Earnings growth of 3.4% over 5 years hasn't been enough to translate into positive returns for Haemonetics (NYSE:HAE) shareholders

Haemonetics Corporation HAE | 78.85 | +1.86% |

Ideally, your overall portfolio should beat the market average. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in Haemonetics Corporation (NYSE:HAE), since the last five years saw the share price fall 40%. Furthermore, it's down 21% in about a quarter. That's not much fun for holders.

With the stock having lost 5.8% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

While the share price declined over five years, Haemonetics actually managed to increase EPS by an average of 18% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

Due to the lack of correlation between the EPS growth and the falling share price, it's worth taking a look at other metrics to try to understand the share price movement.

In contrast to the share price, revenue has actually increased by 7.5% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

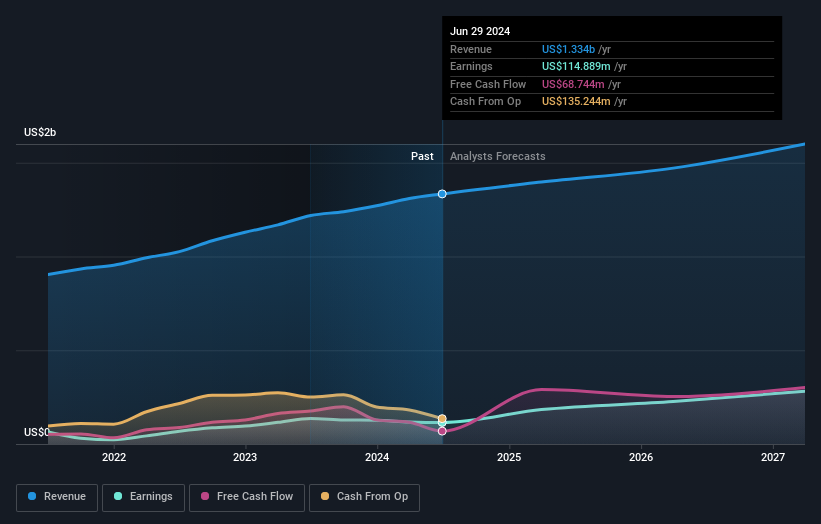

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Haemonetics is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Haemonetics in this interactive graph of future profit estimates.

A Different Perspective

Haemonetics shareholders are down 20% for the year, but the market itself is up 32%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance.

We will like Haemonetics better if we see some big insider buys.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.