Subdued Growth No Barrier To Grand Canyon Education, Inc. (NASDAQ:LOPE) With Shares Advancing 29%

Grand Canyon Education, Inc. LOPE | 164.64 | +1.04% |

Grand Canyon Education, Inc. (NASDAQ:LOPE) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 26% in the last year.

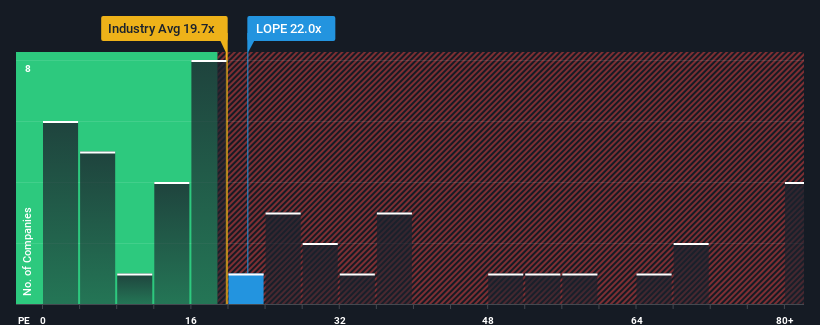

Since its price has surged higher, Grand Canyon Education's price-to-earnings (or "P/E") ratio of 22x might make it look like a sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 19x and even P/E's below 11x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Grand Canyon Education as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

How Is Grand Canyon Education's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Grand Canyon Education's is when the company's growth is on track to outshine the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 19% last year. Pleasingly, EPS has also lifted 36% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 9.2% during the coming year according to the two analysts following the company. With the market predicted to deliver 15% growth , the company is positioned for a weaker earnings result.

In light of this, it's alarming that Grand Canyon Education's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Grand Canyon Education's P/E?

Grand Canyon Education's P/E is getting right up there since its shares have risen strongly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Grand Canyon Education currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Grand Canyon Education with six simple checks on some of these key factors.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.