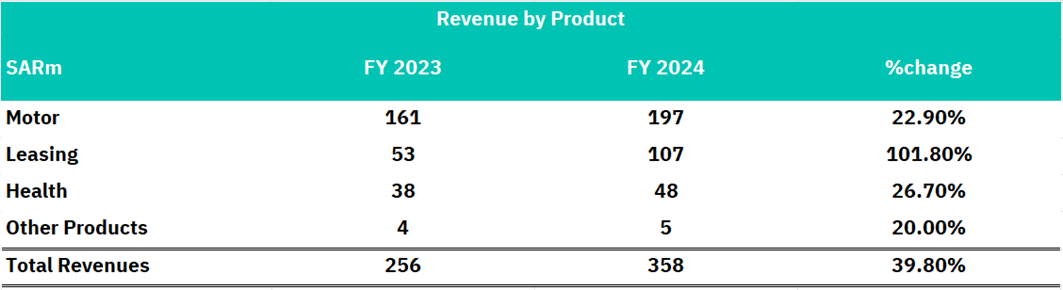

Revenue Growth

Rasan achieved exceptional revenue growth of 39.8% YoY in FY2024, with total revenue reaching SAR 358 million, up from SAR 256 million in FY2023. This growth was primarily driven by:

• Motor Insurance: 22.9% growth to SAR 197 million

• Leasing Insurance: 101.8% growth to SAR 107 million

• Health Insurance: 26.7% growth to SAR 48 million

• Other Products: 20.0% growth to SAR 5 million

The company's growth strategy demonstrates effective diversification while maintaining strong performance in core business lines. The triple-digit growth in leasing insurance is particularly impressive and indicates Rasan's ability to capitalize on emerging market opportunities.

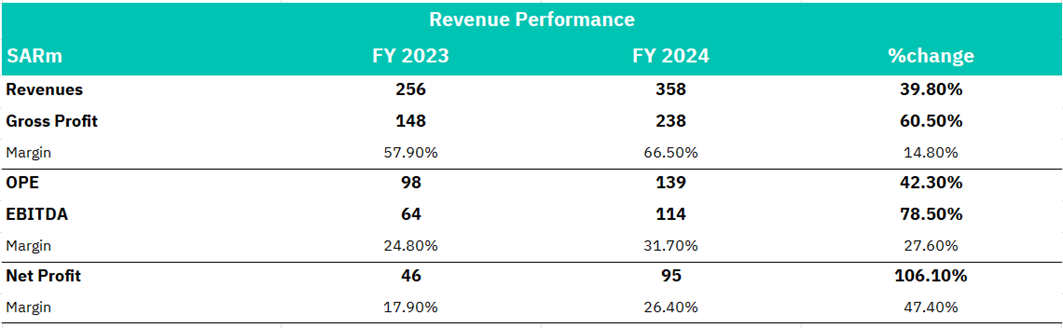

Rasan has shown significant improvement across all profitability metrics:

Gross Profit surged by 60.5% to SAR 238 million, with Gross Margin expanding from 57.9% to 66.5% (+860 bps). EBITDA rose by 78.5% to SAR 114 million, with an increase in EBITDA Margin from 24.8% to 31.7% (+690 bps). Net Profit more than doubled, rising by 106.1% to SAR 95 million, and Net Profit Margin improved from 17.9% to 26.4% (+850 bps).

Rasan has shown substantial growth in gross profit, EBITDA, and net profit, indicating a stronger earnings generation ability. This improvement provides more financial resources for operations, growth investments, and economic downturn resilience. The increase in EBITDA implies improved cash flow generation. With more cash, Rasan can fund operations, pay down debt, or return capital to shareholders through dividends or buybacks. Higher profits and improved margins provide Rasan with increased financial flexibility. This enables strategic initiatives like market expansion, new product development, or acquisitions without financial constraints. These profitability improvements collectively indicate a significant strengthening of Rasan's financial position, positioning the company for sustainable growth and providing the resources and flexibility to navigate market opportunities and challenges.

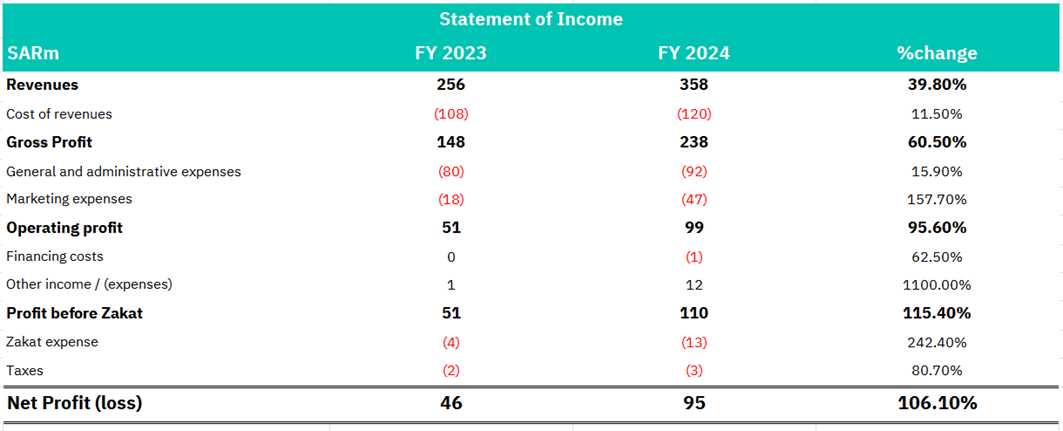

Operating Expenses

While operating expenses increased in absolute terms, they grew at a rate proportionate to or below revenue growth:

• General and Administrative Expenses: Increased by 15.9% YoY, significantly below revenue growth (39.8%)

• Marketing Expenses: Increased by 157.7% to SAR 47 million, reflecting strategic investments in growth

The company's ability to control G&A expenses while scaling demonstrates operational discipline and efficient management.

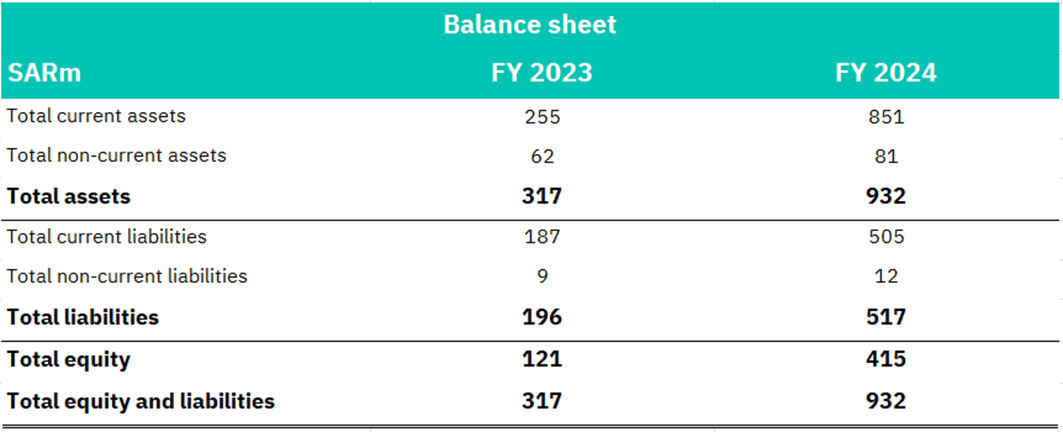

Rasan's FY2024 balance sheet analysis reveals a transformative financial profile marked by hypergrowth execution and prudential capital management, positioning the company as a standout performer in Saudi Arabia's FinTech sector. The company achieved an explosive 194% year-over-year asset expansion to SAR 932 million, driven principally by a 233% surge in current assets (SAR 851 million, 91.3% of total assets), reflecting aggressive working capital deployment to fuel core business scaling while maintaining a capital-light structure through modest 30.6% growth in non-current assets (SAR 81 million). Liquidity metrics strengthened materially, with the current ratio improving to 1.69x (from 1.36x) and a robust quick ratio of 1.52x, demonstrating superior short-term obligation coverage capacity. Asset efficiency remains best-in-class, evidenced by a 0.47x turnover ratio suggesting optimal utilization of its asset base for revenue generation. Liability management reflects strategic discipline, with total liabilities of SAR 517 million dominated by current operational liabilities (97.7%) rather than debt financing, resulting in an ultra-conservative debt-to-equity ratio of 0.25x and near-zero interest expenses (SAR 1 million). Equity capital mushroomed 243% to SAR 415 million, turbocharged by a 22.9% ROE demonstrating premium returns on shareholder investments. Working capital reserves reached SAR 346 million with a 1.69x coverage ratio, while implied cash conversion cycle efficiency suggests superior operational cash flow management. When benchmarked against regional FinTech peers, Rasan's financial architecture combines growth-oriented asset deployment (2.9x industry-average ROE) with fortress-like balance sheet fundamentals (55% liabilities/assets vs. 70%+ sector norm), warranting premium valuation multiples (implied 2.8-3.5x P/B) and establishing the company as a high-conviction growth story with embedded downside protection in Saudi Arabia's evolving digital finance landscape.

Competitive Landscape

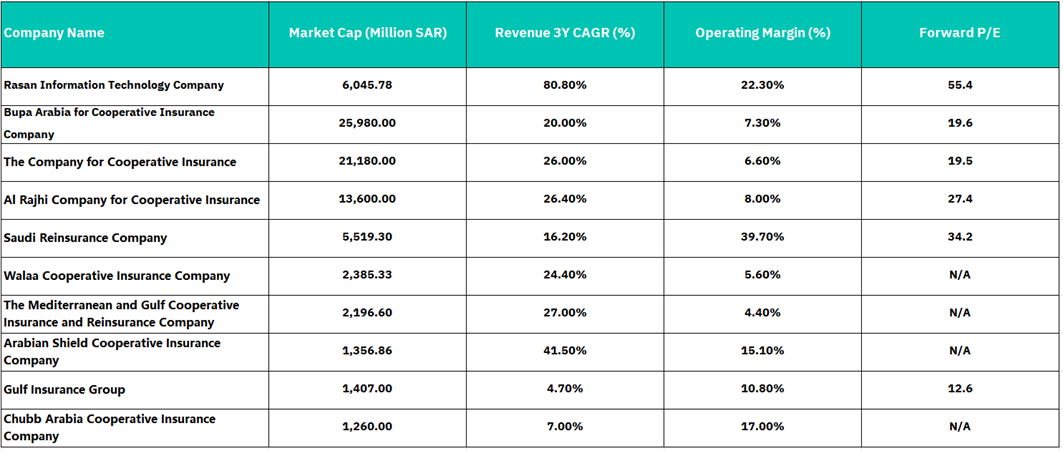

Rasan (6,046M SAR Market Cap) operates in a mid-tier market capitalization range within Saudi Arabia’s insurance sector, dwarfed by industry giants like Bupa Arabia (25,980M SAR) and The Company for Cooperative Insurance (21,180M SAR). However, its smaller size may offer agility in capturing niche markets, particularly in technology-driven insurance solutions. By contrast, larger peers benefit from scale advantages in traditional insurance markets but face slower innovation cycles.

Rasan gets 80.8% CAGR — 2x higher than the next-fastest grower, Arabian Shield (41.5%), and 4x above the sector median (~20%).

Drivers: Likely tied to digital insurance platforms (e.g., Tameeni, Motor Claims SaaS), which align with Saudi Arabia’s Vision 2030 push for fintech adoption. Bupa Arabia (20.0%) and Al Rajhi (26.4%) reflect steady growth in core health and auto insurance but lack disruptive catalysts.

Rasan’s Edge:

Tech Stack: Dominance in SaaS solutions for insurers (e.g., claims management, CRM) creates recurring revenue streams.

Peer Weaknesses:

Bupa Arabia: Overexposed to regulatory risks in health insurance pricing.

Saudi Reinsurance: Heavy reliance on cyclical reinsurance markets (39.7% margin may not be sustainable).

Arabian Shield: High growth (41.5% CAGR) but operating margins (15.1%) lower than Rasan.

Conclusion

Rasan has shown strong growth and financial resilience with its digital platform and asset-light model. In the 2024 fiscal year, it reported a 39.8% YoY revenue surge to 358 million SAR, driven by auto ( + 22.9%), lease ( + 101.8%), and health insurance ( + 26.7%). Profitability improved by 66.5% gross margin and 26.4% net margin, reflecting tech-driven cost efficiency and high-value services.

Rasan expanded assets by 194% with almost zero debt (debt-equity ratio 0.25x) and over 90% current assets, lifting the current ratio to 1.69x. This "capital-efficient, risk-controlled" approach also delivered a 22.9% ROE and 243% equity capital growth over three years.

In competition, Rasan stands out with an 80.8% three-year revenue CAGR (vs. 20% industry average) and 22.3% operating margin. It builds barriers via SaaS (e.g., Treza) and vertical solutions (e.g., Tameeni Motor). Despite pressure from incumbents, its tech edge, policy tailwinds (Saudi Vision 2030), and new business potential (lease insurance, vehicle auctions) offer long-term growth.

Rasan should maintain high R&D and marketing spending, expand regionally (e.g., UAE, Egypt), and deepen ecosystem partnerships (payment networks) to stay core in digital finance. Replicating its Saudi success in emerging markets and enhancing profitability could elevate it to a MENA fintech benchmark, creating sustainable value for investors.

Disclaimer:

Sahm is subject to the supervision and control of the CMA, pursuant to its license no. 22251-25 issued by CMA.

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives. The firm and its analysts do not have any material interests or conflicts of interest in any companies mentioned in this report.

Performance data provided is accurate and sourced from reliable platforms, including Argaam, RASAN Company Prospectus, RASAN Earnings report.

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.