Cable One (NYSE:CABO) Use Of Debt Could Be Considered Risky

Cable One, Inc. CABO | 373.42 | +1.25% |

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Cable One, Inc. (NYSE:CABO) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

What Is Cable One's Debt?

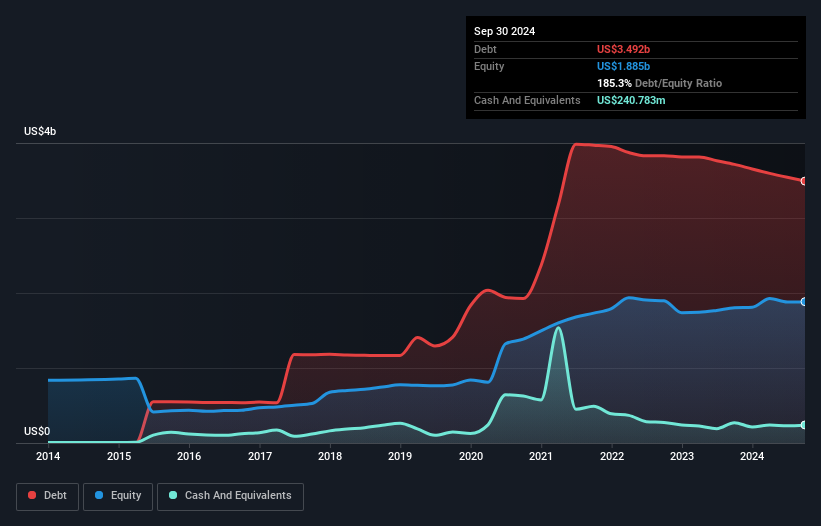

The image below, which you can click on for greater detail, shows that Cable One had debt of US$3.49b at the end of September 2024, a reduction from US$3.71b over a year. However, it also had US$240.8m in cash, and so its net debt is US$3.25b.

How Strong Is Cable One's Balance Sheet?

We can see from the most recent balance sheet that Cable One had liabilities of US$359.8m falling due within a year, and liabilities of US$4.42b due beyond that. Offsetting this, it had US$240.8m in cash and US$58.4m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$4.48b.

The deficiency here weighs heavily on the US$2.26b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Cable One would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Cable One's debt is 3.9 times its EBITDA, and its EBIT cover its interest expense 3.4 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Investors should also be troubled by the fact that Cable One saw its EBIT drop by 12% over the last twelve months. If that's the way things keep going handling the debt load will be like delivering hot coffees on a pogo stick. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Cable One can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent three years, Cable One recorded free cash flow worth 61% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

We'd go so far as to say Cable One's level of total liabilities was disappointing. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. We're quite clear that we consider Cable One to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that Cable One is showing 2 warning signs in our investment analysis , you should know about...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.